In keeping with on-chain information, the US legislation enforcement company moved 49,000 Bitcoin (BTC) — over $1 billion — through the early hours of March 8.

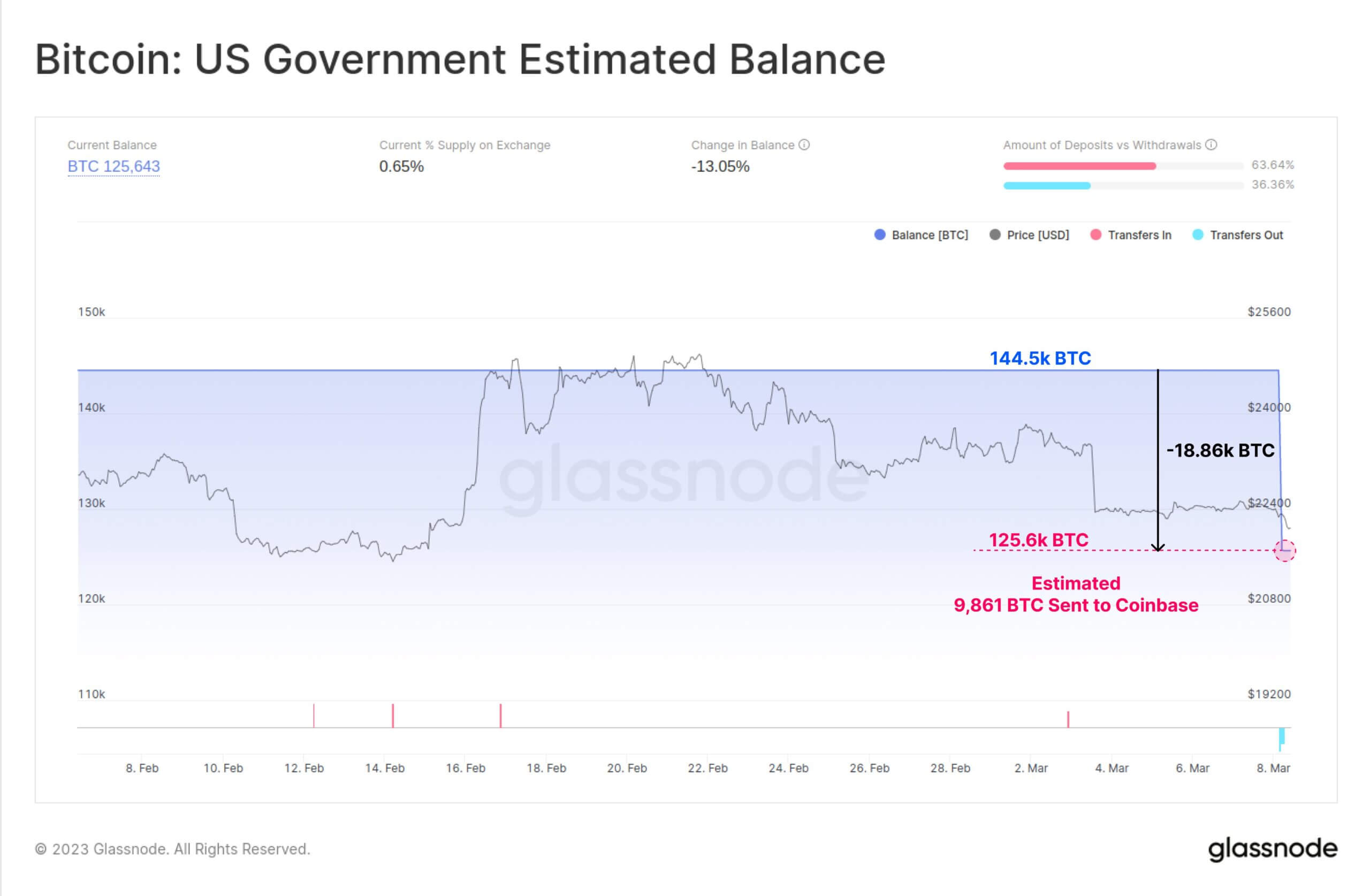

On-chain information supplier Glassnode reported that the US company was transferring round 40,000 BTC, including that the transactions look like inner transfers. Nonetheless, it famous that the federal government company despatched 9,861 BTC (price $219 million) seized from the Silk Street hacker to Coinbase.

In 2022, the US authorities sought the forfeiture of 51,351 Bitcoin seized from James Zhong. On the time, the property had been valued at over $3 billion.

On-chain analyst Lookonchain corroborated Glassnode’s report, including that the company transferred 39,175 BTC ($867M) to 2 new addresses.

US govt BTC holding

Earlier than at present’s transactions, Glassnode mentioned the US authorities’s estimated Bitcoin holding was 144,500 BTC, making the nation a crypto whale.

In the meantime, nearly all of the US acquisitions had been executed via seizures. In 2022, the US Division of Justice seized $3.6 billion price of Bitcoin linked to the 2016 Bitfinex hack. Earlier than that, the federal government took 70,000 BTC from Ross Ulbricht when it introduced down the Silk Street.

