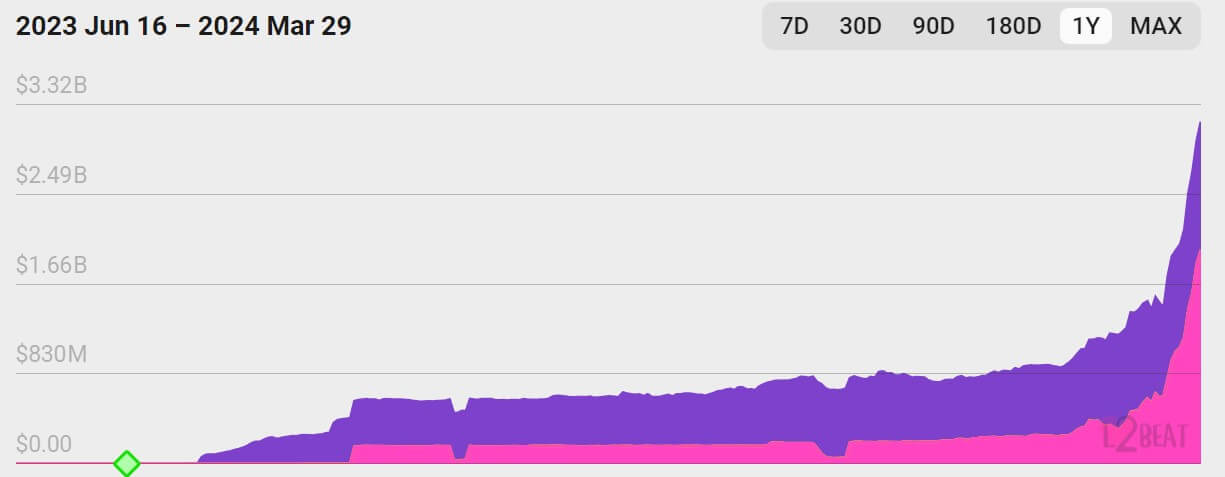

The Ethereum layer-2 community, Base, has witnessed a exceptional surge in property locked, hovering by roughly 200% during the last month to over $3 billion, in accordance with L2beat information.

Key contributor Jesse Pollak disclosed that Base hit the $3 billion milestone 5 days after crossing the $2 billion threshold. Notably, the community took 203 days to succeed in its first billion mark and simply 23 days to the touch $2 billion.

Moreover, on-chain information reveals that the elevated TVL is matched with an ever-expanding consumer base. In response to the Dune analytics dashboard curated by Watermeloncrypto, Base’s every day energetic customers have surpassed 5 million this week, with the community’s complete income already exceeding $36 million.

Consequently, business specialists foresee Base’s development catalyzing the entry of extra corporations into on-chain improvement. Ryan Watkins, the founding father of Syncracy Capital, stated:

“Think about when Wall Road realizes Coinbase is printing $500M+ in annual income from an Ethereum rollup. Base could be the final catalyst that will get enterprises constructing onchain.”

Why Base metrics are rising

The community’s exponential development could be attributed to varied components, together with the notable surge in meme coin actions and the arrival of modern merchandise.

There was a notable surge in memecoins traction on Base lately. Consequently, Base has skilled heightened liquidity and extra favorable market sentiment as business analysts speculated that the property might spearhead the subsequent adoption section.

Notably, starcrypto reported that Base’s memecoins proliferation briefly spiked its community charges above that of rival layer-2 networks regardless of the introduction of the Dencun improve. To handle this surge, the community adjusted its gasoline charge goal to three.75 mgas/s, which gave it 50% extra capability.

Furthermore, Base has witnessed a surge in crypto builders creating new merchandise on the layer-2 answer, additional fostering adoption and utilization.

For context, Base lately welcomed one of many pioneer layer-3 networks, Degen, to its ecosystem on March 28. It stated:

“L3s are appchains which ship lightning-fast transactions as a result of they decide on L2s like Base as an alternative of connecting on to Ethereum. A brand new onchain web calls for new fashions for scaling, and L3s make the most of the ability of L2s in new methods.”

Andrew Forte, the director of enterprise improvement at Dappd, additionally highlighted Coinbase’s current efforts to develop a local sensible pockets that doesn’t want seed phrases or non-public keys for the layer-2 answer. In response to him, this pockets might assist drive Coinbase’s huge consumer base to Base.

Coinbase plans to incentivize builders to contribute to the community via grants, permitting them to construct freely and rewarding those that positively influence the ecosystem.

Pollak added:

“Fuel grants can be upfront, with path to scaling. Builder grants can be primarily retroactive as a result of we’ve noticed that creates aligned incentives and a powerful builder tradition.”