Bitcoin futures are monetary derivatives, basically agreements to purchase or promote Bitcoin at a predetermined value at a particular date. These supply a manner for merchants to invest on the long run value of Bitcoin. Open curiosity refers back to the complete variety of excellent futures contracts that haven’t been settled. Futures contracts may be collateralized in varied methods, together with utilizing the native coin of the contract (BTC or ETH), USD, or USD-pegged stablecoins.

Monitoring the distinction in open curiosity in crypto-margined and cash-margined futures is essential for understanding market dynamics. When Bitcoin futures contracts are collateralized with Bitcoin, the chance of liquidation will increase. If an investor is lengthy Bitcoin with Bitcoin as collateral and the market experiences a pointy downturn, the online lack of the place and the worth of the collateral lower concurrently. This twin loss makes the place extra inclined to being liquidated or stopped out.

In less complicated phrases, utilizing Bitcoin to again a protracted place on Bitcoin amplifies the dangers. If the worth of Bitcoin falls, not solely does the worth of the place lower, however the collateral itself additionally loses worth, making a compounded danger.

Then again, collateralizing futures contracts with USD or stablecoins can considerably cut back the chance of huge leverage cascades throughout market downturns. Utilizing a steady asset as collateral, the worth of the collateral stays fixed, even when the underlying asset’s market value fluctuates. This stability offers a buffer in opposition to sudden market actions and reduces the chance of compelled liquidations.

