- Gabor Gurbacs tweeted that the overseas central banks are promoting U.S. Treasuries.

- The advisor added that the Tether is the most important purchaser of U.S. Treasuries.

- Gurbacs commented that if Tether was a rustic, it will have been the highest 30 holders of the Treasuries.

Gabor Gurbacs, the Technique Advisor on the international funding agency VanEck Associates Company, shared on Twitter that whereas overseas central banks are promoting U.S. Treasuries, the asset-backed stablecoin Tether is the largest purchaser.

Notably, Gurbacs added, “If Tether was a rustic, it’d be among the many prime 30 holders of U.S. treasuries.”

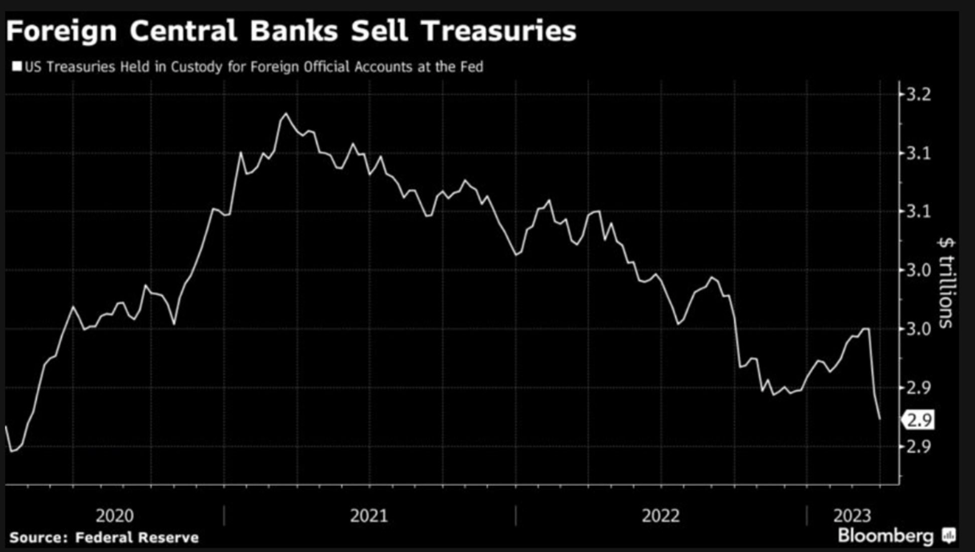

Based on the current report of the tv media Bloomberg, the overseas central banks have been liquidating Treasury holdings, facilitating money from the Federal Reserve to mitigate the banking turmoil.

Reportedly, the overseas holdings of Treasury securities have fallen by $76 billion within the week by way of March 22 to $2.86 trillion, creating the most important weekly decline since 2014.

Considerably, Joseph Abate, the Managing Director of the British multinational common financial institution, Barclays commented that the “borrowing was precautionary,” including:

The central financial institution wished to construct a struggle chest of accessible {dollars} in case the banking disaster deteriorated however didn’t wish to hearth promote its Treasuries.

Gurbacs asserted that Tether has purchased the most important share of U.S. Treasuries, noting, “U.S. management ought to admire Tether for purchasing and holding U.S. treasuries.” He included a graph of the U.S. Treasuries offered by overseas central banks, which the favored investor Willem Middelkoop shared some hours earlier than.

Middelkoop commented that the overseas banks have been promoting Treasuries; Russia virtually offered every thing whereas China continues to promote. He recommended “FED will should be a purchaser once more quickly,” including that “debt monetization is the nuclear possibility.”