Key Takeaways

- Crypto had moved consistent with shares and different threat belongings all through the rate of interest tightening cycle

- This relationship weakened in June amid the crypto regulatory crackdown

- The correlation has not too long ago picked up once more, nonetheless

- Going ahead, relationship might change once more because the market anticipates the tightening cycle is coming to an in depth

We all know that throughout the digital asset area, the completely different cryptocurrencies are extremely correlated. As a generalisation, it’s honest to say that many altcoins are likely to commerce like levered bets on Bitcoin.

Going past the asset class and assessing correlations with different asset sorts turns into extra attention-grabbing. Probably the most intriguing traits to trace is the correlation between Bitcoin and shares. If we wish to assess Bitcoin by a macroeconomic lens, its relationship with different asset courses is of significant significance.

The final eighteen months have thrown this relationship into a brand new mild, as correlations have been extraordinarily excessive amid one of many quickest rate of interest tightening cycles in latest historical past. With liquidity sucked out of the financial system, threat belongings had been hammered final yr, together with Bitcoin.

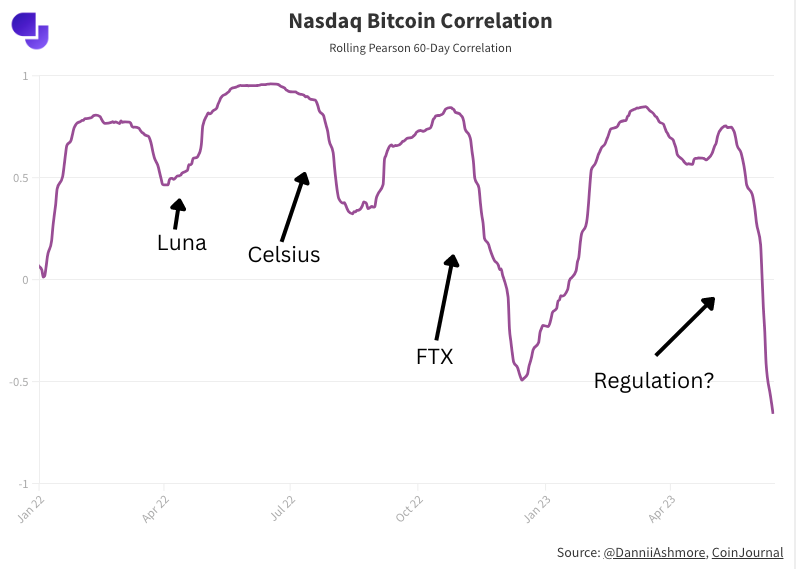

In comparison with the tech-heavy Nasdaq, Bitcoin’s correlation has been persistently excessive all through this era, bar a number of noticeable situations. As displayed on the under chart from an evaluation we compiled six weeks in the past, the collapses of Luna, Celsius and FTX noticed deviations on this relationship.

These clarify themselves, as dramatic crypto-specific episodes that had no impact on shares. Nonetheless, the more moderen deviation was greater than any: coming in June amid the regulatory crackdown (chart is taken from June fifteenth, every week after the Binance and Coinbase lawsuits).

In actual fact, this deviation introduced the Nasdaq’s correlation with Bitcoin to a five-year low. If we now re-run this chart, we see the correlation has picked again up once more, rising to 0.5 and trending upwards.

In actual fact, this deviation introduced the Nasdaq’s correlation with Bitcoin to a five-year low. If we now re-run this chart, we see the correlation has picked again up once more, rising to 0.5 and trending upwards.

This highlights what we already knew: the deviation is barely non permanent. It got here following a month the place the Nasdaq jumped 10% off softer forecasts across the future path of rate of interest hikes, whereas Bitcoin fell 9% over the identical time interval as lawmakers tightened their squeeze on the trade, suing the 2 largest exchanges and confirming a number of tokens constituted securities.

The local weather has picked up for crypto since. Ripple received an vital case (or, partially received, however the end result was undoubtedly optimistic for the area), whereas a slew of spot ETF functions have additionally served to extend optimism.

Whereas the deviation was all the time going to be non permanent, going ahead within the medium-term, issues might get extra attention-grabbing. It’s because, lastly, the market is anticipating that almost all of rate of interest hikes are within the rearview window, with maybe just one extra nonetheless to be endured, if even.

This might launch the shackles which have been round Bitcoin’s ankles, and it stays to be seen how the asset will henceforth transfer in relation to the inventory market. We all know that the correlation picked up as quickly because the Federal Reserve started mountain climbing rates of interest; correlations go to 1 in a disaster, and there’s a flight to high quality – threat belongings endure in that situation, and that’s precisely what we noticed.

There’s each likelihood that each shares and Bitcoin will proceed to commerce in tandem, but when/when this tightening cycle ends, it’s going to at the very least give the market a contemporary alternative to commerce them while world liquidity shouldn’t be being pulled off the desk.

Whatever the relationship between the duo, the under chart reveals simply how dependent Bitcoin has been on yields – the two-year treasury yield, plotted on an inverse scale, has moved exceptionally intently with Bitcoin, ever for the reason that latter’s all-time excessive in November 2021.

How will Bitcoin’s relationship with gold change?

It’s Bitcoin’s relationship with gold that gives an equal quantity of intrigue, given the previous’s designs on turning into some kind of digital equal of the latter. Ought to Bitcoin turn into a retailer of worth, it might want to turn into a bit of extra boring with regard to cost actions – one thing gold is well-known for.

Nonetheless, correlation between the 2 belongings has dipped, shifting in the other way to that of shares. From rising markedly this yr, it has fallen sharply within the final month.

If Bitcoin is to realize what so many wish to do – turn into an uncorrelated asset able to providing a portfolio hedge properties – it should flip the script right here. Its relationship with shares might want to loosen, whereas it might want to get nearer to the best way gold trades.

Having stated that, Bitcoin has been round solely 14 years, and has traded with cheap liquidity for a lot lower than that. It’s nonetheless discovering its ft, and it stays early – actually in comparison with gold, which has been round for hundreds of years.