- Lido DAO sunsets Solana undertaking as a consequence of monetary points, backed by 92% neighborhood vote.

- P2P workforce thought-about $1.5M funding or Solana exit as a consequence of $484,000 losses.

- Solana staking to be halted by February 2024.

In a decisive transfer, Lido DAO has chosen to sundown the Lido on Solana undertaking, following a convincing neighborhood vote in favour of this plan of action. The choice has been attributed to the undertaking’s monetary constraints, leaving it unsustainable.

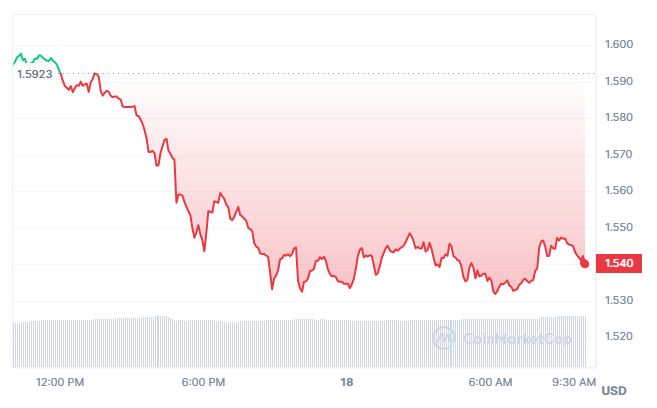

Following the transfer, the worth of the LDO token, Lido DAO’s native cryptocurrency, has dropped by nearly 4% previously few hours.

Lido DAO (LDO) worth chart

Lido DAO (LDO) worth chart

Sunsetting Lido on Solana

The Lido on Solana undertaking will endure a phased sundown course of over the approaching months. Notably, stSOL token holders may have till February 2024 to unstake their property by the Lido on the Solana frontend.

This resolution was reached after intensive deliberations and a neighborhood vote, with over 92% of Lido token holders endorsing the sunsetting of the Lido on Solana protocol. The choice choice, which garnered simply over 7% help, concerned offering further funding to the undertaking.

Monetary concerns

The P2P validator workforce, liable for Lido on Solana, offered two situations to the neighborhood. The primary state of affairs was to infuse $1.5 million in funding to maintain the undertaking, whereas the second was to exit the Solana blockchain.

The monetary particulars revealed that the workforce invested roughly $700,000 into growth and help, however their income amounted to solely $220,000, leading to a major lack of $484,000. Ought to the neighborhood have chosen the sunsetting choice, the P2P workforce would have relied on $20,000 per 30 days in help from Lido DAO for technical upkeep over a interval of 5 months, commencing from September 4, 2023.

The choice to wind down the Lido on Solana undertaking, regardless of sturdy relationships throughout the Solana ecosystem, was deemed vital for the broader success of the Lido protocol ecosystem.

This isn’t the primary occasion of Lido discontinuing its liquid staking options. Previous to this, Lido had already ceased liquid staking operations on Kusama and Polkadot.

The sunsetting course of on Solana will embrace a right away halt to staking, voluntary off-boarding for node operators starting on November 17, 2023, and a ultimate date for stSOL token holders to unstake by February 4, 2024, by way of the Command Line Interface (CLI).