Bitcoin costs recovered previous the $40,100 mark on Jan. 24, 2024 amidst continued inflows and outflows involving numerous spot Bitcoin ETFs.

Bitcoin (BTC) was up almost 1% over the 24 hours ending at 11:55 p.m. UTC. on Wednesday, reporting a worth of $40,143 and a market cap of $786 billion. Throughout an ancient times that lasted about 5 hours, Bitcoin was value lower than $40,000, and it briefly fell as little as $39,563 at 9:00 pm.

The crypto market in its entirety is up 1.8% over 24 hours. Different main property have additionally seen positive factors: Solana (SOL) is up 5.8%, Dogecoin (DOGE) is up 1.2%, Avalanche (AVAX) is up 2.2%, and XRP is up 0.1%. In the meantime, Ethereum (ETH) is down 0.2%, BNB is down 1.7%, and Cardano (ADA) has seen no change.

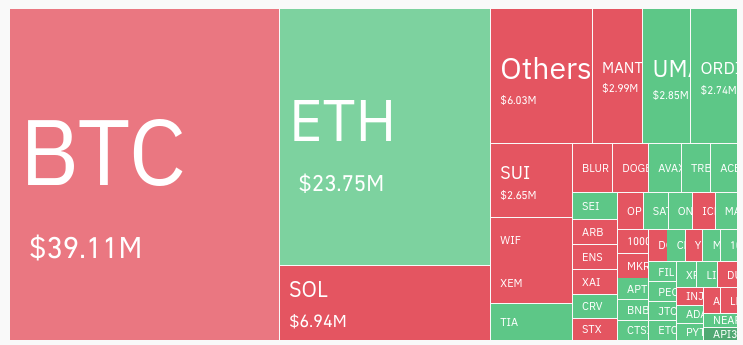

The market noticed 37,063 dealer liquidations value $105.6 million within the 24 hour-period ending at 11:40 p.m., based on Coinglass. Of these liquidations, $39.11 million concerned Bitcoin (BTC) and $23.75 million concerned Ethereum (ETH).

GBTC outflows might have an effect on costs

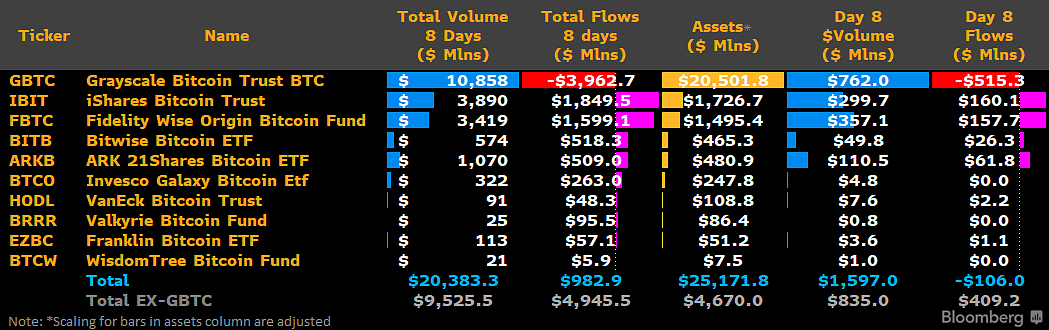

StarCrypto Insights discovered that that GBTC outflows moved 19,236 BTC out of the fund on Jan. 23, an quantity valued at greater than $754 million.

GBTC outflows offset inflows into numerous different spot Bitcoin ETFs, a pattern finest seen in long-term information. Bloomberg ETF analyst James Seyffart reported that as of Jan. 23, GBTC has skilled $3.96 billion in cumulative outflows over 8 days, whereas different funds have seen $4.95 billion in inflows over the identical interval. This reduces general spot Bitcoin inflows to only $982.9 million.

Any Bitcoin that enters and stays in the marketplace is anticipated to extend the provision out there to traders, thereby lowering costs.

Investor sentiment ensuing from fading hype round spot Bitcoin ETFs might also influence costs alongside different developments.

On the time of press, Bitcoin is ranked #1 by market cap and the BTC worth is up 0.74% over the previous 24 hours. BTC has a market capitalization of $785.67 billion with a 24-hour buying and selling quantity of $22.06 billion. Study extra about BTC ›

BTCUSD Chart by TradingView

Market abstract

On the time of press, the worldwide cryptocurrency market is valued at at $1.56 trillion with a 24-hour quantity of $52.93 billion. Bitcoin dominance is at the moment at 50.30%. Study extra ›