In line with on-chain information, the online worth of Ethereum faraway from staking has surpassed $1 billion in worth over the previous 24 hours, but once more showcasing the community’s means to carry out reside network-wide updates with out situation.

ETH withdrawals in motion

A complete of $1.7 billion has been withdrawn for the reason that Shanghai and Capella upgrades went reside. Nevertheless, as spherical 2 of withdrawals started, the worth of Ethereum withdrawn elevated. Spherical 1 took 4.14 days to finish as validators within the queue had been processed.

18,442,455 ETH is at the moment staked, with a worth of $38.5 billion as of press time. Because of this,

staked ETH makes up 15.32% of the whole provide, with 33% staked with Lido.

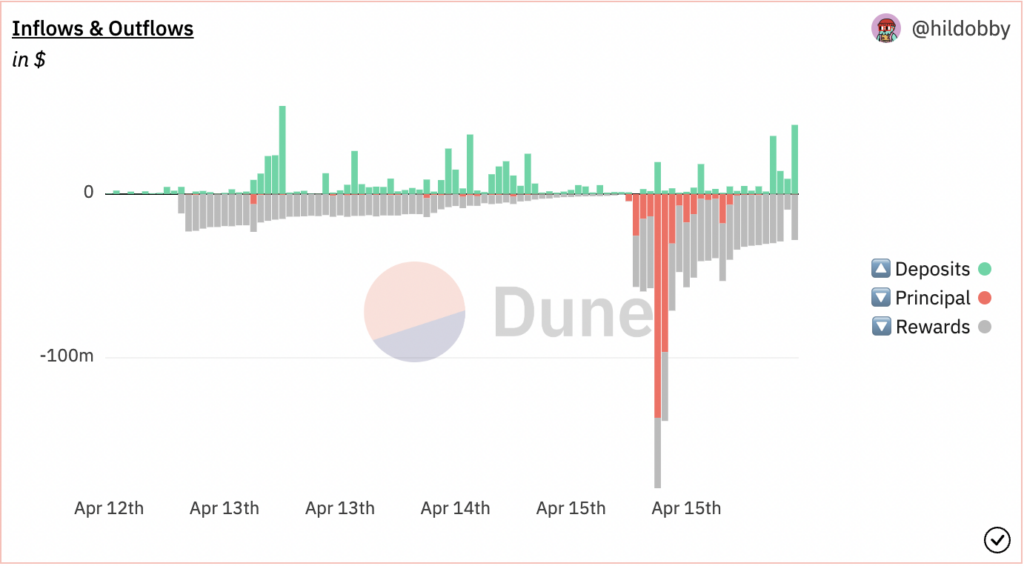

With withdrawals now open, traders have been withdrawing their preliminary capital and the earned rewards. Staked Ethereum earns curiosity over time, and when a validator earns over 32 ETH by way of rewards, the surplus quantity doesn’t add to their principal. As a substitute, it will get withdrawn robotically as a reward fee each few days.

The chart beneath reveals the huge distinction between deposits and withdrawals (rewards and principal funds) for the reason that improve.

Rewards

Staking rewards started round 15% and had been placed on a predefined falling curve relative to the variety of validator individuals till the Merge when the community took over. The present validator reward is 4.33%, together with consensus rewards and transaction charges. These rewards spiked to round 5.2% within the days main as much as the improve however have since returned to their downward trajectory. Whole staking rewards have fallen by 1.4% for the reason that Merge final September once they jumped to five.8% from 4.3%.

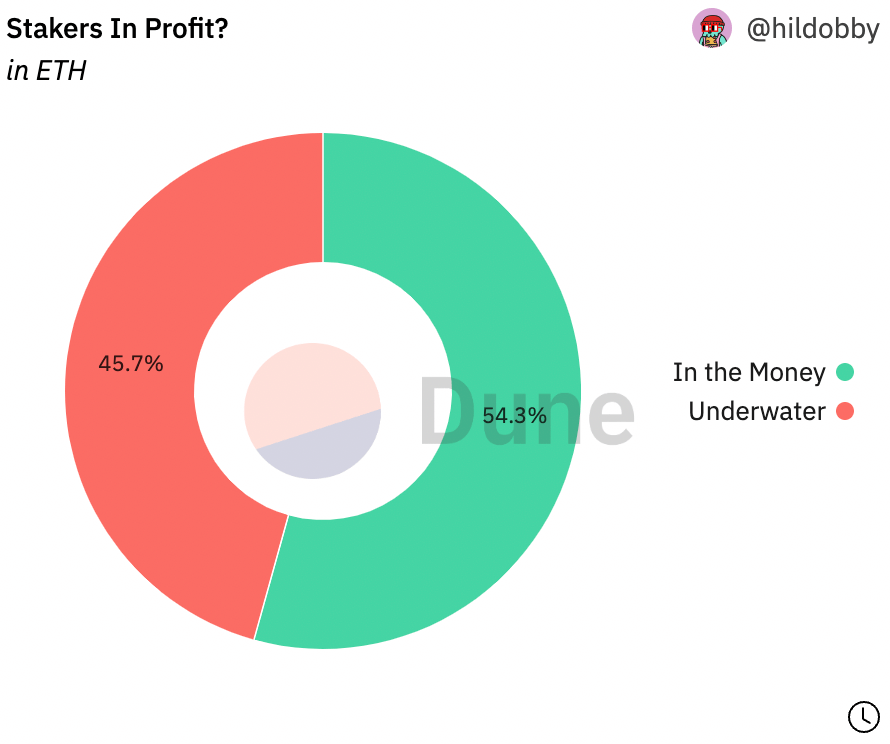

Along with the change in deposits, withdrawals, and rewards, the typical worth of Ethereum staked with validators has lowered since withdrawals opened. Because of this, 54.3% of stakers at the moment are in revenue with ETH round $2,000.

Bullish momentum

In the end, each the Shanghai and Capella upgrades seem to have been successful, because the community is processing new deposits, principal withdrawals, and reward funds with none vital points. Moreover, these actions are being carried out on a quantity of billions of {dollars} price of Ethereum every day.

Whereas blockchain networks can definitely nonetheless be thought of to be in beta in some ways, Ethereum’s means to undertake such monumental undertakings of reside community upgrades with out situation is extremely encouraging for our burgeoning trade.

The submit $1B staked ETH withdrawn in 24hrs as spherical 2 begins appeared first on starcrypto.