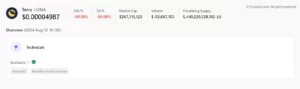

On August 10, Terra Luna Traditional (LUNC) skilled a 23.3% worth enhance when quantity accelerated, hitting mid-level costs. Little proof of robust shopping for momentum from the OBV and DMI painted a confused image of the development. This was accompanied by a pleasant leap to above 60 on the RSI, suggesting that some volatility and bearish sentiment got here again into this market.

The growth in its worth got here simply ten days after the Cosmos chain vulnerability that was exploited to make an unauthorized withdrawal of about $4M got here to gentle, affecting Terra’s costs. Terra chain began producing new blocks on August 8 and completed with the improve of the blockchain. A sudden pump in its worth shines a greater gentle on the crypto market purpose of buying the tokens at a $0.000076 low (from August 8 until August 10) as costs surge to $0.000087. Nevertheless, since August 12, hoarding has calmed down, and now the token worth has gone down by 6.86%.

Attainable Pattern Reversal Has Began

The chart above depicts that the LUNC token has been extremely unstable for the final 72 hours— with extra brief sellers than lengthy patrons. It signifies that the token has been slumping downward, with a number of sudden dips ensuing within the liquidation of enormous numbers of holders and the acquisition of some to promote at a loss. The final market sentiment is bearish, and these whale dumps may imply the token has little or no to no bullish strain or is simply getting performed with.

Future Outlook

With hyperinflation leading to Luna Traditional (LUNC) shedding 99.99% of its worth, its fourteen-day relative energy index (RSI) studying of 60.69 is a tell-tale signal that the token is overbought. Whereas it’s nonetheless within the threshold, a excessive RSI of 70 (which means oversold) is just not unimaginable.

The token is at the moment oversold, indicating a brief market frenzy the place the possibilities of losses are a lot increased than earnings, as per technical evaluation. Additional, in gentle of the huge liquidations on lengthy positions, this means a continuation of draw back strain. Ought to this development proceed, additional falls may set off extra liquidations and implement a bearish temper. Nonetheless, occasional brief liquidations may sign transient recoveries; nonetheless, these are unlikely to be robust sufficient to induce a reversal of momentum in any capability.

Luna Traditional will seemingly observe the market over the subsequent six months and whether or not one thing is finished to work on excessive inflation. If these adjustments are usually not made, it’d discover its valuation involves a standstill and even go in reverse. Whereas there could also be speculative rallies, the broader course seems fragile. Warning needs to be taken because the token might proceed to stay unstable, topic to exterior elements reminiscent of market manipulation.