- ADA’s rating drops to tenth by market cap amid a big worth lower.

- Solely 35% of ADA holders are at the moment in revenue, contrasting with BTC and ETH.

- ADA’s on-chain exercise declines, reflecting decreased engagement amidst the value drop.

Cardano (ADA), a layer-1 blockchain community, is going through a difficult interval as its worth continues to drop and its market rating declines. Notably, ADA is now ranked because the tenth largest cryptocurrency by market cap, following an enormous lower in worth. Within the final month alone, ADA’s worth has fallen by 28%, and it has seen a virtually 22% drop year-to-date, in response to CoinMarketCap.

Furthermore, current knowledge from IntoTheBlock shared on X reveals that solely about 35% of ADA holders are at the moment in revenue. This contrasts starkly with different main cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), the place 86% and 81% of holders, respectively, are seeing income. The state of affairs has led to elevated scrutiny of Cardano’s near-term demand potential as extra traders are going through losses.

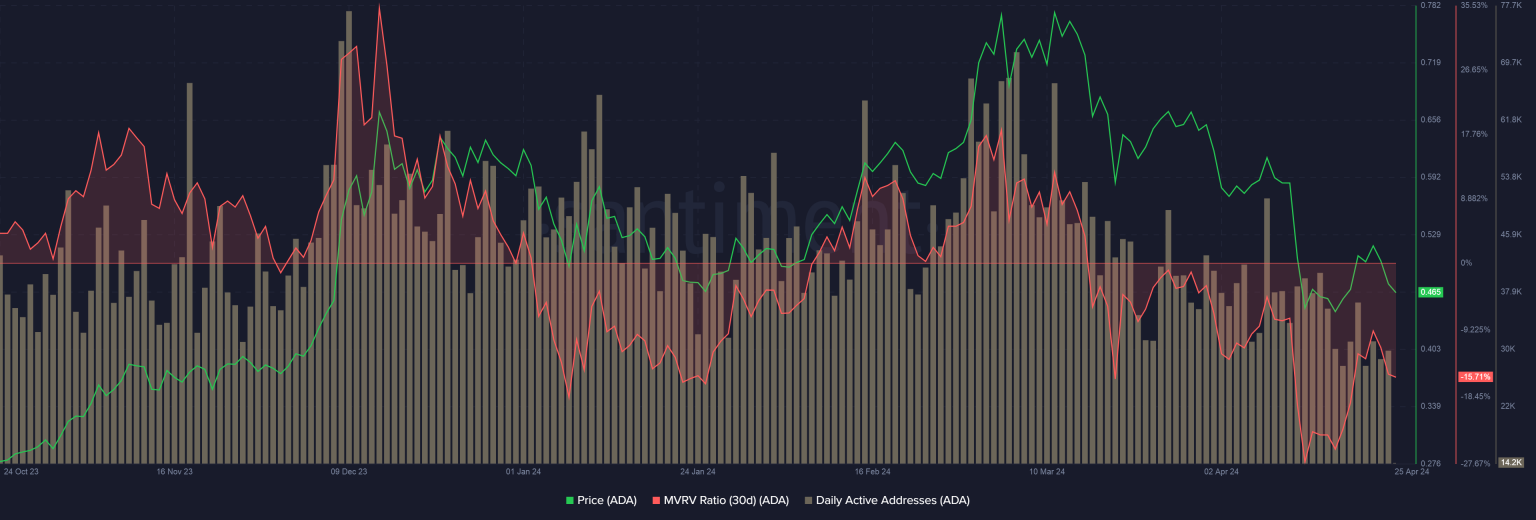

ADA’s market efficiency has additionally influenced its place relative to different cryptocurrencies. Over the previous month, it has been surpassed in market valuation by Dogecoin (DOGE) and Toncoin (TON). Moreover, the community has seen its common unrealized loss widen to fifteen.71%, indicating that if holders have been to promote their ADA at present costs, they might incur a mean lack of 15.71%.

A major drop in on-chain exercise accompanies the downturn in ADA’s market worth. In accordance with Santiment knowledge, every day lively addresses on the Cardano community have decreased from over 70,000 throughout its worth peak to about 30,000 at the moment. This decline in exercise displays the decreased engagement and transaction volumes on the community.

Regardless of the present market situations, ADA’s restoration stays doable. Historic knowledge means that ADA might enter a brilliant cycle in 2025, probably reaching new all-time excessive ranges, following a sample noticed a 12 months after the 2020 Bitcoin halving.

