Key Takeaways

- Ever for the reason that Merge went dwell in September, Ether has underperformed Bitcoin considerably

- That is regardless of the availability of Ethereum falling post-Merge

- Extra Ether can also be being staked for the reason that Shapella improve in April

- Demand has fallen with regard to Bitcoin, nonetheless, overriding the decrease provide

- Regulatory crackdown and better institutional curiosity in Bitcoin seems to be driving the divergence, writes our Head of Analysis

One of many extra fascinating traits to comply with inside crypto is that of the ETH / BTC chart. In different phrases, how the world’s two largest cryptocurrencies transfer in relation to at least one one other. Now ten months on from the Ethereum Merge, it looks like time to re-analyse the connection.

The Merge utterly reworked Ethereum, switching the community to a proof-of-stake mechanism quite than the proof-of-work mechanism it was on beforehand. Then again, Bitcoin stays (and at all times will probably be) a proof-of-work blockchain.

Which means the basics underlying the Ethereum community have flipped. Maybe that is most noticeable when plotting the overall circulating provide of ETH. The Merge going dwell in September 2022 stands proud like a sore thumb, with the availability (barely) contracting from that date.

Zooming in on the post-Merge interval within the subsequent chart reveals the contraction. The availability has lowered at a median fee of 0.15% per thirty days. Previous to the Merge, the availability grew by 0.41% per thirty days.

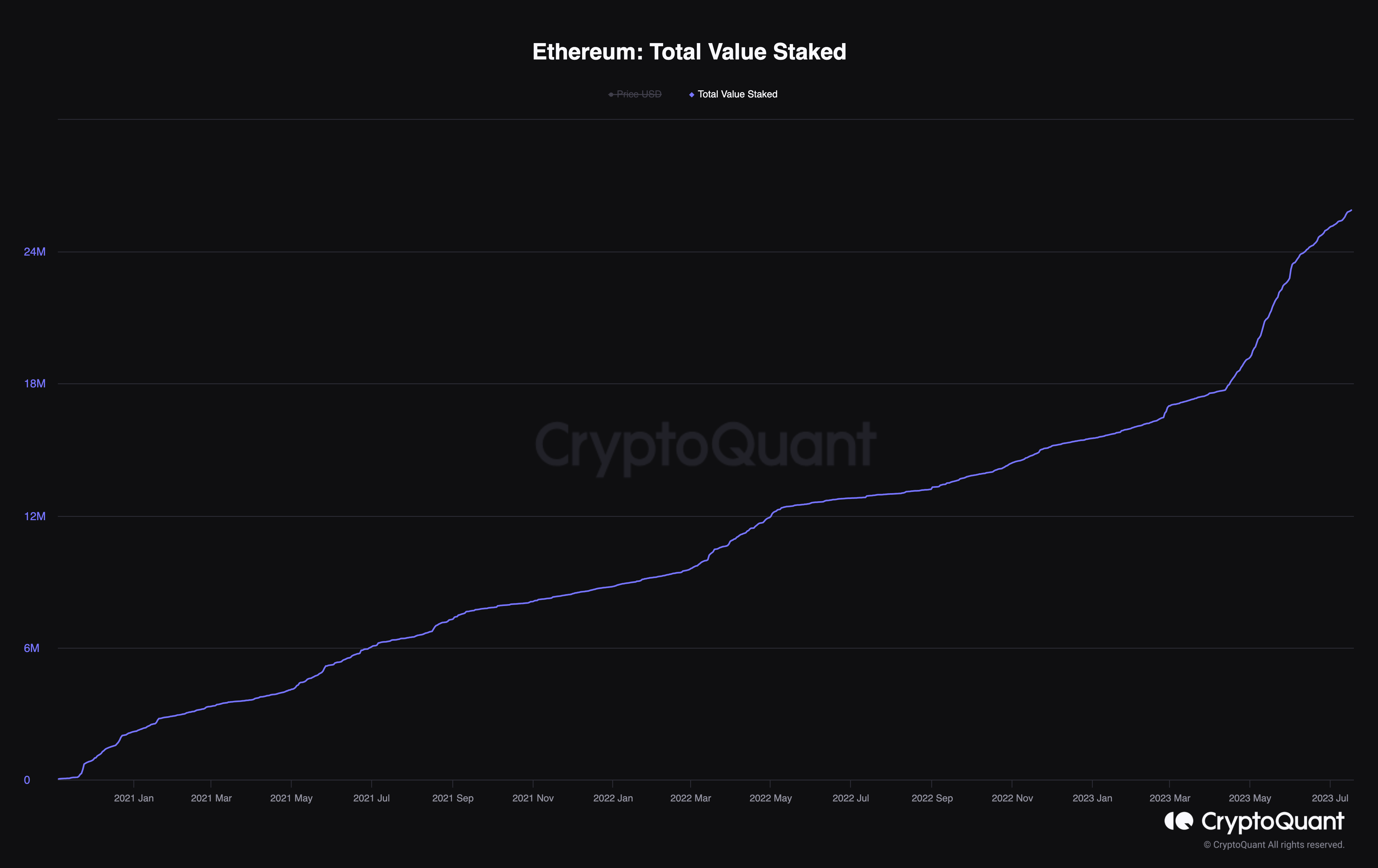

Furthermore, the availability of liquid Ether has contracted even additional than the above charts present. Trying on the whole worth of staked Ether, the sample was comparatively regular from when the staking contract opened in November 2020. This development kind of continued because the Merge went dwell in September 2022. Nonetheless, as seen on the subsequent chart, the quantity of staked Ether spiked notably in April of this yr, because the Shapella improve went dwell.

