Regardless of the inflow of considerable capital into these new spot Bitcoin ETFs, with CoinShares reporting $1.18 billion in inflows into digital asset ETFs globally final week, the anticipated optimistic influence on Bitcoin’s worth hasn’t materialized. This raises questions concerning the underlying mechanics of those ETFs and their affect on Bitcoin’s worth.

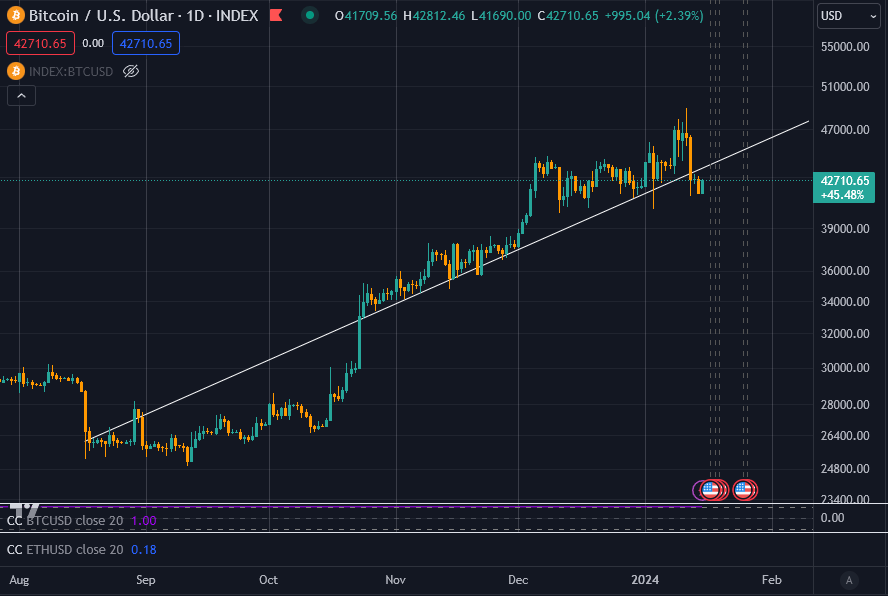

Let’s first guarantee we appropriately body the scenario. The current worth run-up picked up steam when BlackRock introduced their submitting for a spot Bitcoin ETF on June 15, 2023. At the moment, Bitcoin’s worth was round $25,000. Subsequently, there was a 70% enhance to round $42,000, the place it primarily traded sideways.

Because the ETFs launched, Bitcoin spiked to $49,000 however offered off quickly to round $42,000. Trying on the chart, it’s rational to recommend that maybe Bitcoin was overbought at above $44,000 for this level within the cycle.

With that in thoughts, let’s have a look at how Bitcoin purchases work in relation to the spot Bitcoin ETFs that had been not too long ago sanctioned.

How Bitcoin is valued for ETF functions.

The operation of spot Bitcoin ETFs is extra advanced than it seems. When people purchase or promote shares of an ETF, just like the one provided by BlackRock, Bitcoin isn’t purchased or offered in actual time. As a substitute, the Bitcoin that represents the shares is bought not less than a day earlier. The ETF issuer creates shares with money, which is then used to purchase Bitcoin. This oblique mechanism signifies that direct transfers of Bitcoin between ETFs don’t happen. Subsequently, the influence on Bitcoin’s worth is delayed and doesn’t replicate real-time buying and selling exercise.

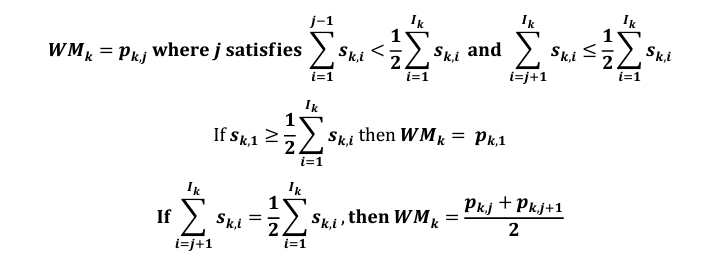

Primarily, with an ETF like BlackRocks, the share worth on any given day is supposed to symbolize the typical worth for Bitcoin throughout commonplace buying and selling hours, not the dwell worth of Bitcoin at any given time. Most ETFs use ‘The CF Benchmarks Index’ to calculate the value of Bitcoin for any given day; the CF Benchmarks web site describes it as;

“The CME CF Bitcoin Reference Fee (BRR) is a as soon as a day benchmark index worth for Bitcoin that aggregates commerce information from a number of Bitcoin-USD markets operated by main cryptocurrency exchanges.”

