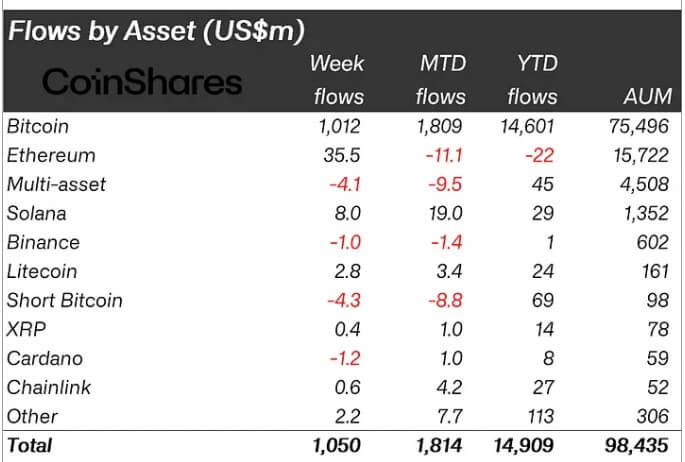

The cumulative year-to-date inflows into crypto-related funding merchandise have reached a file excessive of $14.9 billion, in accordance with in accordance with CoinShares’ weekly report.

This file was achieved following a 3rd straight week of inflows that totaled $1.05 billion final week. Notably, the ETPs’ buying and selling volumes rose by 28% to $13.6 billion in the course of the reporting interval, a big departure from the subdued actions seen in earlier weeks.

In the meantime, James Butterfill, CoinShares’ head of analysis, identified that current value will increase out there have pushed the full worth of property underneath administration for digital asset ETPs to $98.5 billion.

Constructive sentiments

A circulate breakdown exhibits that Bitcoin-related ETPs accounted for 99% of the full inflows, recording $1.01 billion final week. Surprisingly, brief Bitcoin merchandise noticed one other week of outflows, totaling $4.3 million.

Butterfill defined that the substantial inflows into BTC ETPs confirmed constructive sentiments returning to the market. He wrote:

“[The inflows] recommend that sentiment is popping broadly constructive regardless of the current value rises. That is probably as a consequence of traders decoding the FOMC minutes and up to date macro knowledge as mildly dovish.”

These constructive sentiments additionally prolonged to Ethereum-related funding merchandise, which noticed their highest inflows at $36 million since March. Butterfill said that these inflows “have been probably an early response to the approval of ETH ETFs in america.”

Notably, different large-cap digital property, like Solana, Chainlink, and Litecoin, recorded cumulative inflows exceeding $10 million in the course of the reporting interval.

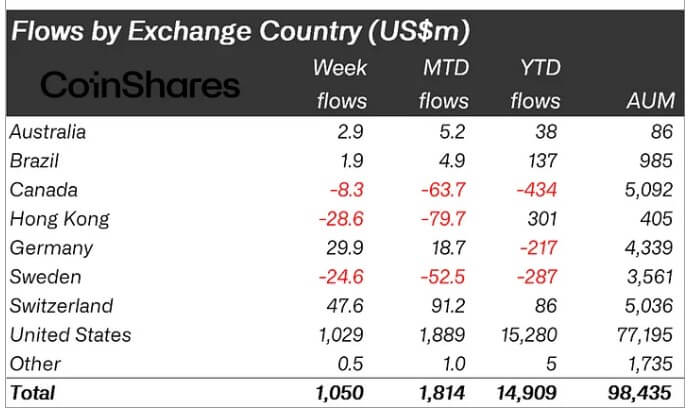

Whereas sentiments in america seem to influence traders’ pursuits in crypto merchandise positively, the identical can’t be mentioned for ETFs in Hong Kong.

In line with CoinShares, because the preliminary constructive launch of Bitcoin spot-based ETFs in Hong Kong (which noticed $300 million within the first week), there have been additional outflows of $29 million final week. This brings the full outflows within the city-state to roughly $80 million this month, the very best amongst nations.