Key Takeaways

- Ethereum accomplished its long-awaited Merge improve in September 2022

- Stakers are at the moment incomes roughly 4% APY from their Ether tokens

- 19% of the full Ether provide is staked, the bottom ratio of any of the main cash

- Staking rewards are divided amongst stakers, which means the APY earned decreases as extra customers stake

- Demand on the community will increase fuel charges and finally contributes to extra APY, which means there are a number of components at play when making an attempt to evaluate the place the yield might land

- All in all, it stays up for debate as to the place the yield is headed, regardless of many analysts predicting basement-level yields of 1%-2% are inevitable

The basics of Ethereum had been completely remodeled in September 2022 when the Merge went reside, the blockchain formally turning into a proof-of-stake consensus. The implications for this are many, nonetheless one of many extra fascinating points is that traders can now earn a yield from staking their Ether tokens.

Let’s dive into how common staking has been, the place it’s trending going ahead, and speculate about the place the all-important APY might land.

Ethereum stakers are rising

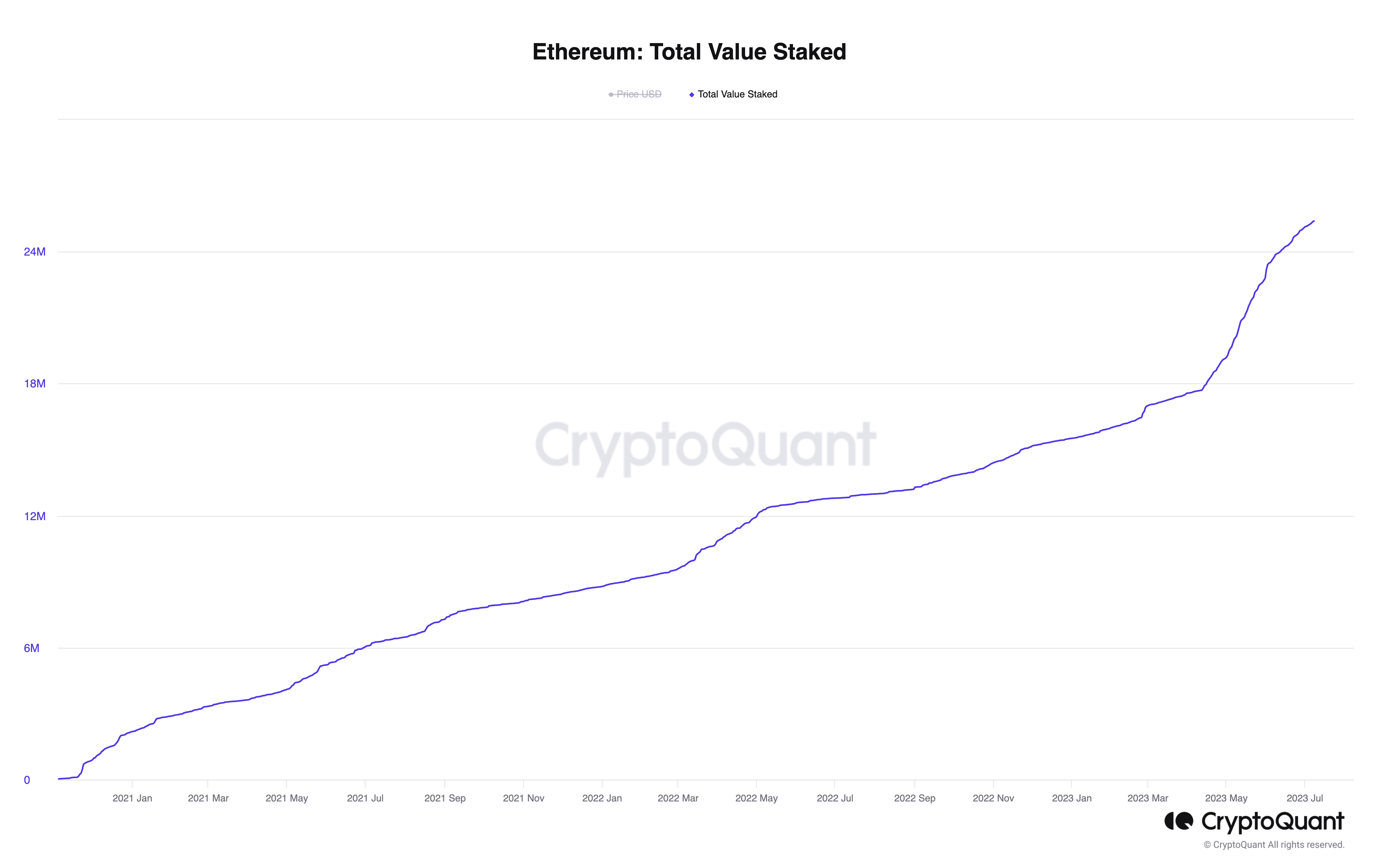

Ethereum staking has proved wildly common. There’s at the moment virtually 18.75% of the full provide staked. The under chart from CryptoQuant exhibits that not solely has the rise been constant, however the fee of enhance has steepened noticeably because the Shapella improve in April.

