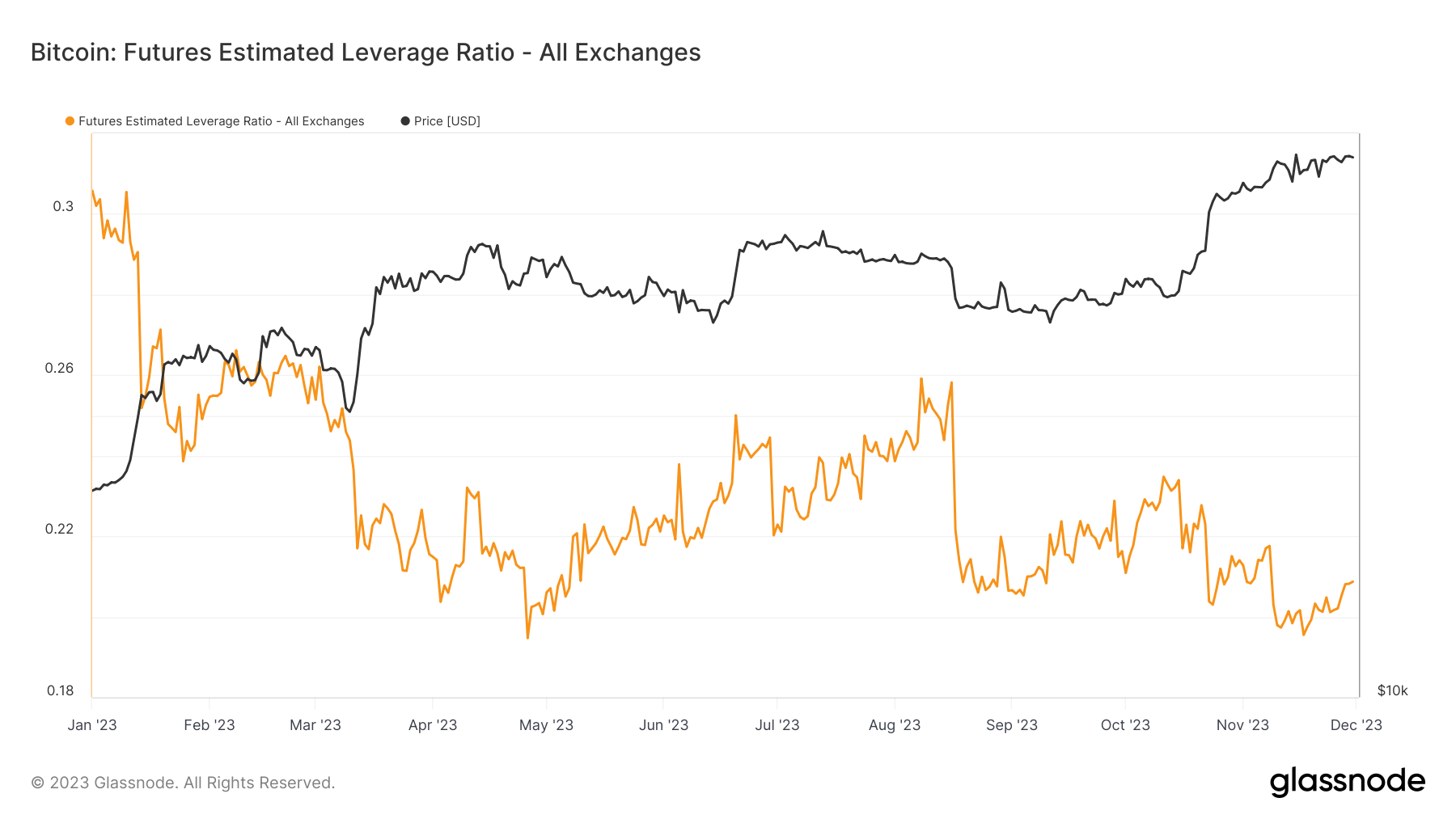

The estimated leverage ratio for Bitcoin futures, outlined because the ratio of the open curiosity in futures contracts to the stability of the corresponding alternate, is a barometer for gauging the diploma of leverage that merchants make use of of their positions. Analyzing this ratio, particularly for a high-volatility asset like Bitcoin, offers invaluable insights into the habits and techniques of traders within the digital foreign money market.

The leverage ratio is important because it displays the common leverage degree that every one Bitcoin futures merchants are utilizing. A excessive leverage ratio signifies that merchants borrow closely to commerce, which may amplify positive factors and losses. Conversely, a low ratio suggests a extra cautious method, which means that merchants are lowering their reliance on borrowed funds. This dynamic can considerably affect the steadiness and volatility of the Bitcoin market.

StarCrypto’s evaluation of Bitcoin futures’ estimated leverage ratio in 2023 reveals thrilling tendencies.

Initially, the 12 months began with the next leverage ratio, however a transparent downward development was evident because the months progressed. The ratio decreased considerably from January to April, reflecting a shift towards threat aversion. This may very well be attributed to components similar to market volatility, adjustments in regulatory frameworks, or broader financial circumstances impacting investor sentiment.

Curiously, the interval from Might to July marked a slight improve within the leverage ratio. This shift may very well be interpreted as a short lived rise in dealer confidence or a response to particular market circumstances, maybe an uptick in Bitcoin costs or favorable information within the crypto house. Nevertheless, this was short-lived, because the development once more decreased from August, culminating within the lowest common leverage ratio in November. This sustained lower in the direction of the tip of the 12 months suggests a continued cautious method by merchants, probably in response to ongoing market uncertainties or a strategic shift amongst traders in the direction of holding methods.

The general lowering development in leverage utilization all through 2023 signifies a market that’s more and more leaning towards threat administration and stability. The fluctuations in leverage utilization additionally spotlight the reactive nature of the market to exterior components, similar to financial indicators, regulatory information, or vital world occasions. These adjustments in leverage replicate the market’s response to speedy circumstances and broader shifts in investor habits and sentiment.

The 2023 development of a usually lowering leverage ratio suggests a shift in the direction of extra conservative buying and selling methods and a heightened give attention to threat administration. This development is a big indicator of market sentiment, reflecting warning and a desire for stability amongst traders in an in any other case unstable market. Because the digital foreign money panorama continues to evolve, monitoring such metrics will stay important for understanding the dynamics of cryptocurrency buying and selling and investor habits.

The submit Understanding investor sentiment by way of the Bitcoin leverage ratio appeared first on StarCrypto.