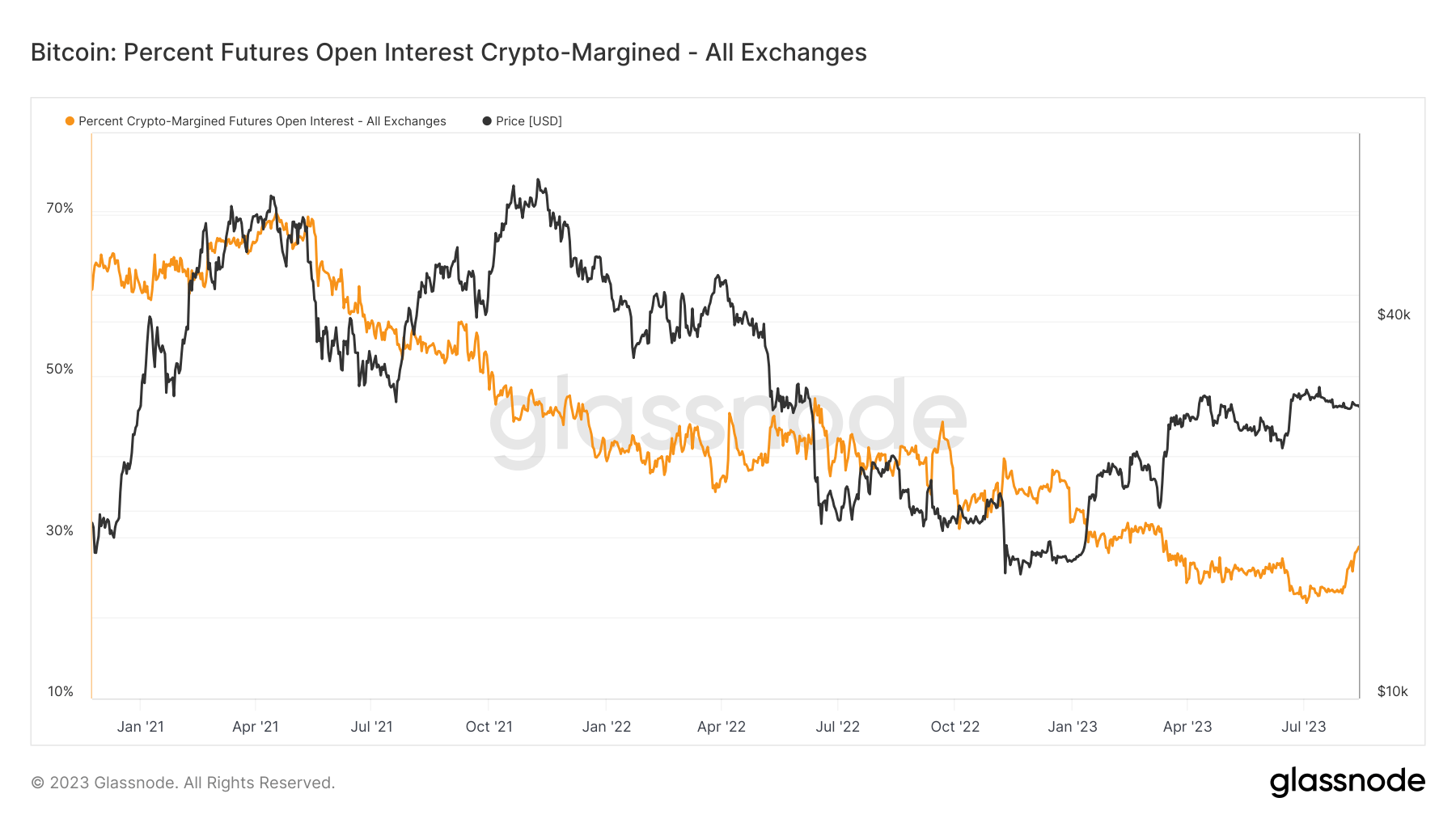

Based on information from Glassnode, the p.c of futures open curiosity that’s margined within the native coin of the contract (e.g., BTC and ETH) presently stands at 28.8%. This determine reached an all-time low on July 3, dropping to 21.8%.

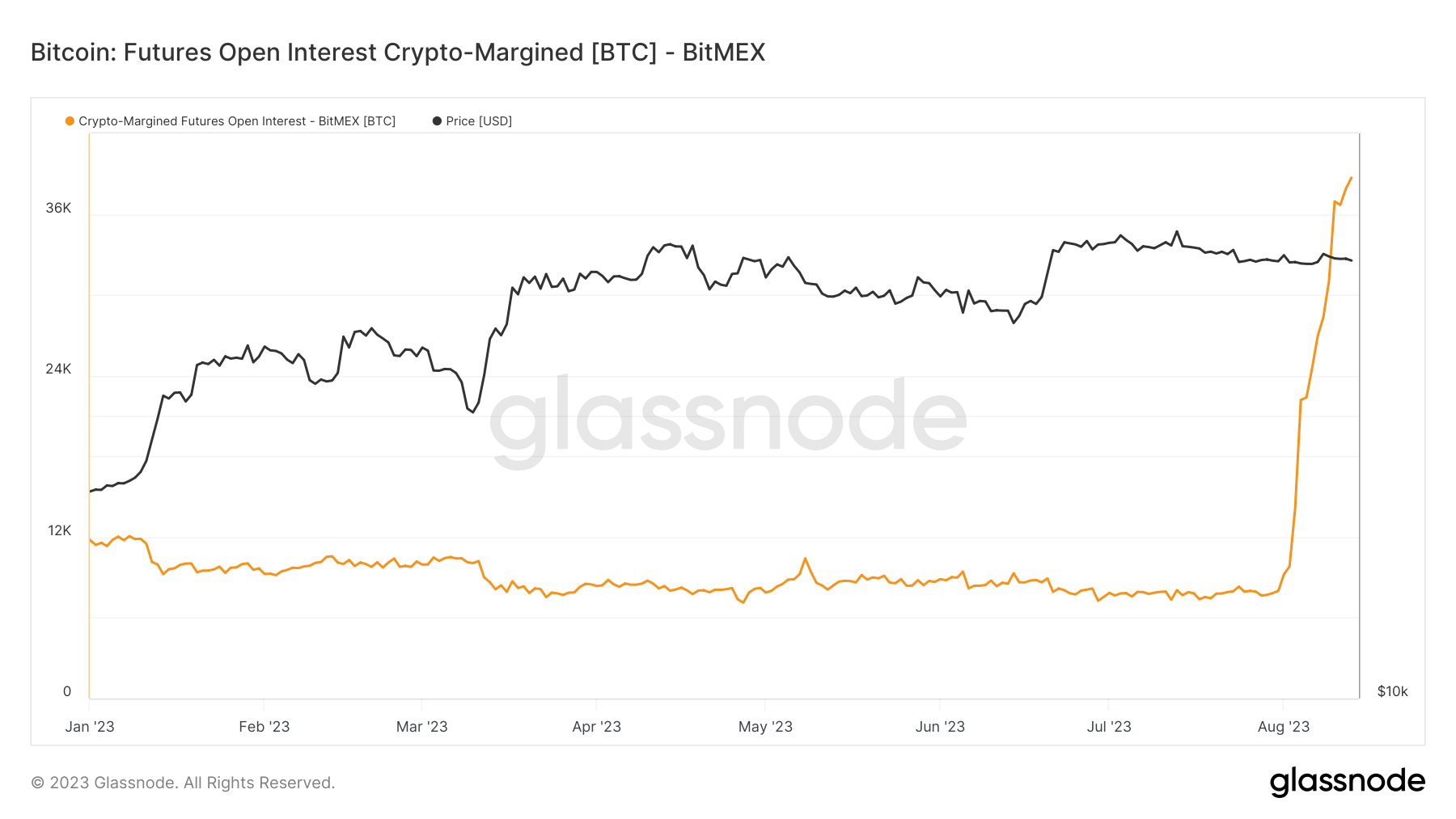

The latest improve in crypto-margined open curiosity may be attributed to BitMEX, which noticed an aggressive spike in August. The full quantity of futures contracts open curiosity collateralized in crypto elevated from 7,998 BTC on July 31 to 38,712 on August 12, representing a 384% improve.

