Knowledge from Glassnode analyzed by StarCrypto signifies that long-term Bitcoin holders have hit an all-time excessive, with a give attention to Bitcoin that was beforehand energetic 2+ and 5+ years in the past.

The cohort of buyers from Feb. 2021 is at a mean of 66% drawdown from the acquisition value, whereas those that purchased within the 2017 bull run are at present in revenue. The common value of Bitcoin 2 years in the past was round $36,000, and the typical value 5 years in the past was $9,500.

Buyers who bought Bitcoin for round $20,000 in 2017 needed to endure nearly 4 years of decrease costs till Bitcoin lastly broke above the 2017 excessive in early 2021. Nonetheless, purchases from the peak of the 2021 bull run in November have seen falling costs ever since.

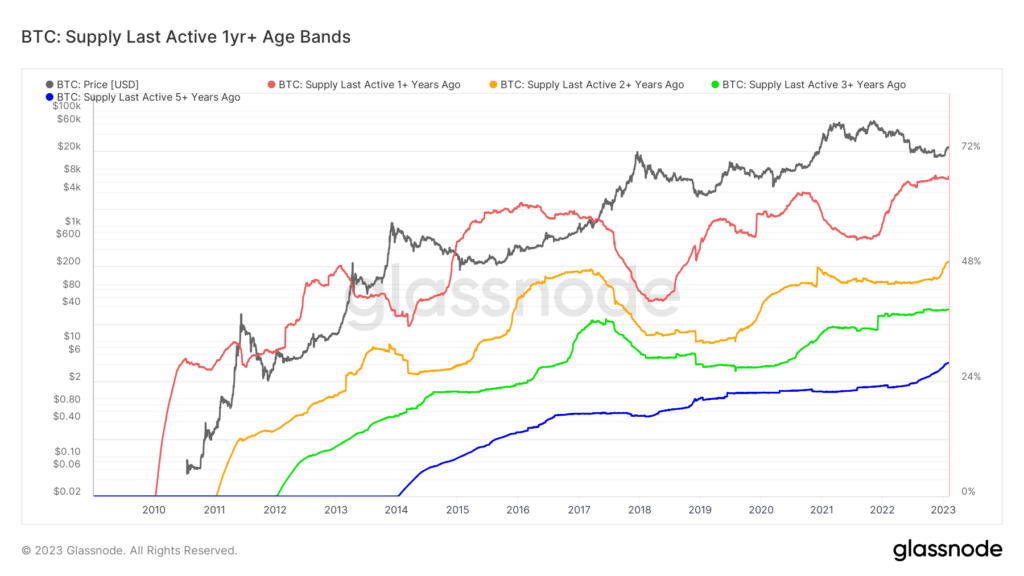

The chart under highlights the Bitcoin provide that was final energetic at set age bands from 1 to five years. The purple line signifies the share of Bitcoin’s provide that was final energetic over one 12 months in the past, whereas the blue line depicts Bitcoin that has not moved in over 5 years.

Bitcoin, which was final energetic over 5 years in the past, has reached an all-time excessive of 28% provide of the whole obtainable Bitcoin. The 5+ 12 months provide has seen constant development since data started in 2014. Nonetheless, between 2016 and 2018, and 2020 and 2021, the availability plateaued considerably. Since mid-2021, the 5+ 12 months provide has expanded quickly.

Additional, the Bitcoin that was final energetic over 2+ years in the past has damaged 48% of the whole provide for the primary time. The two+ 12 months provide final peaked in 2017 earlier than it fell to round 30% from a excessive of 47%. The sharp enhance within the proportion of Bitcoin that hasn’t moved in 2+ years is rising on the quickest charge in historical past, indicating robust resolve inside the cohort.

The info additionally confirms that round 36% of all Bitcoin modified palms inside the final 12 months. The remaining 64% has not moved since Bitcoin was at $38,000.

On the time of press, Bitcoin is ranked #1 by market cap and the BTC value is down 2.23% over the previous 24 hours. BTC has a market capitalization of $441.87 billion with a 24-hour buying and selling quantity of $18.21 billion. Study extra ›

BTCUSD Chart by TradingView

Market abstract

On the time of press, the worldwide cryptocurrency market is valued at at $1.06 trillion with a 24-hour quantity of $46.45 billion. Bitcoin dominance is at present at 41.63%. Study extra ›