Bitcoin (BTC) skilled a “flash-pump” to $138,000 on Binance.US throughout early buying and selling hours of June 21, based on information from the crypto trade.

The Bitcoin worth spike lasted solely seconds earlier than returning to its regular stage and was particular to the trade’s BTC/USDT buying and selling pair, whereas different belongings continued buying and selling at their traditional ranges.

Low market depth

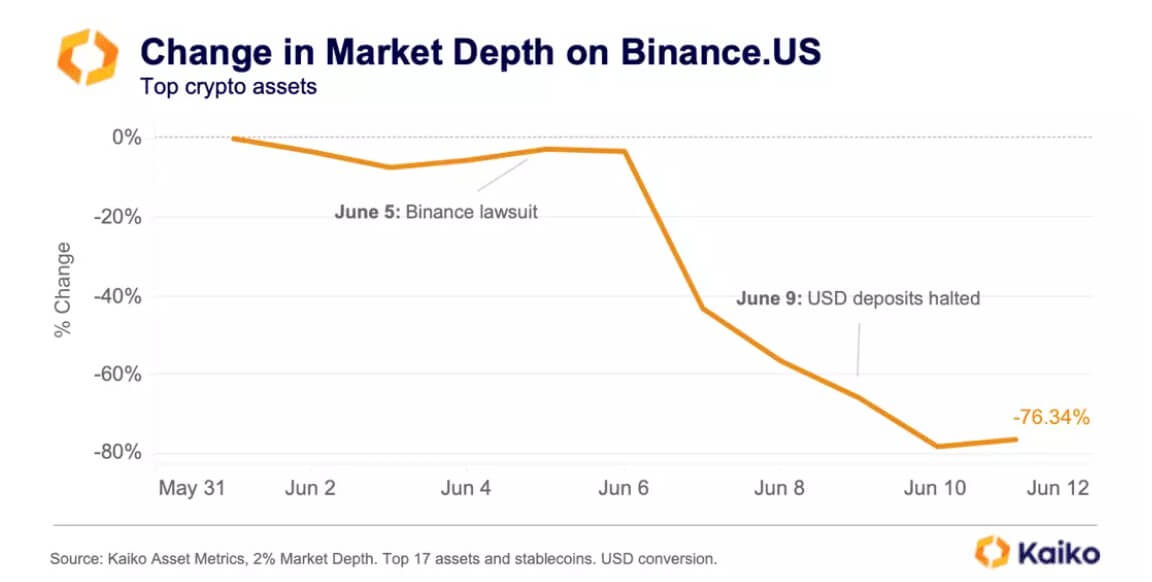

Because the U.S. Securities and Change Fee filed its lawsuit in opposition to Binance.US on June 5, market makers and merchants have fled the trade as a consequence of considerations about potential asset lock-ups.

Blockchain analytical agency Kaiko reported that the trade’s market depth fell by virtually 80% as of June 12, with its market depth for 17 tokens dropping to $7 million from the $34 million recorded on June 4—a day earlier than the SEC’s lawsuit.

On the time, Kaiko mentioned:

“[Binance US] market makers are nervous and wish to keep away from volatility-induced losses and the non-negligible chance that their belongings might get caught on an trade à la FTX collapse.”

Moreover, the trade’s liquidity difficulty has been exacerbated by its banking companions’ resolution to halt their USD cost channels. In Could, Bitcoin traded at practically a 3% low cost on Binance US in comparison with different rival exchanges.

Binance.US market share plunges

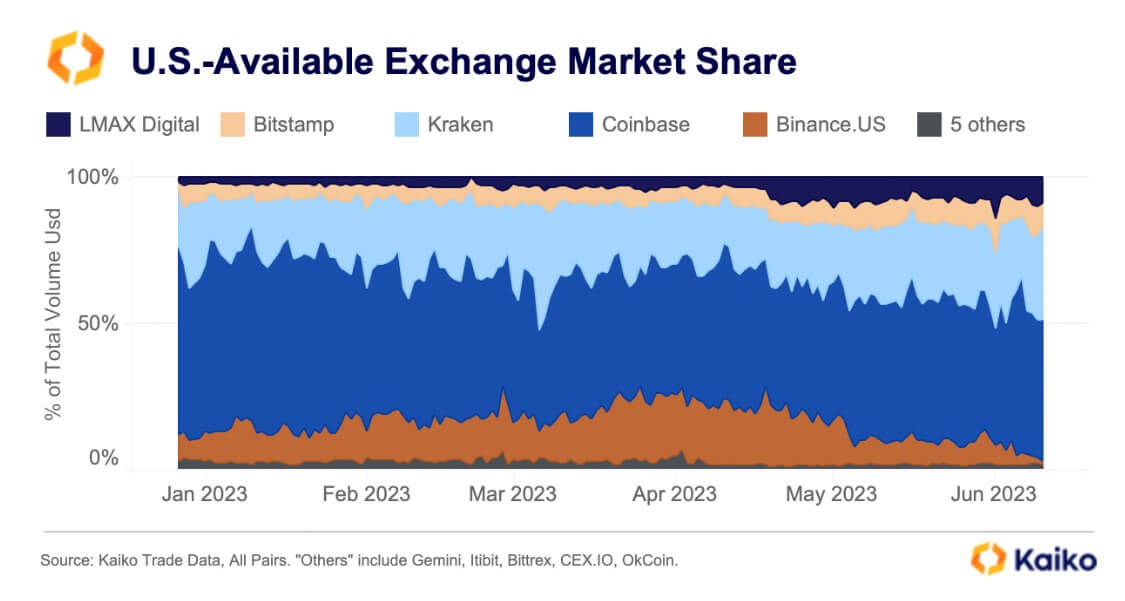

The embattled crypto trade market share in relation to different U.S.-based platforms has dropped to 1%, based on Kaiko information.

Kaiko famous that this was considerably decrease than its all-time excessive of 27% recorded a couple of months in the past, including that “the trade’s fame has been severely harmed” by the lawsuit filed in opposition to it by the SEC.

Whereas the Court docket rejected the SEC’s try to freeze its belongings, the trade has needed to take care of different points, together with the layoff of about 50 employees members throughout a number of departments.

In the meantime, Binance US has maintained that it could battle the SEC’s allegations in Court docket.

The publish Bitcoin worth briefly pumps to $138,000 on Binance.US amid trade’s liquidity disaster appeared first on StarCrypto.