Key Takeaways

- The SEC is suing Paxos, the issuer of Binance’s stablecoin, BUSD

- The stablecoin is to be phased out, with no new tokens minted

- Over $1 billion has been redeemed within the three days for the reason that announcement

- BUSD is accountable for one-third of the buying and selling quantity on Binance

- Tether is the massive winner, being based mostly offshore, and has jumped to recapture 50%+ of the market, with that mark certain to rise

I wrote a deep dive final October analysing the stablecoin wars. It’s time for a severe replace to it as a result of issues have…occurred.

On the time, the horse making the most important good points was none apart from Binance’s BUSD. The flagship product of the most important trade on the planet, Binance had bolstered its market share considerably by delisting a number of different stablecoins from its trade, together with USDC.

It additionally introduced the auto-converting of buyer holdings from USDC into BUSD, a transfer I used to be stunned didn’t irk folks extra, to be brutally sincere.

Anti-competitive? Certain, completely. However a robust enterprise transfer regardless, and BUSD obtained a pleasant kick off the again of it. The under graphic present the way it ramped up in consequence – hit “Play Timeline” within the prime left to see it wrestling market share from its rivals.

The social gathering is over

However this week introduced a knock on the door. Who’s the one who knocks? The SEC.

Authorities got here in scorching, with the bombshell announcement that the SEC is to sue Paxos, who subject and handle the BUSD stablecoin. A violation of fine previous safety legal guidelines seems to have drawn their ire.

Paxos will now not subject the BUSD stablecoin, which means that the world’s seventh-largest cryptocurrency – and third-biggest stablecoin – will disappear.

Nicely, extra like fade away. Paxos has confirmed that BUSD redemptions can be honoured by means of at the very least February 2024, however no new tokens can be minted. Binance, the place one-third of the quantity is performed by means of BUSD, will steadily part out BUSD pairs in favour of different stablecoins.

BUSD peg wobbles however is swiftly restored

BUSD fell off its $1 peg, regardless of assurances from Paxos that every one tokens have been backed up by reserves and needed audits have been handed. It hit $0.995 instantly after the announcement on Monday.

Nevertheless, it has since recovered, with no scarcity of arbitrageurs snapping up the chance for slightly unfold. At time of writing, it’s coaching at $0.9999 and nothing appears askew.

BUSD/USD chart by TradingView

So allow us to be clear. The Binance peg remained fairly secure, with the market probably not ever genuinely fearing for its well being. Certainly, in wanting again over the historical past of BUSD (are we already speaking prior to now tense?), the peg has by no means actually been a difficulty.

What the above chart additionally exhibits is that merchants are already bidding their adieus to BUSD. Paxos has already redeemed over a billion {dollars} in BUSD for the reason that announcement.

What subsequent for Binance?

Binance can be wonderful. Certain, their ambitions for international takeover might have pulled again a bit, however they’ll merely flip over the opposite stables. CEO Changepeng Zhao did verify the trade would proceed to assist BUSD whereas it’s phased out, acknowledging that he would anticipate customers emigrate to different stables over time.

https://twitter.com/cz_binance/standing/1625067495760560128

Zhao later elaborated on the incident on Twitter Areas, placing notable distance between the trade and BUSD, one thing he has not performed so perceptibly earlier than.

“BUSD isn’t issued by Binance,” mentioned Zhao. “We now have an settlement to let (Paxos) use our model, however that’s not one thing that we created.”

“With BUSD gone, BUSD slowly winding down over time, we’ll proceed to work with extra stablecoin issuers or creators,” Zhao mentioned. Translation: anticipate USDC to return to Binance screens and a progress in share for Tether.

Is that this good or unhealthy for different stables?

So, what about the remainder of the gang? Ought to they quake of their boots, with regulators clamping down on the business at giant? Or ought to they pop then champagne, with a progress in market share inevitable?

Nicely, it relies upon.

Different US-based stables could also be involved. Circle, issuer of USDC, can be frantically assessing whether or not its personal product is now a safety, and whether or not regulators will look harshly upon it, too. It feels prefer it’s one of the crucial oft-asked questions within the house – “what constitutes a safety?” And no person actually is aware of. However hey, that’s the state of crypto and regulation proper now.