This Shapella improve, often known as Shanghai, allowed staked Ether to lastly be offered, with among the early stakers having locked up their tokens since This fall of 2020. Regardless of concern that this might result in an enormous quantity of Ether flooding the market and denting the worth, the other has occurred. With the indefinite lock-up restriction now not an element, the Ether staked has spiked noticeably, with the development far steeper within the three months since.

However how has this structural break on the availability facet affected Ether’s efficiency towards Bitcoin? Much less provide equals a better value, proper? Effectively, no truly. Nearly on a dime from when the Merge went dwell, ETH has fallen relative to Bitcoin, as I’ve plotted on the under chart (the black line denotes the Merge in September).

The rationale, after all, is that value is ruled by provide and demand, quite than simply provide. And whereas provide has contracted, the demand facet of the equation has not held up – at the least relative to Bitcoin.

Ether underperforms Bitcoin

Two months after the Merge, FTX collapsed, sending all the crypto sector for a spin. As is customary in occasions of value decline, Bitcoin fell lower than the remainder of the market. Thus, Ether falling towards Bitcoin within the aftermath of the crash isn’t a surprise.

Nonetheless, up to now in 2023, the crypto market has been on hearth, with token costs accelerating throughout the board because the macro local weather has softened amid falling inflation. The Nasdaq jumped 32% within the first six months of the yr, its greatest half-year return since 1983. And but, regardless of the crypto market driving this wave, Ether fell additional nonetheless towards Bitcoin, one thing which seemingly bucks the development.

The reason being almost certainly regulation. The good regulatory crackdown within the US has been brutal on crypto, however Bitcoin has not been as squarely within the crosshairs as a whole lot of the market. This has led to Bitcoin dominance rising to its highest degree in two years, now comprising over 50% of all the cryptocurrency market cap. It opened the yr at 42% (it was additionally roughly at this degree on the time of the Ethereum Merge in September).

This comes amid sentiment that Bitcoin could possibly be carving out its personal area of interest within the house. That is the view that many within the house have lengthy held (and a Bitcoin maximalist’s sworn mantra), however the distinction now’s that the regulation seems to be coming round to the identical perspective. I’ll let Coinbase CEO Brian Armstong put it extra succinctly than I:

“We return to 2021, we needed to grow to be a public firm, we described every thing about our enterprise, the property that we listing on our platform, how we do staking. The SEC at that time allowed us to grow to be a public firm”.

“A very totally different tone began to occur (a couple of yr in the past),” Armstrong continued. “We sort of acquired this info from the SEC that, nicely truly every thing aside from Bitcoin is a safety.”

Though Ether was not current on the listing of tokens introduced by the SEC that comprised securities, a listing which included another fashionable cryptos reminiscent of MATIC, SOL and ATOM, it has not been immune. Seen kind of in a gray space, Ether nonetheless has suffered because the regulatory blows stored coming. Whereas final week’s XRP ruling is optimistic for the house, and there will probably be many extra twists and turns to return, it nonetheless looks like Bitcoin has separated itself from the gang.

Additional reinforcing this view is the slew of Bitcoin ETFs submitted for approval from among the world’s largest asset managers, together with Blackrock. Denied repeatedly up to now, the presence of massive names backing Bitcoin amid this suffocating US authorized setting is one other boon for the orange coin. And whereas one might (rightly) hypothesise {that a} Bitcoin ETF would make an Ether ETF extra possible, there isn’t any denying that Bitcoin has pulled additional forward within the race.

This has led to a state of affairs in 2023 the place Bitcoin has outperformed Ether, which appears shocking when the latter has tended to outperform the previous throughout prior intervals of value growth. However it’s at all times necessary to recollect how transient the buying and selling historical past for each Ether and Bitcoin is. Ether was solely launched in 2015, and it was one other couple of years earlier than it traded with any real liquidity. So, leaning on previous efficiency should at all times be achieved with a pinch of salt. Moreover, the crypto market has by no means skilled a macro setting like this.

Lastly, any hopes that the Merge would speed up Ether into the stratosphere maybe neglected how a lot of the improve was priced in. This was within the works for a very long time, repeatedly delayed earlier than it lastly got here and went.

All in all, this has led to Ether lagging Bitcoin, with the latter growing its dominance over not solely Ether, however the crypto market as a complete. Issues are altering shortly in crypto, and Bitcoin has been weathering the turbulent waters higher than altcoins in latest months, primarily as a result of authorized local weather.

Then once more, the best way costs have been going, Ether traders can’t be too sad – regardless of Ether’s second-place medal, it’s nonetheless up 57% up to now this yr. It could possibly be worse, even when they did again the improper horse.