- XRP ETF approval might sign regulatory shift, boosting confidence in digital property.

- Altcoins like Litecoin are gaining traction amid rising hypothesis and market curiosity.

- Upcoming US elections might reshape crypto laws, impacting dealer sentiment considerably.

The potential approval of an XRP exchange-traded fund (ETF) may very well be a serious set off for a brand new crypto market rally. With Bitwise’s up to date submitting, hypothesis is rising about whether or not the US Securities and Alternate Fee (SEC) will approve an XRP-based ETF. This occurs throughout an ongoing authorized battle between Ripple and the SEC, rising discussions about crypto laws.

Many consider this approval may very well be a turning level, probably beginning a broader market increase. Plus, the elevated deal with altcoins like Litecoin and memecoins reveals a change in market sentiment, with merchants preparing for a surge in crypto costs.

XRP ETF: A Path to Regulatory Flexibility?

If accredited, an XRP ETF might symbolize a shift within the regulatory panorama. Considerably, it will point out that US regulators is perhaps softening their stance on digital property, particularly given the SEC’s robust actions in recent times.

The crypto market has confronted heightened scrutiny from the SEC, leaving buyers and innovators cautious of the regulatory setting. Nevertheless, there may be rising optimism {that a} potential XRP ETF approval might sign a extra balanced strategy by the SEC in direction of digital property.

Furthermore, the upcoming US Presidential election has added to this optimism. Former President Donald Trump has promised to take away SEC Chair Gary Gensler if re-elected.

Many within the crypto group see this potential change in management as a optimistic improvement, hoping a brand new administration may create a greater regulatory setting for digital property. As such, merchants are watching the XRP ETF approval as a possible signal of a extra favorable regulatory stance towards the crypto trade.

Altcoins Surge in Anticipation of XRP ETF

Moreover XRP, different altcoins corresponding to Litecoin (LTC) and memecoins have been gaining traction, with merchants positioning themselves for potential worth rallies.

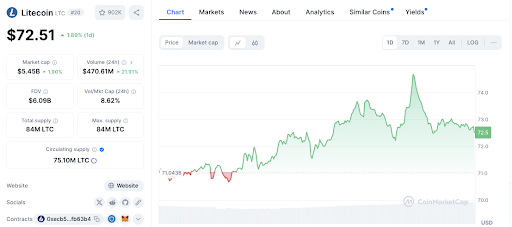

Litecoin, specifically, has seen notable worth motion. At present buying and selling at $72.69, it has skilled a 2.79% improve over the previous 24 hours. Furthermore, the buying and selling quantity for LTC has risen by 21.20%, indicating rising market curiosity.

Learn additionally: XRP ETF Hypothesis Fuels Spike in Choices Market Exercise

Technically, Litecoin is in a consolidation section, with assist at $70.70 and resistance round $74.00. A breakout above $74 might drive additional upward momentum, whereas a drop beneath $70.70 might sign bearish sentiment.

Elevated buying and selling volumes recommend rising curiosity in altcoins as hypothesis round regulatory developments continues to develop.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be liable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.