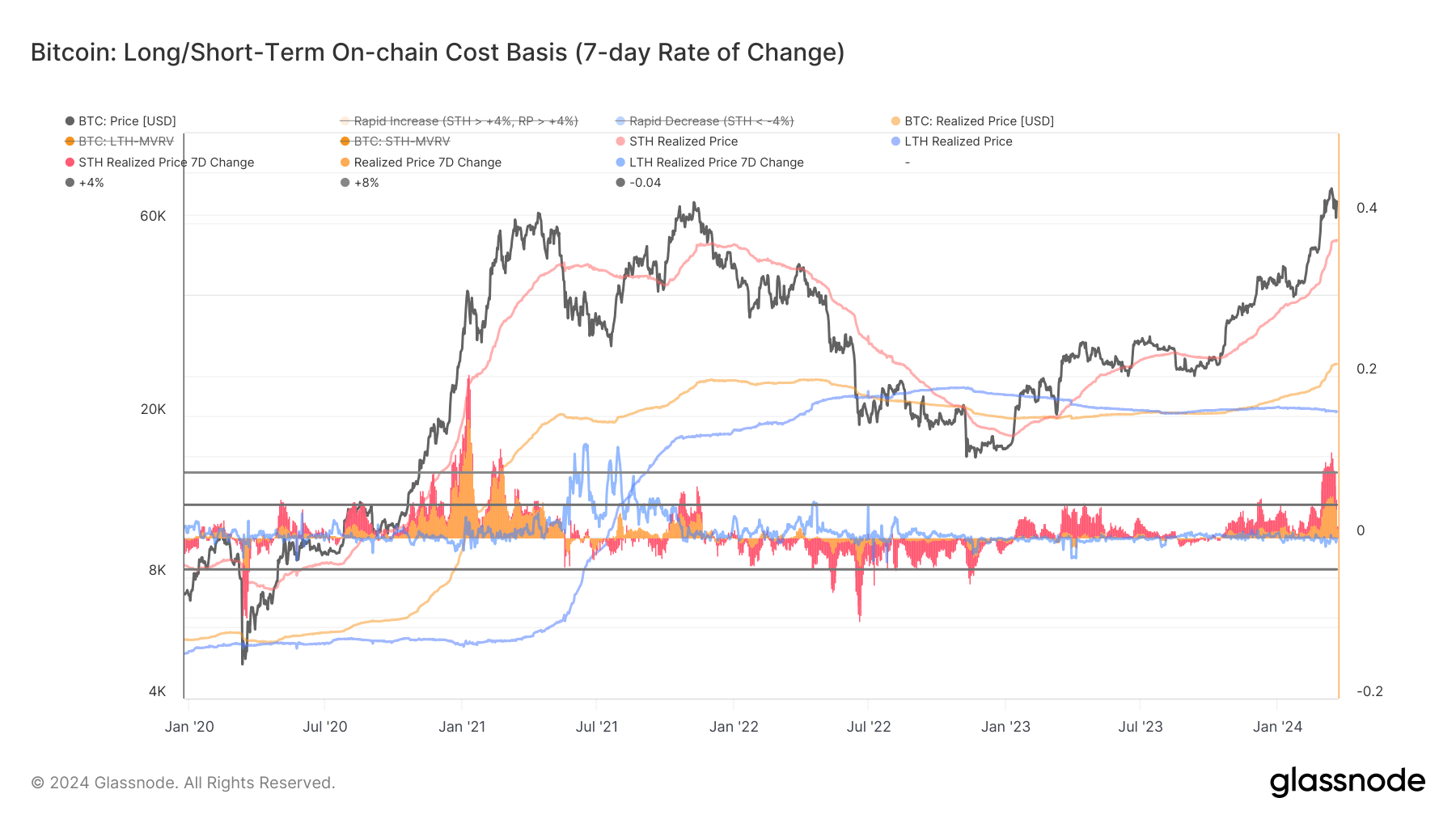

The realized Bitcoin worth represents the common on-chain acquisition price. It’s a helpful metric because it completely gauges the market’s valuation baseline at any given level. When dissected by way of the lens of short-term and long-term holders, it offers insights into the cohorts’ funding horizons and their acute impact on Bitcoin’s worth.