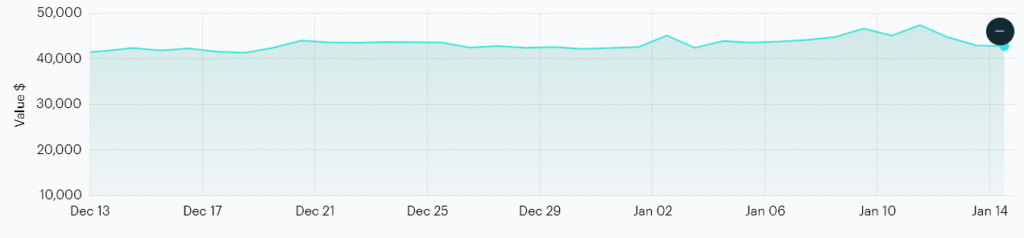

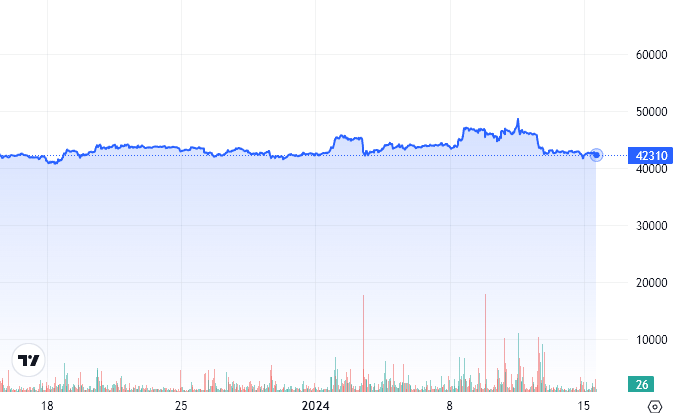

It makes use of a median worth throughout Bitstamp, Coinbase, Gemini, Itbit, Kraken, and LMAX Digital. In keeping with CF Benchmarks, that is what the value of Bitcoin seems like. Discover its current excessive was $47,525 on Jan. 11.

Right here is similar interval and Y-axis scale utilizing StarCrypto information on a 1-hour timeframe. As of press time, Bitcoin is value $42,594.27, in keeping with CF Benchmarks, whereas StarCrypto has it at $42,332.35 in real-time. This implies the spot ETF, which isn’t obtainable in the present day as it’s a public vacation within the U.S., is buying and selling at a reduction to identify Bitcoin ETFs.

I’ll be trustworthy: I didn’t suppose this was what would occur when the ETFs launched. I humbly believed that the ETFs would truly monitor the value of Bitcoin, and establishments would purchase and promote BTC relative to the traded ETF shares. How mistaken and naive I used to be.

I learn by means of the S1 filings in depth however, in some way, didn’t take into account that the underlying Bitcoin can be purchased doubtlessly days later by way of closed-door trades for common costs. I took it without any consideration that the CF Benchmark Index worth can be a dwell combination worth. Notably, that does exist, and it’s known as the BRTI. Nonetheless, that is solely used for ‘reference’ functions, not for truly calculating any commerce costs.

How Bitcoin will get into an ETF.

That is how Bitcoin is usually traded throughout the completely different spot Bitcoin ETFs.

Licensed Contributors comparable to Goldman Sachs, Jane Avenue, and JPMorgan Securities place their creation orders for baskets of shares with a ‘Switch Agent, Money Custodian, or Prime Execution Agent’ by a set time on any commonplace enterprise day. That is 2 pm for Grayscale, whereas BlackRock has a 6 pm cut-off time.

Following this, the Sponsor (ETF) is answerable for figuring out the whole basket Internet Asset Worth (NAV) and calculating any charges. This course of is often accomplished as quickly as practicable; for instance, with Grayscale, it’s 4 pm; for BlackRock, it’s 8 pm, New York time. Exact timing right here is important for guaranteeing the correct valuation of the hampers based mostly on the day’s closing market information.

You will have seen phrases comparable to T+1 and T+2 floating round regarding ETFs. The time period “T+1” or “T+2” refers back to the settlement dates for these transactions. “T” stands for the transaction date, the day the order is positioned. “T+1” means the transaction shall be settled the subsequent enterprise day after the order is positioned, whereas “T+2” signifies settlement occurring two days later.

With the spot Bitcoin ETFs, a liquidity supplier transfers the whole basket quantity in Bitcoin to the Belief’s vault stability on both the T+1 or T+2 date, relying on the precise prospectus. This reportedly ensures the transaction aligns with commonplace monetary market practices for settling trades. The execution and settlement of the Bitcoin buy and its switch into the Belief’s buying and selling pockets usually occur on T+1, not when the ETF shares are bought.

OTC Buying and selling and its implications

A vital facet of this mechanism is the Over-The-Counter (OTC) buying and selling concerned. Trades are performed between institutional gamers in a personal setting, away from public exchanges. Whereas in a roundabout way influencing market costs, these transactions set a precedent for alternate costs. Suppose establishments, comparable to BlackRock, agree on a cheaper price for Bitcoin throughout these OTC trades. In that case, it will possibly not directly affect the market worth if that info turns into obtainable to the general public or market makers. It doesn’t, nevertheless, have an effect on the dwell worth of Bitcoin as these trades aren’t added to the worldwide mixed order ebook. They’re primarily peer-to-peer personal trades.

Additional, based mostly on the CF Benchmark Index pricing methodology, if Bitcoin had been to commerce at, say, $42,000 all day however then rally into near $50,000 within the closing minutes of the day, the CF index worth would seemingly be nicely beneath the present spot worth relying on quantity (and different difficult calculations made by CF Benchmarks.) This may then imply the NAV can be calculated based mostly on a cheaper price than the spot worth, and any creations or redemptions for the next day would happen OTC, aiming to be as near NAV as potential.

Any market makers who’ve entry to those OTC desk trades are then unlikely to wish to commerce Bitcoin on the present spot worth of $50,000, doubtlessly eradicating liquidity at these increased costs and thus bringing the spot worth again consistent with the NAV of the ETFs. Within the brief time period, the ETF NAVs might very nicely play a way more important position in defining the spot Bitcoin worth and, subsequently, cut back volatility towards a smoother common worth.

Nonetheless, these trades should nonetheless happen on the blockchain, necessitating the switch of Bitcoin between wallets. This motion, particularly amongst institutional wallets, will develop into more and more important for market evaluation. For instance, Coinbase Prime’s scorching pockets facilitates trades, whereas establishments’ chilly storage wallets are used for longer-term holding and will be analyzed on platforms like Arkham Intelligence. I imagine the extra clear these OTC trades can develop into, the higher for all market individuals. Nonetheless, the visibility of those actions is at the moment considerably opaque, one thing the SEC seemingly believes is ‘greatest’ for traders.