- Bitcoin Journal researcher reviewed on-chain information and concluded BTC is unlikely to crash to $50K.

- The researcher noticed new capital inflows absorbing BTC provides from long-term holders.

- He famous BTC’s MVRV Z-Rating sits at 2.68, indicating the market is midway by way of the bull cycle.

In accordance with Dylan LeClair, Head of Analysis at Bitcoin Journal, Bitcoin is experiencing a full-fledged bull market regardless of latest retracement, asserting the unlikelihood of BTC crashing to $50K. LeClair expressed this sentiment in a latest publish on X, updating the group on the present state of the Bitcoin market.

The researcher reviewed on-chain information, uncovering an interaction between long-term holders distributing their holdings and a surge of recent capital inflows. One of many studied metrics was the availability distribution, notably from Bitcoin’s realized market cap angle.

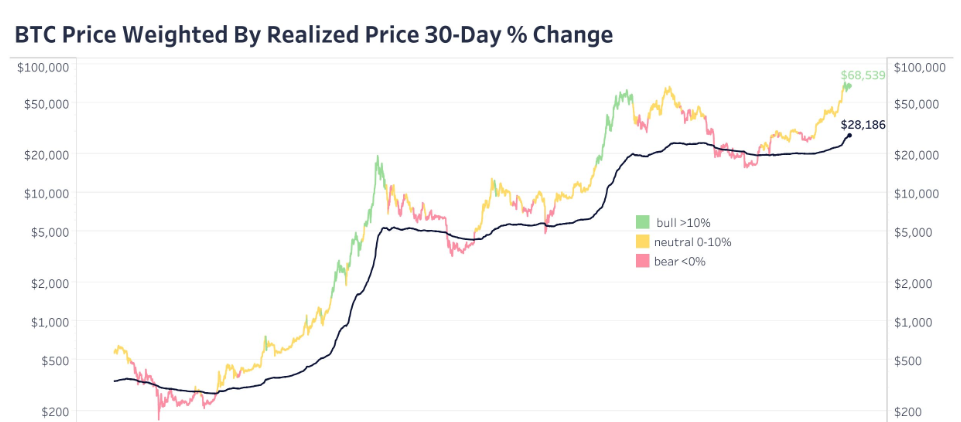

LeClair famous that Bitcoin’s realized market cap is witnessing a excessive optimistic charge of change. This metric, which displays the worth of every BTC on the worth final moved on-chain, means that outdated Bitcoin holders are distributing their holdings, primarily taking earnings.

Curiously, LeClair famous that new capital inflows are impressively absorbing this provide. In accordance with him, this phenomenon sometimes happens throughout bullish cycles and is happening as soon as once more.

Moreover, LeClair famous that whereas previous efficiency doesn’t assure future outcomes, traditionally, substantial worth appreciation for Bitcoin occurred throughout realized market cap development, notably above 10%.

Furthermore, LeClair highlighted that Bitcoin’s Market Worth to Realized Worth Ratio (MVRV) Z-Rating at present sits at 2.68. The researcher said that the determine signifies the market is roughly midway by way of the present bull cycle.

The analyst believes the present stage, mixed with the continued realized cap development, suggests there may be room for additional development earlier than reaching such a peak.

Additionally, LeClair analyzed the derivatives market, highlighting the bottom perpetual futures open curiosity in Bitcoin phrases in latest months. He famous the development signifies lowered leverage and frothy hypothesis, additional supporting a wholesome bull run.

Moreover, the analyst known as consideration to BlackRock’s latest transfer to replace its Bitcoin ETF prospectus to incorporate main monetary establishments like Citadel, Goldman Sachs, UBS, and Citigroup. “The large boys desire a piece of the motion,” LeClair remarked.

The analyst concluded by drawing parallels between the present section and the one noticed in 2020 earlier than a major worth surge. LeClair stays bullish on Bitcoin long-term, viewing it as a hedge in opposition to the inevitable debasement of conventional currencies.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t accountable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.