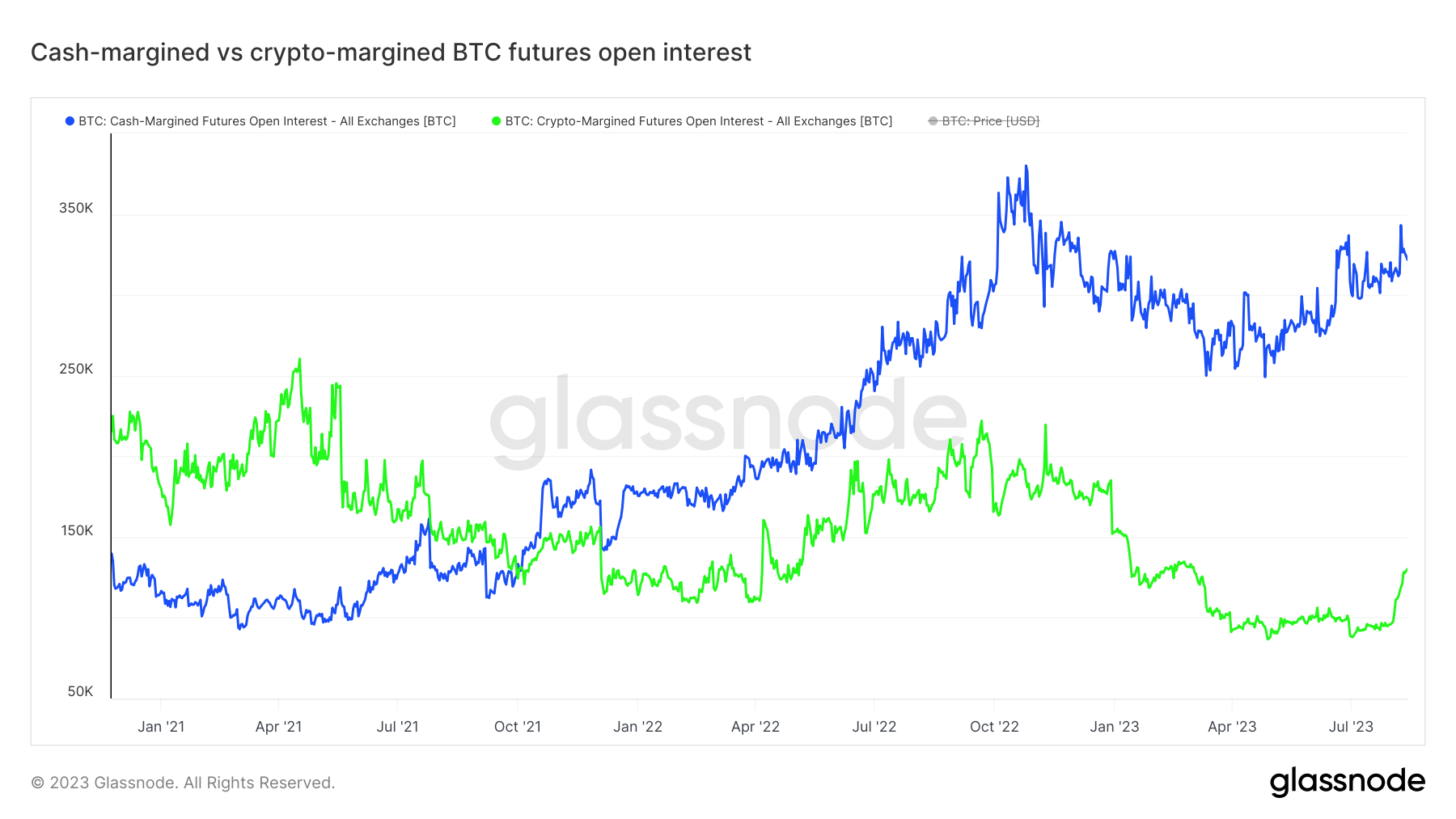

Evaluating the crypto-margined and cash-margined futures open curiosity reveals a discrepancy that has by no means been larger. This divergence signifies a rising market desire for stability and danger mitigation as extra merchants go for USD or stablecoin collateralization.

The shift in direction of cash-margined futures could sign market individuals’ new, extra cautious method, reflecting issues over potential volatility and the will to attenuate publicity to liquidation dangers.

The put up Decline in crypto-margined futures could sign market maturity appeared first on StarCrypto.