- AGIX’s value hits a 7-day excessive at $1.39, up 28% over the month amid merger information.

- AGIX quantity surges by 97.27%, and the market cap reaches $1.78 billion.

- Bollinger bands widen on the AGIX chart, signaling elevated volatility.

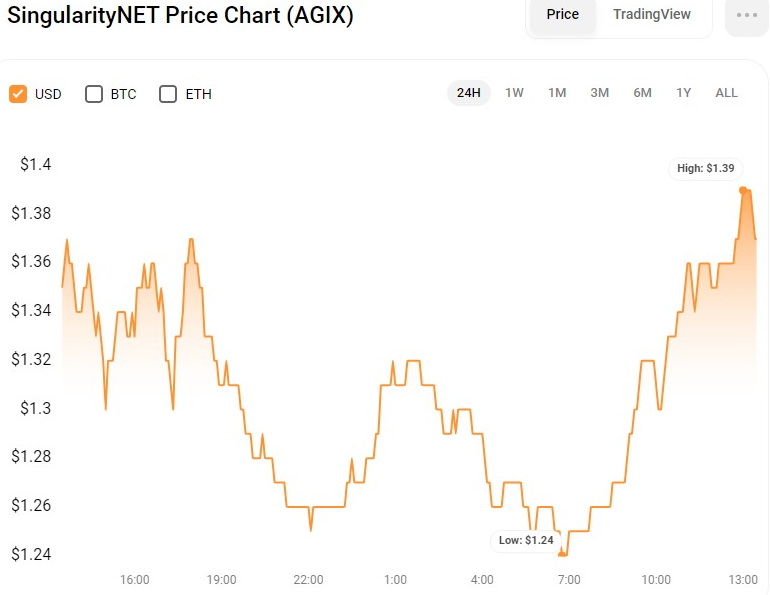

Because the information of a merger of SingularityNET (AGIX), Fetch.ai (FET), and Ocean Protocol (OCEAN) into AltSignals (ASI) Token, which might have a diluted valuation of $7.5 billion, AGIX has been on a constructive surge. Because of this, the AGIX bullish momentum regained energy, sending the worth to a 7-day excessive of $1.39 after discovering assist at an intra-day low of $1.20. At press time, AGIX was buying and selling at $1.39, up 7.98% within the prior 24 hours and 28% within the earlier month.

If the constructive momentum breaks over the $1.39 resistance, the following resistance ranges to observe for are $1.50 and $1.60, as traders proceed to imagine within the potential of AltSignals (ASI) Token. Nevertheless, if the worth fails to interrupt over $1.39, there could also be a short pullback all the way down to the $1.20 assist stage earlier than attempting one other constructive rise.

In the course of the rise, AGIX’s market capitalization and 24-hour buying and selling quantity elevated by 7.595% and 97.27%, respectively, to $1,775,791,076 and $544,730,216. This bounce displays elevated curiosity and funding within the AGIX token, with the potential for extra beneficial properties if the bullish pattern continues.

AGIX/USD Technical Evaluation

On the AGIXUSD 4-hour value chart, the Bollinger bands are widening, with the higher and decrease bands touching $1.3686 and $1.07931, respectively. This pattern factors to heightened volatility within the close to future, with the higher and decrease bands probably serving as resistance and assist ranges for value strikes.

Nevertheless, because the bullishly engulfed candlestick has breached the higher Bollinger band, the upward pattern might proceed within the brief time period. Conversely, this may counsel an overbought place, which might lead to a value downturn.

The Cash Stream Index (MFI) ranking of 78 lends validity to the overbought circumstances, indicating that the asset’s current upward momentum could also be reaching its restrict. Because of this, merchants ought to take care and always monitor market motion for indications of a reversal or correction. Nevertheless, with the stochastic RSI transferring above its sign line at 42.89, there’s nonetheless room for extra upward motion earlier than a correction occurs.

Moreover, the Chaikin Cash Stream (CMF), which is now within the damaging space with a ranking of -0.06, is rising, indicating that promoting strain could also be diminishing and purchasers might quickly reclaim management of the asset’s value motion. This means that, whereas prudence is suggested, there’s potential for extra constructive momentum quickly.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be liable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.