Shapella lastly allowed staked Ether to be withdrawn, with some early stakers having had tokens locked up since This fall of 2020. There was therefore some concern that Ether could be withdrawn en masse as soon as the Shapella improve went reside, the next promote strain sure to dent the worth. Not solely has this occurred, however staking has solely develop into extra common because the improve.

Regardless of the recognition of Ethereum staking, and the shortage of withdrawals sparked by Shapella, the community’s staked tokens as a % of the full provide nonetheless pale compared to different proof-of-stake blockchains.

Regardless of the recognition of Ethereum staking, and the shortage of withdrawals sparked by Shapella, the community’s staked tokens as a % of the full provide nonetheless pale compared to different proof-of-stake blockchains.

The chart under highlights Ethereum in yellow, its 19% ratio far under the opposite main proof-of-stake cash. Assessing the remainder of the highest 10 by staked market cap, these cash common a 53% stake ratio, with solely BNB Chain remotely near Ethereum, sitting at 15%.

If we then shift the chart to evaluate the full market cap of the staked portion of cash, Ethereum’s dominance is evident. Its 19% staked tokens carry a worth of $43 billion – greater than the opposite 9 cryptos’ staked market caps mixed.

Ethereum’s low staked ratio implies that it ought to have extra, a minimum of if different cash can be utilized as a benchmark. That is very true when contemplating current bullish developments on the Ethereum community which recommend it could be solidifying its place because the market-leading sensible contract platform. Most notable of those might be dialogue round potential Ether futures ETFs, in addition to the announcement that PayPal is launching a stablecoin on the community this week.

So, what occurs to the staking yield if the quantity of staked Ether does certainly proceed to extend? Keep in mind, the full annual yield paid out to stakers is calculated as follows:

[(gross annual ETH issuance + annual fees*(1-% of fees burned)]

These complete staking rewards are then divided by the common ETH staked over the yr to commute the APY.

In different phrases: The quantity of ether staked is within the denominator of the fraction. In order the quantity staked will get larger, the APY shrinks. This impact can already be seen in what has occurred up to now. Analysts had predicted a yield of 10%-12% forward of the Merge, nonetheless right now it’s nearer to 4%. And that’s 4% with its staking ratio utterly out of whack in comparison with different proof-of-stake cash, as talked about above.

What occurs subsequent?

With the quantity of Ether staked rising incessantly, is the yield subsequently primed to break down?

Some analysts consider it’s headed in the direction of 1%-2%; some even suppose much less. The truth is that no person actually is aware of as a result of, as all the time, demand depends on quite a lot of components.

We have to bear in mind, as we frequently say in these columns, that speculating on the way forward for crypto is so tough as a result of now we have such little knowledge to work with. That is true for Ethereum as a complete, which solely launched in 2015, however particularly so relating to the yield, because the Merge has solely been reside since September (or since April in the event you rely the “true” completion date as post-Shapella).

Therefore, it’s a problem to forecast the staking yield going ahead. We’ve got centered on the spectacular progress of staking to this point, and whereas it will drive the yield down, demand on the community will enhance the numerator of the aforementioned system and kick the yield up.

