- WLD surges 9.57% in 24 hours, hitting $9.24 amid Private Custody launch.

- Worldcoin’s pivot to consumer information management boosts market cap by 56.31%.

- Kenya’s ban prompts Worldcoin’s privacy-focused strategic shift.

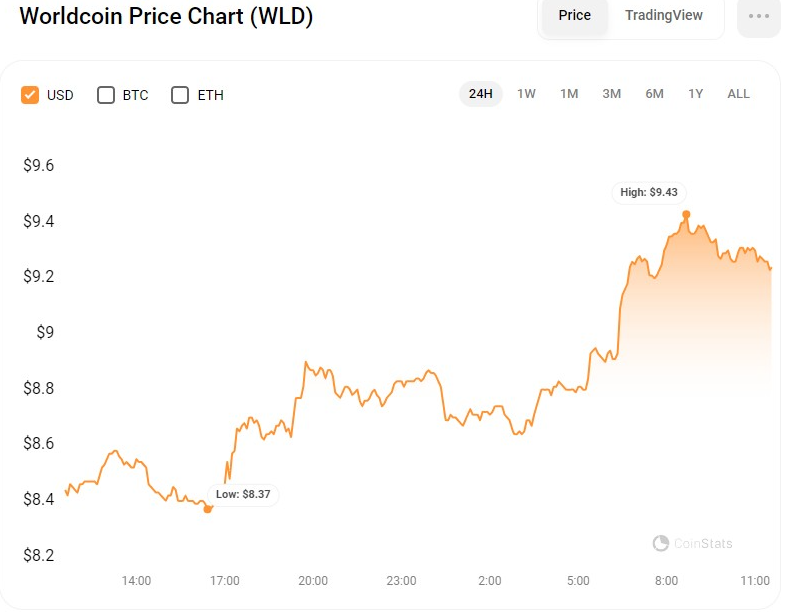

With the launch of its Private Custody characteristic, Worldcoin (WLD) has seen a notable improve in worth, surging to a seven-day excessive within the final 24 hours. Throughout the rally, WLD’s value swayed between an intra-day excessive and low of $8.35 and $9.45, respectively. At press time, the bullish momentum was nonetheless answerable for the market, with WLD exchanging fingers at $9.24, a 9.57% surge from the intra-day low.

This growth comes amidst rising privateness considerations and regulatory scrutiny in numerous nations, together with a notable ban in Kenya. The brand new characteristic represents a strategic pivot for the cryptocurrency challenge, specializing in enhancing consumer management over private information and addressing the privateness points which have shadowed its operations.

Worldcoin’s Shift to Private Custody

Worldcoin’s introduction of Private Custody marks a major transition in its method to consumer information administration. The characteristic permits customers to retain their private information, together with photographs and metadata used for World ID iris code technology, on their units.

This transfer is in response to the growing demand for privateness and safety within the digital age, the place information breaches and unauthorized entry have turn out to be prevalent considerations. By empowering customers with full management over their information, Worldcoin goals to foster a safer and trust-based relationship with its consumer base.

The implementation of Private Custody additionally permits superior options like Face Authentication. This characteristic enhances the safety framework of Worldcoin by permitting customers to confirm their identities via a neighborhood, on-device course of. This growth isn’t solely a step ahead in securing consumer information but in addition in constructing a user-centric expertise ecosystem that prioritizes particular person privateness and autonomy.

Addressing Privateness Issues

Worldcoin’s determination to stop storing private information on its servers comes within the wake of assorted privateness considerations and regulatory challenges throughout the globe. Notably, the challenge confronted a setback in Kenya, the place the federal government imposed a ban on Worldcoin operations on account of security and information privateness points. The ban highlighted the essential want for initiatives like Worldcoin to undertake extra stringent information safety measures and guarantee compliance with native rules.

In response to those challenges, Worldcoin has taken a proactive method by implementing Private Custody and discontinuing non-obligatory Information Custody at orb visits. This transfer is aimed toward reinforcing the challenge’s dedication to privateness and safety, guaranteeing that customers’ private data stays of their management.

WLD/USD Technical Evaluation

On the WLDUSD 24-hour value chart, the Vortex Indicator, which screens pattern course, is indicating a powerful bullish rally, with the uptrend line (blue) trying to interrupt above the downtrend line (purple). This factors to a possible constructive turnaround within the close to future as shopping for stress rises and sellers lose management. This sample reveals that the constructive momentum within the WLD market is gaining traction and should persist within the brief run.

The Stochastic RSI has moved from the oversold stage to 34.91, supporting the idea of a bullish reversal as momentum turns in the direction of the buying aspect. This sample can be per the elevated quantity noticed in latest buying and selling periods, exhibiting extra investor curiosity and engagement in driving the value upward.

Moreover, WLD’s buying and selling quantity and market capitalization have elevated by 10% and 56.31%, to $1,468,358,030 and $434,080,770, respectively, through the rise.

The Relative Volatility Index (RVI), which measures a safety’s volatility, has additionally elevated, suggesting that costs would transfer larger. With the RVI rising above its sign line and a ranking of 57.68, an upward breakthrough may be approaching. This may draw extra merchants wanting to revenue from the rising pattern, driving costs additional larger within the brief time period.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t accountable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.