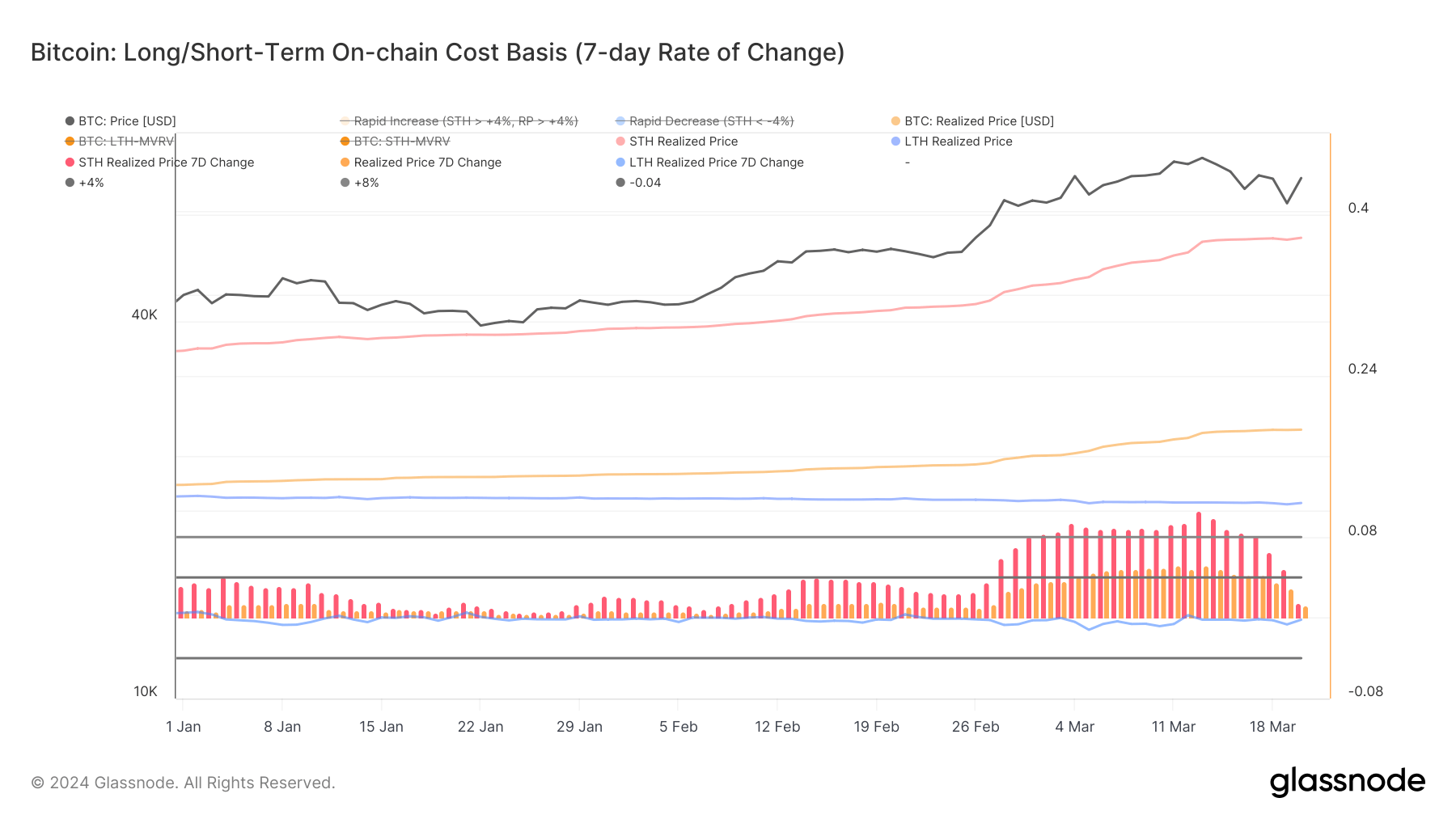

These cohorts’ 7-day change in realized worth offers a significantly better metric visualization. The 7-day change in realized worth for short-term holders reached its three-year excessive on Mar. 13, at 10.62%. The 7-day change in realized worth for long-term holders the identical day stood at -0.183%, representing a slight lower from the earlier weeks.

This divergence between STH and LTH realized costs suggests a sturdy inflow of short-term speculative curiosity into the market. New market contributors had been getting into at larger worth ranges than long-term holders between Mar. 6 and Mar. 13, driving the cohort’s realized worth up. The rise in STH realized worth culminating on Mar. 13, when Bitcoin’s worth peaked at above $73,100, implies that vital investments have been made at or close to peak costs.

Monitoring adjustments in realized costs for each LTHs and STHs is significant due to their potential to indicate shifts in market sentiment and potential stress factors. As an example, a rising STH realized worth, significantly with Bitcoin’s worth enhance, can sign rising optimism or speculative demand as newer entrants are prepared to take a position at larger worth ranges. The comparatively secure or reducing LTH realized worth change suggests a maintain sentiment amongst long-term buyers, who could not transfer their holdings regardless of worth fluctuations, thus anchoring the market’s foundational notion of worth.

The information from Glassnode confirmed a market at a possible inflection level. The dramatic enhance in STH realized worth change, alongside a major enhance in Bitcoin’s worth, indicated a short-term bullish sentiment pushed by speculative buying and selling and new entrants attracted by the momentum. Nonetheless, spikes as sharp because the one seen on Mar. 13 hardly ever last more than a few weeks earlier than experiencing a major correction, which is exactly what occurred previously week.

The 7-day change in short-term holder realized worth dropped by 1.469% by Mar. 20, following Bitcoin’s lower to $61,000 and a subsequent restoration to $68,000. This sharp drop reveals that the speculative enthusiasm cooled down, and the market entered a consolidation section. Knowledge signifies that the shopping for momentum and optimism that drove the numerous enhance in STH realized worth and, by extension, Bitcoin’s worth has tempered, resulting in a extra cautious market sentiment.

A number of interpretations might be drawn from this information level. Firstly, the discount within the charge of change in STH realized worth may point out that the inflow of recent capital at larger valuation ranges has slowed. The simultaneous lower in each the STH realized worth change and Bitcoin’s market worth can even recommend a discount in sell-side stress from short-term holders.

Usually, a excessive STH realized worth change, particularly when it units a report because it did on Mar. 13, may point out a heightened probability of promoting exercise as short-term holders look to capitalize on good points. Nonetheless, as this stress subsides, it may stabilize costs, albeit at a stage decrease than the latest highs, because the market absorbs the results of earlier speculative buying and selling.

Trying forward, this era of recalibration may pave the way in which for resistance to be created at this worth stage, because it permits the market to digest latest good points. Furthermore, the conduct of long-term holders will proceed to be a vital issue to observe, as their steadiness amidst volatility usually serves as an anchor for the market’s stability.