- Whale shifts $3.33M in $WLD to Binance, going through a $50K loss.

- WLD’s worth dips 10.4%, with its market cap additionally falling 9.77%.

- Technical indicators counsel an ongoing bearish WLD development.

In a monetary maneuver, a cryptocurrency whale transferred 624,479 $WLD tokens, valued at roughly $3.33 million, into the Binance alternate to mitigate additional losses. Nonetheless, this motion resulted in an estimated $50k monetary setback.

As reported by Lookonchain in an X (previously Twitter) put up, the monetary exercise commenced with the whale shopping for the tokens, totaling a spend of roughly $3.38 million over the previous month.

Lookonchain famous:

He accrued 624,479 $WLD($3.38M) from #Binance previously month at a median worth of $5.42 after which deposited it into #Binance 4 hours in the past.

Throughout this accumulation part, the tokens had been purchased at a median worth of $5.42 every. The following deposit again into Binance was geared toward curbing losses as market circumstances shifted.

WLD Coin Value Motion

Regardless of a 5% acquire within the month-to-month chart, Worldcoin’s WLD token, linked to Sam Altman’s iris-scanning challenge, has seen a big weekly decline of 15.72%. As of press time, the token’s worth stands at $5.158, marking a ten.4% lower from the day gone by, persevering with its bearish development.

Worldcoin’s market capitalization additionally declined by 9.77% to settle at roughly $1.09 billion. This lower has shifted WLD’s rating, positioning it because the 72nd-largest cryptocurrency by market capitalization.

Such fluctuations are important as they have an effect on the token’s visibility and investor confidence. Contrasting with the decline in its market cap and worth, the buying and selling quantity of the WLD token tells a special narrative.

There was a considerable enhance in buying and selling exercise, with a 72.77% rise previously 24 hours, pushing the buying and selling quantity to $648.76 million. This spike means that regardless of the downward development in worth, curiosity in buying and selling the WLD token stays excessive, seemingly indicating speculative buying and selling or traders shopping for the dip.

WLD’s Bear Energy Intensifies

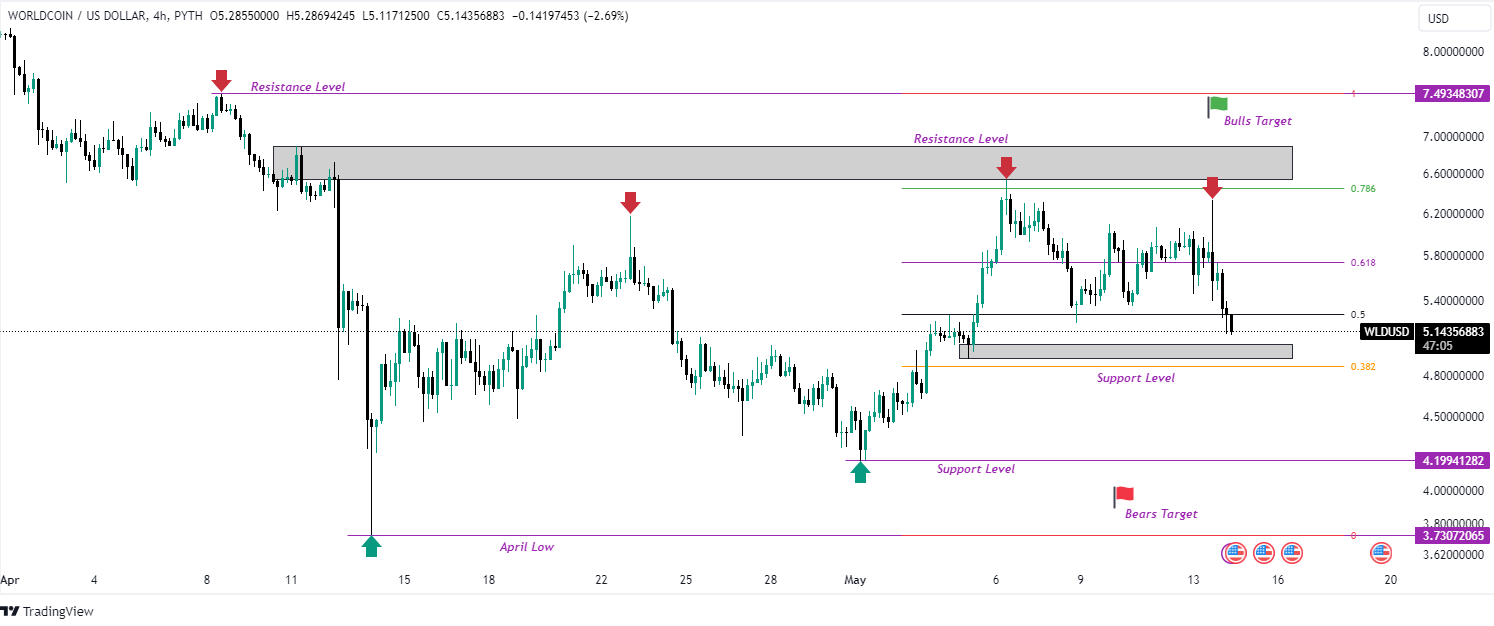

The WLD token is approaching a important assist degree at $5.04 on the 4-hour chart. If the prevailing bearish sentiment continues, this assist degree could also be breached, probably resulting in additional worth declines in the direction of the following assist degree at $4.19.