Nonetheless, the nation tends to public sale off its seized crypto property. As of Feb. 2022, the US authorities held $4.08 billion of Bitcoin.

Bitcoin sheds 2% in 24 hours

Bitcoin dumped 1.67% over the past 24 hours to commerce at $22,048 as of press time, in response to StarCrypto’s information.

The US company transfers birthed speculations throughout the neighborhood, with many fearing a sell-off. Often, BTC inflows into exchanges improve the promoting strain on the asset.

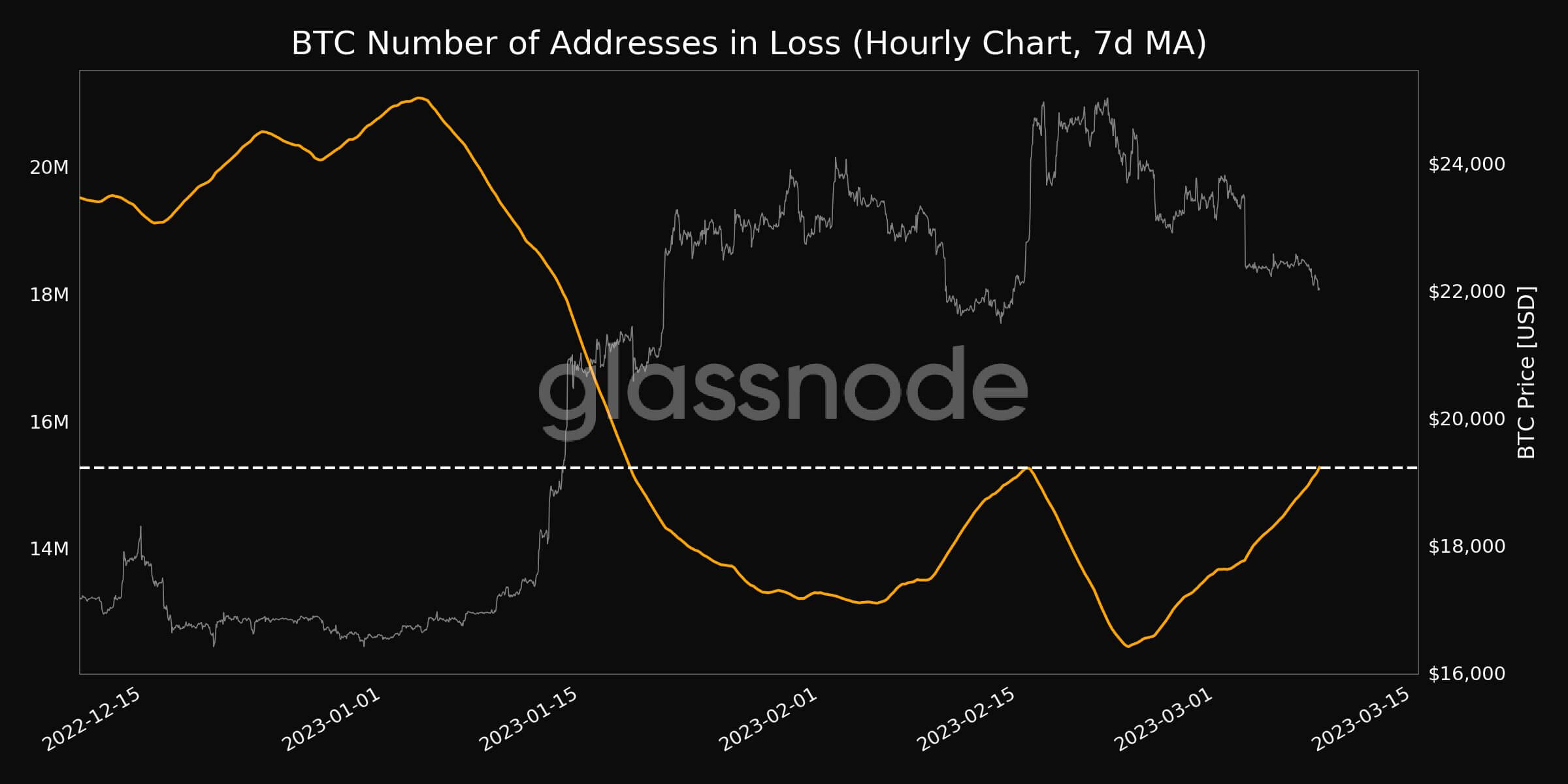

With BTC giving up a lot of its January and February positive aspects, Glassnode’s information confirmed that the variety of addresses holding BTC at a Loss on the seven days transferring common metrics reached a 1-month excessive of 15,270,797.429.

StarCrypto Perception reported that roughly $200 million Bitcoin was withdrawn from exchanges on March 7 — the third highest withdrawal on the year-to-date metric.

In the meantime, Fed Chair Jerome Powell’s latest assertion about growing rates of interest additional exacerbated its value efficiency.