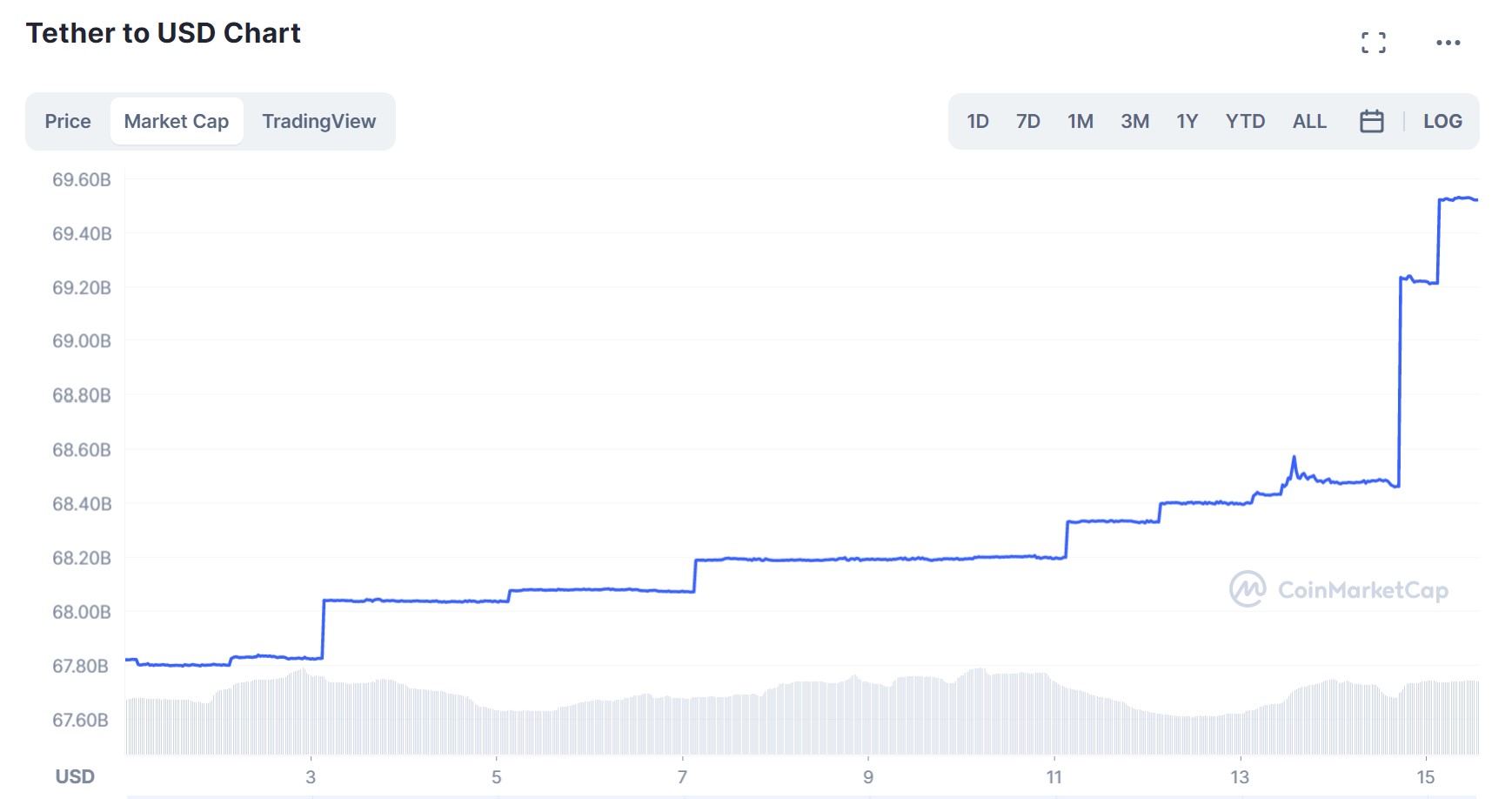

The large winner? Tether. Probably the most controversial coin within the house, the much-discussed Tether has the large benefit in that it’s based mostly offshore. And it has already proven, with its market cap leaping $1 billion within the 24 hours publish this fiasco alone.

USDT opened February with a market cap of $67.8 billion. It’s now $69.5 billion.

USDT Market Cap, February, by way of CoinMarketCap

It’s not simply BUSD share that Tether has been hoovering up. USDC additionally noticed outflows as traders worry it may very well be subsequent in line for a clampdown. Plotting the market share of the assorted stablecoins under exhibits that Tether is now once more above 50% dominance.

And so, we at the moment are in a spot the place the cryptocurrency business, which I’ve usually criticised for being considerably extra centralised than it’s made out to be, is certain to rely much more upon one social gathering – Tether.

After all, that is extra regarding given Tether’s tumultuous historical past and ongoing issues over reserves, which I additionally crafted up a deep dive on final 12 months. No matter your ideas on the controversy, it’s exhausting to argue that the continuing dialogue and lack of transparency which causes the dialogue within the first place is unhealthy for the business at giant.

For higher or worse, nonetheless, that’s the place the business at present sits. With the majority of “decentralised” finance working on USDT, USDC and different centralised stables, it once more emphasises how centralised the system is, with very actual central factors of failure.

Whereas that centralisation was already stark, the actual concern popping out of this growth with BUSD is that focus is now about to develop much more.

The business’s reliance on Tether is simply going a technique – up.