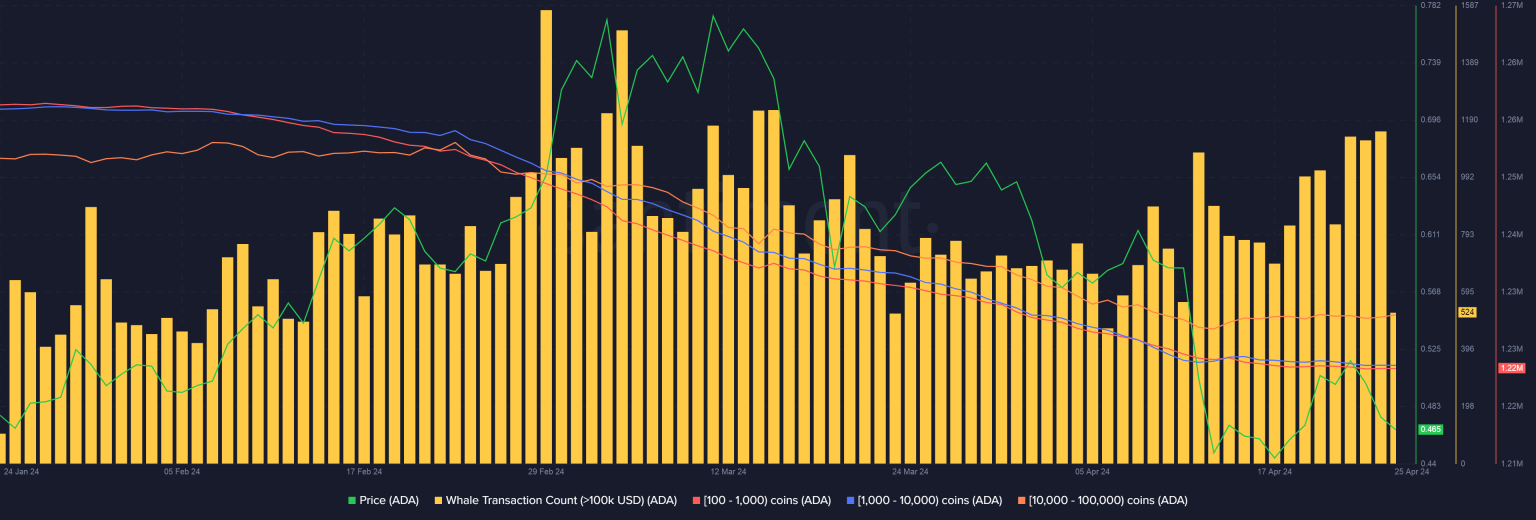

Nevertheless, investor sentiment stays tepid as knowledge from Santiment exhibits that whale cohorts have been internet sellers, decreasing their holdings constantly over the past 2-3 months. This lack of serious shopping for exercise through the worth dip raises questions in regards to the depth of investor curiosity in ADA at decrease costs.

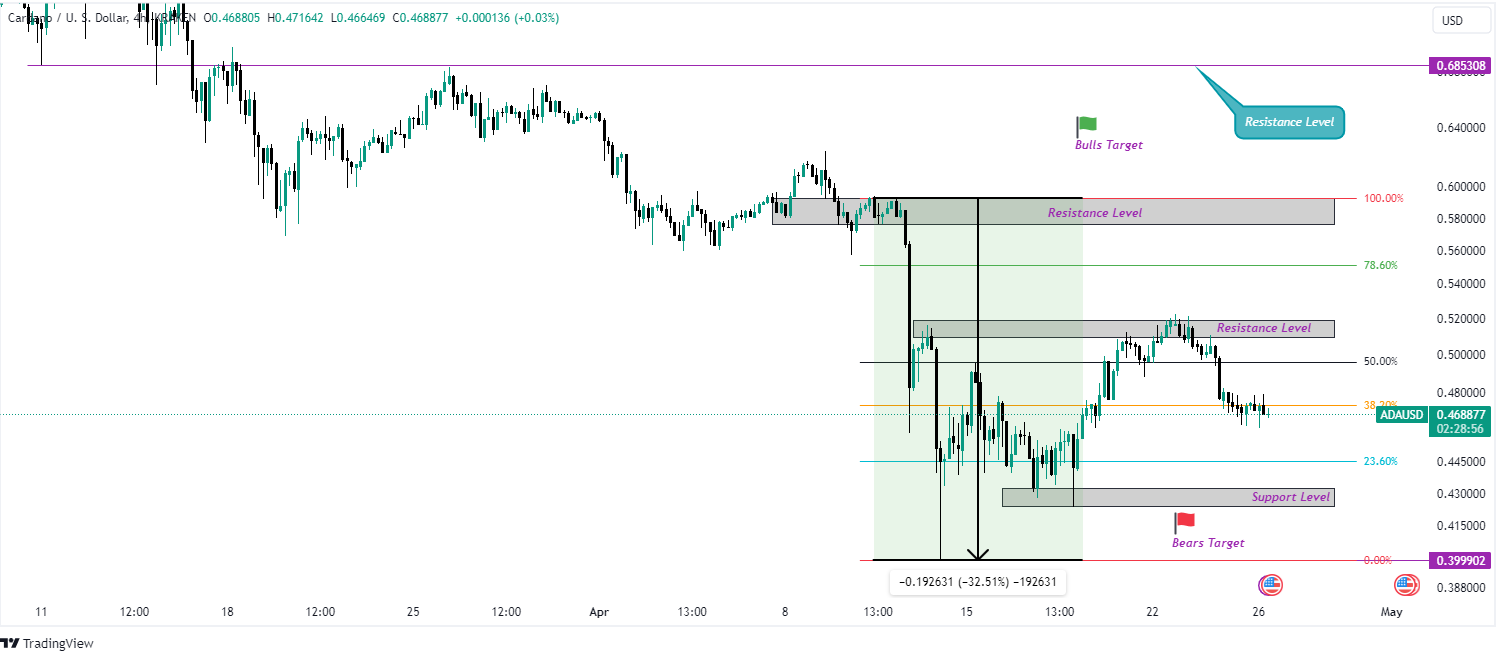

ADA/USD Worth Motion

On the 4-hour chart, the ADA token is beneath the affect of a bearish sentiment, indicating potential additional worth declines. Since reaching a vital degree on April 12, ADA has seen a big drop of 32.15%, as depicted by the value vary instrument. Presently, ADA’s worth hovers across the 38.20% Fibonacci retracement degree.

Ought to ADA handle to shut above this level, it could sign an upward trajectory, probably difficult the 50% Fibonacci degree and even surpassing resistance ranges favored by bulls. Conversely, ought to ADA proceed its bearish momentum and shut under the 38.20% Fibonacci degree, it might sign a continuation of downward motion, presumably retesting the assist degree under it. A profitable breach of this assist degree may lead ADA costs additional downwards, aligning with bearish targets.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version is just not answerable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.