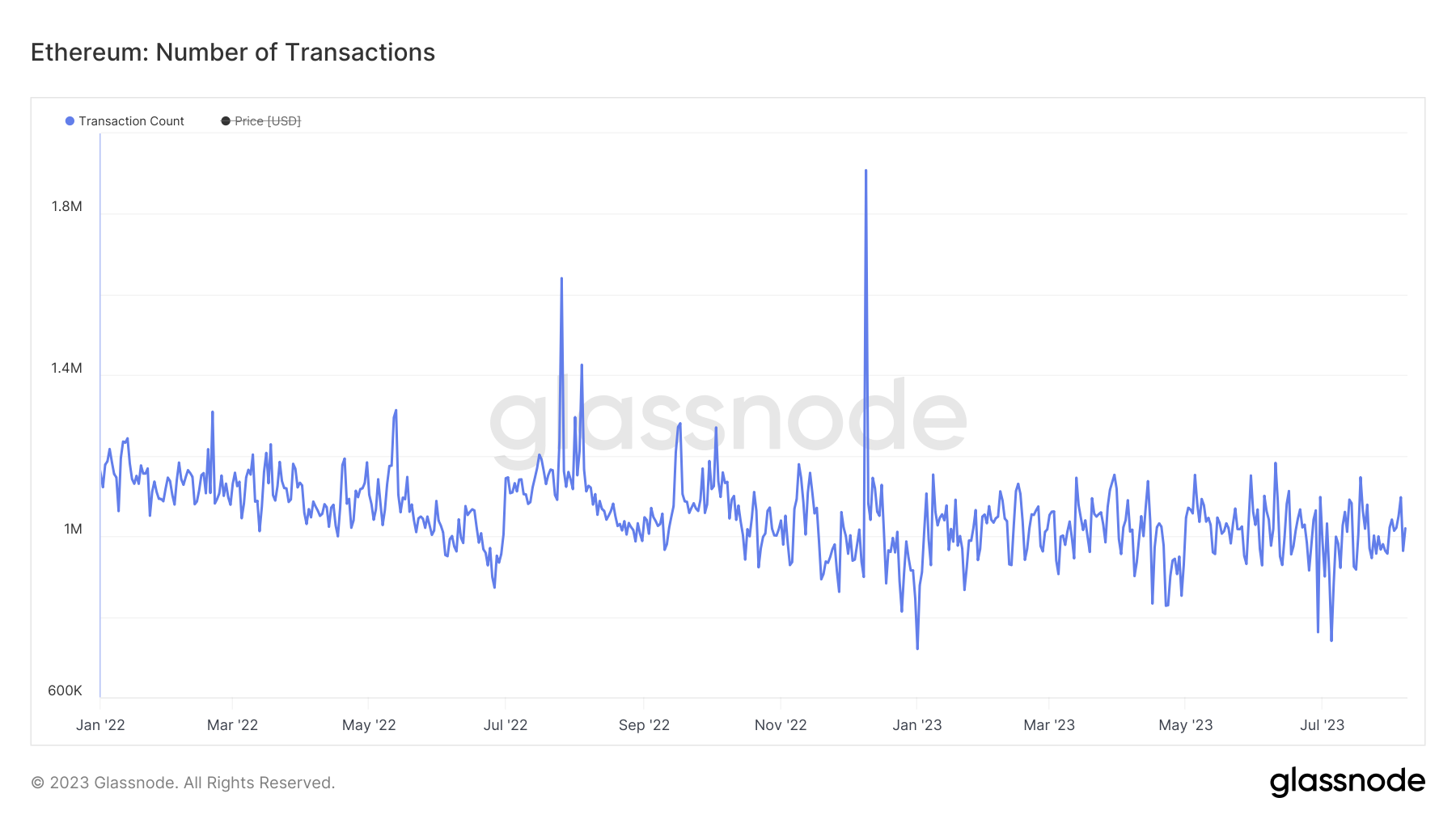

Certainly, taking a look at complete transactions, the speed has been fairly resilient all through the final eighteen months, regardless of the massacre within the sector final yr.

Then once more, crypto is altering shortly. It stays tough to foresee how regulation, infrastructural improvement (restaking and Eigeanlayer spring to thoughts for example) and the macro panorama, simply to call just a few components, will have an effect on the local weather going ahead.

Talking of macro, there’s additionally the matter of trad-fi yields. At the moment, the Fed funds fee is 5.25%-5.5%, having been near-zero previous to March 2022. Backing out chances from Fed futures implies the market is anticipating the top of the cycle is close to. To not point out, with the mammoth quantity of debt within the present system, charges can not keep excessive ceaselessly.

May falling trad-fi yields have an effect on demand for staking yield? Maybe – whereas it’s exhausting to separate the general liquidity drain and suppressing of threat property that happens out of hiked charges, the superior (and risk-free) return is unquestionably a key cause why capital has flooded out of DeFi within the final yr. Whereas previously-dizzying DeFi yields have collapsed, trad-fi yields have rocketed because the Federal Reserve has scrambled to rein in rampant inflation.

Moreover, if yield does fall down in the direction of 1%-2%, stakers may start to drag out and search elsewhere for revenue. This may subsequently create a reflexive relationship with regard to the yield.

All in all, it stays too early to take a position about the place the Ethereum staking yield is finally headed, a minimum of with any diploma of confidence; it is dependent upon too many components and the pattern house is just too transient up to now. It does appear doubtless, if not inevitable, that the yield will decline to some extent, however the query of how a lot is a tough one to reply. Whereas many are adamant the APY will cascade downwards to uber-thin ranges – and for the avoidance of doubt, it could do – now we have offered right here a minimum of some factors of consideration as to why the scenario might not be as clear reduce.