If this decrease degree can be breached, the WLD token would possibly then set its sights on reaching the bulls’ goal by difficult the lows seen in April. Conversely, if the $5.04 assist degree proves sturdy, the WLD token may expertise a worth rally.

This upward motion may problem the resistance degree close to the 78.6% Fibonacci retracement. Breaking by this resistance may probably propel the WLD costs towards the bulls’ goal, surpassing the $7.49 mark.

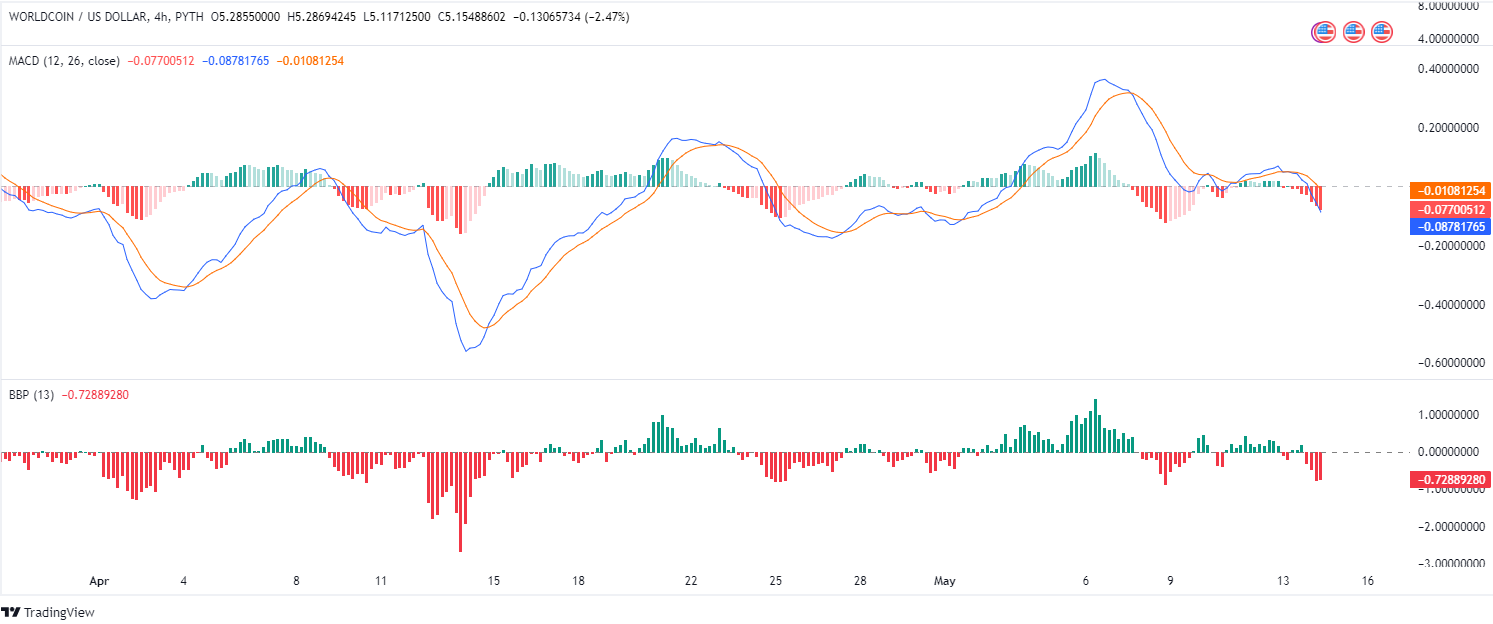

From a technical evaluation perspective, the MACD indicator underscores the bearish sentiment, displaying a pointy downward trajectory. Positioned at 0.0108 beneath each the zero line and the sign line, the MACD signifies that the bearish momentum within the WLD market is more likely to proceed within the brief time period.

That is additional corroborated by the MACD’s histogram, which exhibits enlarging crimson bars beneath the zero line, reinforcing the power of the present bearish temper. In parallel, the Bull Bear Energy indicator additionally contributes to this evaluation, exhibiting widening bars beneath the zero line.

These indicators, collectively, level to gaining momentum within the downward development of the WLD token market, indicating that this motion might proceed for the foreseeable future.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t liable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.