In a heated US political local weather, monetary analyst Michael A. Gayed just lately remarked that the rising nationwide debt exceeding $35 trillion is a extra vital menace to democracy than political management. Gayed emphasizes that the rising fee of debt outpaces each tax revenues and inflation, making a precarious fiscal setting.

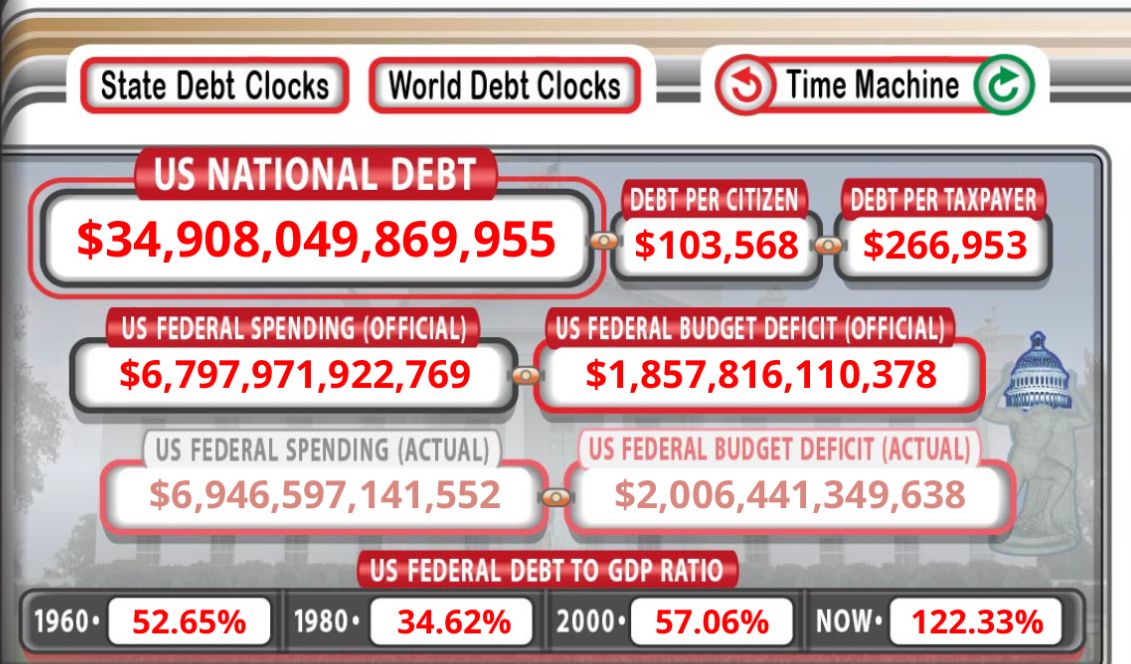

The US federal debt-to-GDP ratio, which has escalated from 52.65% in 1960 to 122.33% at present, additional illustrates the unsustainable nature of the nation’s fiscal insurance policies. The chance of a extreme financial downturn turns into extra pronounced because the debt grows unchecked.

The USA nationwide debt has now reached $34.9 trillion. Debt per citizen stands at $103,568, whereas the debt per taxpayer has risen to $266,953. The US federal finances deficit can be vital, with the official determine at $1.8 trillion and the precise deficit exceeding $2 trillion.

In response to Gayed, Erik Voorhees, founding father of ShapeShift and a outstanding voice in crypto, highlighted the gravity of the state of affairs. Voorhees asserts that the rising debt, regardless of presidential administrations, poses an unavoidable financial menace. He predicts that the relentless progress in nationwide debt will culminate in a catastrophic bond market collapse, leading to widespread monetary damage.

Voorhees additionally means that the present political panorama, represented by leaders like Trump and Biden, can’t mitigate this trajectory. The projected annual enhance in debt by greater than $1 trillion below any believable state of affairs illustrates the dire monetary outlook. This unsustainable debt progress, Voorhees argues, is a extra substantial menace to democracy than any single political determine.

The implications of such an financial collapse are profound. Voorhees envisions a state of affairs the place society would possibly navigate this turmoil with dignity and rules, probably rising extra affluent. Nonetheless, this may considerably depart from the Twentieth-century notion of huge nation-states. He posits that Bitcoin or related decentralized belongings are essential for this transformation. By its inherent financial sport idea, Bitcoin might stop the financial debasement that facilitates the expansion of huge nation-states.

Bitcoin’s standing as a extra enduring asset than fiat currencies, which has but to be absolutely realized, could possibly be pivotal on this shift. Voorhees believes that as Bitcoin is perceived as a extra secure retailer of worth over generations, it could constrain the enlargement of huge nation-states by limiting their capacity to inflate their currencies.

Ought to Republicans win in November, Voorhees states that Trump and Vance are unlikely to scale back the debt materially, however they might present an setting the place crypto can thrive. By doing so, they’d allow the roots of crypto to deepen within the cultural and financial panorama, probably making them resilient sufficient to face up to the anticipated monetary upheaval.

“The most effective factor Trump/Vance can do throughout their administration, since they can not (and received’t) materially scale back the debt state of affairs, is to create 4 years of permissive house wherein crypto might thrive, unpersecuted.”

Voorhees’ perspective displays a broader sentiment inside the crypto group, which views decentralized digital belongings as a possible safeguard in opposition to the financial instability of huge nationwide money owed. The crypto business’s capacity to supply a substitute for conventional fiat techniques could also be vital in navigating future monetary challenges.