Strike, a Bitcoin-based fee community and monetary app, is increasing to the Philippines to develop cross-border funds and remittance markets.

“The Philippines is without doubt one of the largest remitting markets on this planet, particularly from the US,” Jack Mallers, CEO of Strike, mentioned to starcrypto. In 2021, about $12.7 billion in money remittances was despatched from U.S.-based Filipinos to the Philippines, in keeping with Statista information.

“So far as the expertise we construct, it’s one of many lowest-hanging fruits — worldwide funds are an enormous ache and all the time have been. There’s been incremental innovation from SWIFT and Western Union, however it’s nonetheless extremely tough.”

Even throughout Western international locations, conventional cross-border cash transfers companies are slower as financial institution transfers can take a number of days for funds to maneuver from one account to a different.

Strike makes use of instantaneous, low-cost micropayments via the Lightning Community, a layer-2 fee protocol on high of Bitcoin, which permits hundreds of thousands to billions of transactions per second to transpire throughout the platform. The app’s platform additionally permits customers to switch U.S. {dollars} to native fiat currencies, just like the Philippine peso, for lower than 1 cent per transaction, Mallers famous.

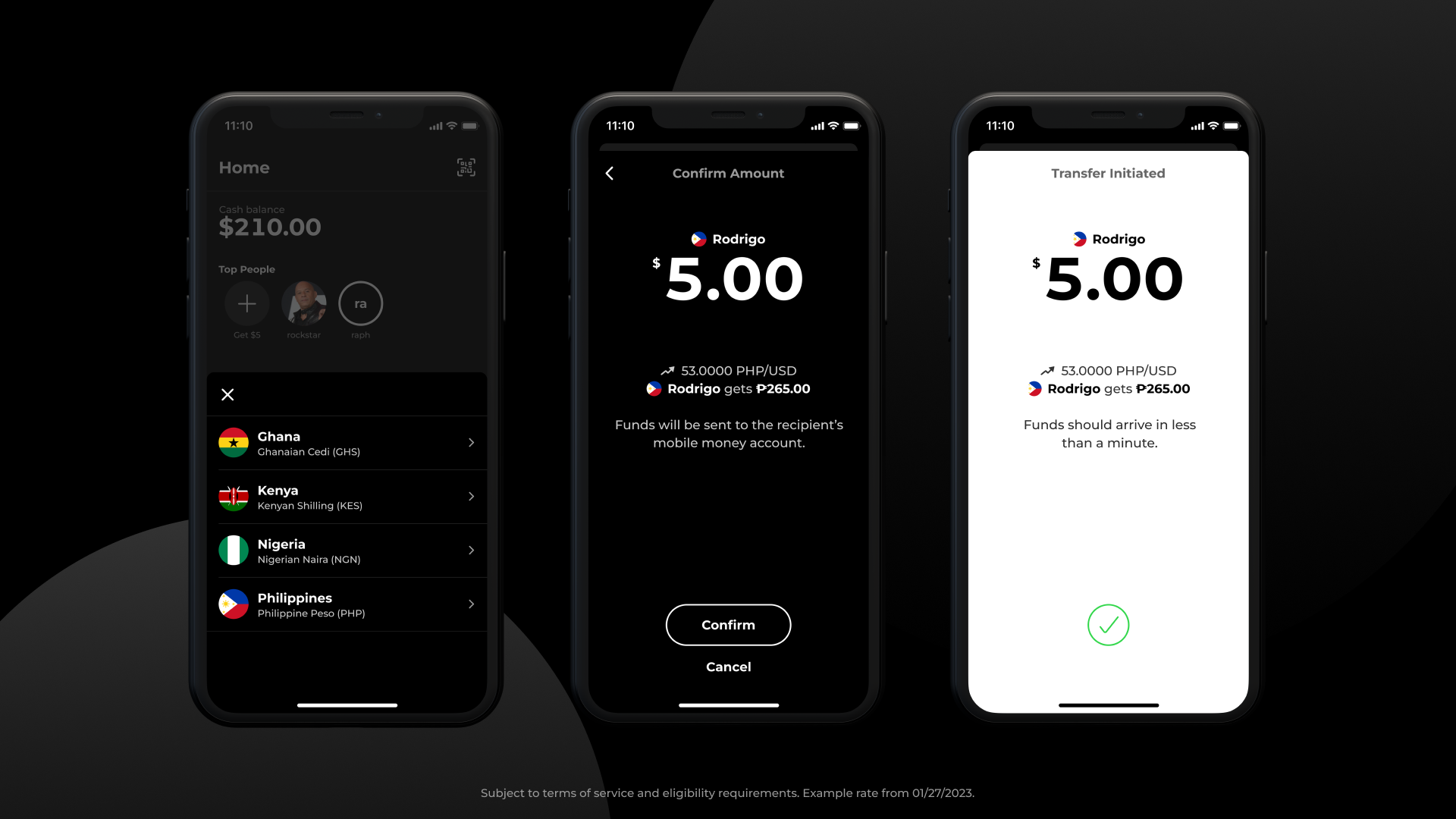

Picture Credit: Strike (opens in a brand new window)

“None of our customers have to the touch Bitcoin,” Mallers mentioned. The app makes use of Bitcoin to switch cash from one consumer’s account to a different, no matter its value. “The aspiration of the enterprise is to cover Bitcoin underneath the hood” so customers may benefit from its fee community, he added.

For instance, if a buyer needs to take $5 and ship it to a rustic just like the Philippines, the Bitcoin is transformed over the Lightning Community and reconverted into the native foreign money “within the order of seconds to minutes versus days or perhaps weeks,” Mallers mentioned.

Apart from the Philippines, Strike plans on increasing additional within the Latin American and African areas as nicely because of the “excessive quantity of demand,” Mallers shared. “We’re seeing companions pop up everywhere in the world.”

Now, Strike is gaining demand and companions looking for out integrations from in every single place between the U.Ok. and all through Europe all the best way to “20 new international locations we’ll probably add in February in Africa,” Mallers added.

Earlier this month, Strike partnered with funds supplier Fiserv, the mother or father firm of Clover (the flamboyant white digital register at many small companies at this time), to develop its companies.

Final 12 months, it raised $80 million in a Collection B spherical to drive its efforts to develop fee options for retailers, marketplaces and monetary establishments, the corporate mentioned. Strike additionally joined forces with Visa in August 2022 to launch a rewards card that pairs with its utility.

On the whole, the corporate’s partnerships and announcement level to its concentrate on rising the remittance market via its utility and different various avenues, like Clover.

“The purpose is to make cross-border funds and international funds cheaper and sooner,” Mallers mentioned. “But in addition extra accessible. There’s enormous worth right here for monetary inclusion.”

Some Strike customers will ship quantities as little as 10 cents to their households, Mallers shared. However via a standard monetary system, the charges would outweigh the advantages, he added. “We are able to course of a 10-cent fee…and also you don’t need to log into Chase for a global wire switch.”

Going ahead, there are alternatives to enhance the present remittance markets whereas additionally unlocking new markets, he added. “You’ll begin to see a renaissance of instruments actually closing that massive delta hole and also you’ll begin seeing extra monetary establishments like Sq. and CashApp reap the benefits of this.”

Over the following decade, Mallers thinks remittance networks and purposes like Lightning and Strike will develop alternatives from the two billion to three billion individuals which can be “usually included within the international worldwide funds system” to all 8 billion.

“That’ll be like a renaissance second,” Mallers mentioned. “It’s a extremely enormous deal.”