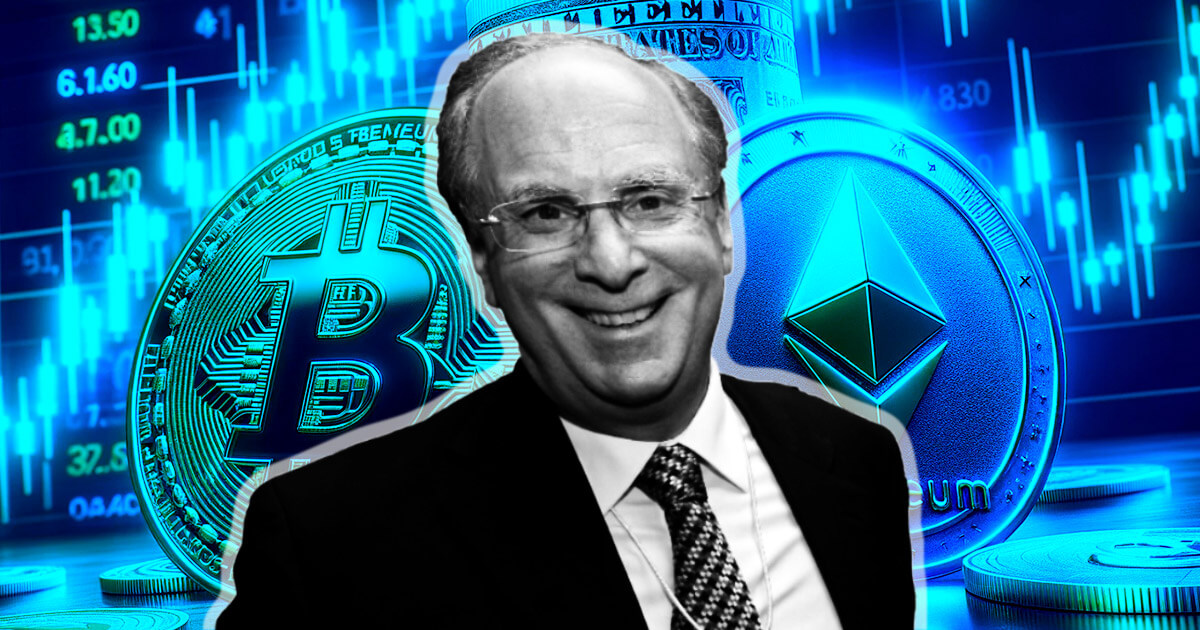

BlackRock CEO Larry Fink mentioned the record-breaking efficiency of IBIT has made him extra bullish about the way forward for Bitcoin.

Fink made the assertion throughout an interview on Fox Enterprise on March 27, the place he referred to as the corporate’s spot Bitcoin ETF essentially the most quickly increasing fund in historical past.

He additionally said:

“I’m very bullish on the long-term viability of Bitcoin.”

He additionally mentioned that the SEC classifying Ethereum as a safety wouldn’t be that detrimental to its future and wouldn’t hamper the corporate from issuing a spot ETH ETF. Nevertheless, Fink didn’t disclose additional particulars in regards to the standing of the present utility course of.

Explosive success

The BlackRock CEO mentioned he was notably struck by the efficiency of IBIT, which has shattered expectations, drawing vital retail investor curiosity past preliminary predictions.

Fink mentioned:

“I used to be pleasantly shocked and would by no means have predicted earlier than we filed it that we’d see this sort of retail demand.”

The explosive success of the IBIT ETF is rooted in numerous investor issues and market situations, together with fears of inflation, prevailing financial uncertainties, and a burgeoning recognition of the significance of portfolio diversification by way of different belongings.

Bitcoin’s enchantment is additional magnified by its intrinsic properties, comparable to a capped provide and decentralized framework, positioning it as each a strategic retailer of worth and a prudent hedge towards the vulnerabilities of standard monetary methods.

Fink’s commentary highlights a notable pivot in investor sentiment in direction of Bitcoin, spotlighting the flagship crypto’s burgeoning enchantment within the conventional monetary sector.

Shifting tides

The keenness surrounding the spot Bitcoin ETFs signifies a extra vital development of institutional engagement with Bitcoin on the horizon. This shift suggests a reevaluation of digital belongings, transitioning from speculative novelty to a acknowledged funding avenue.

Based mostly on his management on the helm of the globe’s preeminent asset administration agency, Fink’s optimism wields appreciable affect, doubtlessly shaping monetary sector attitudes in direction of Bitcoin.

The trajectory of IBIT’s progress illustrates a burgeoning confidence in Bitcoin’s lasting worth and its rising position throughout the broader monetary ecosystem.

Fink’s feedback lend vital assist to Bitcoin’s credibility and its potential position within the international monetary panorama. Moreover, the endorsement might encourage additional institutional exploration of Bitcoin and different cryptocurrencies, marking a shift in direction of extra inclusive funding methods that acknowledge the advantages of digital belongings.

The put up Larry Fink ‘very bullish’ on Bitcoin after IBIT’s record-breaking efficiency appeared first on StarCrypto.