- Regardless of a market-wide worth decline at the beginning of final week, the crypto market recovered as Bitcoin closed the week at $102,800.

- Bitcoin has now reached a brand new all-time excessive of $106,000.

- In the meantime, US spot crypto ETFs proceed to log consecutive optimistic days of inflows.

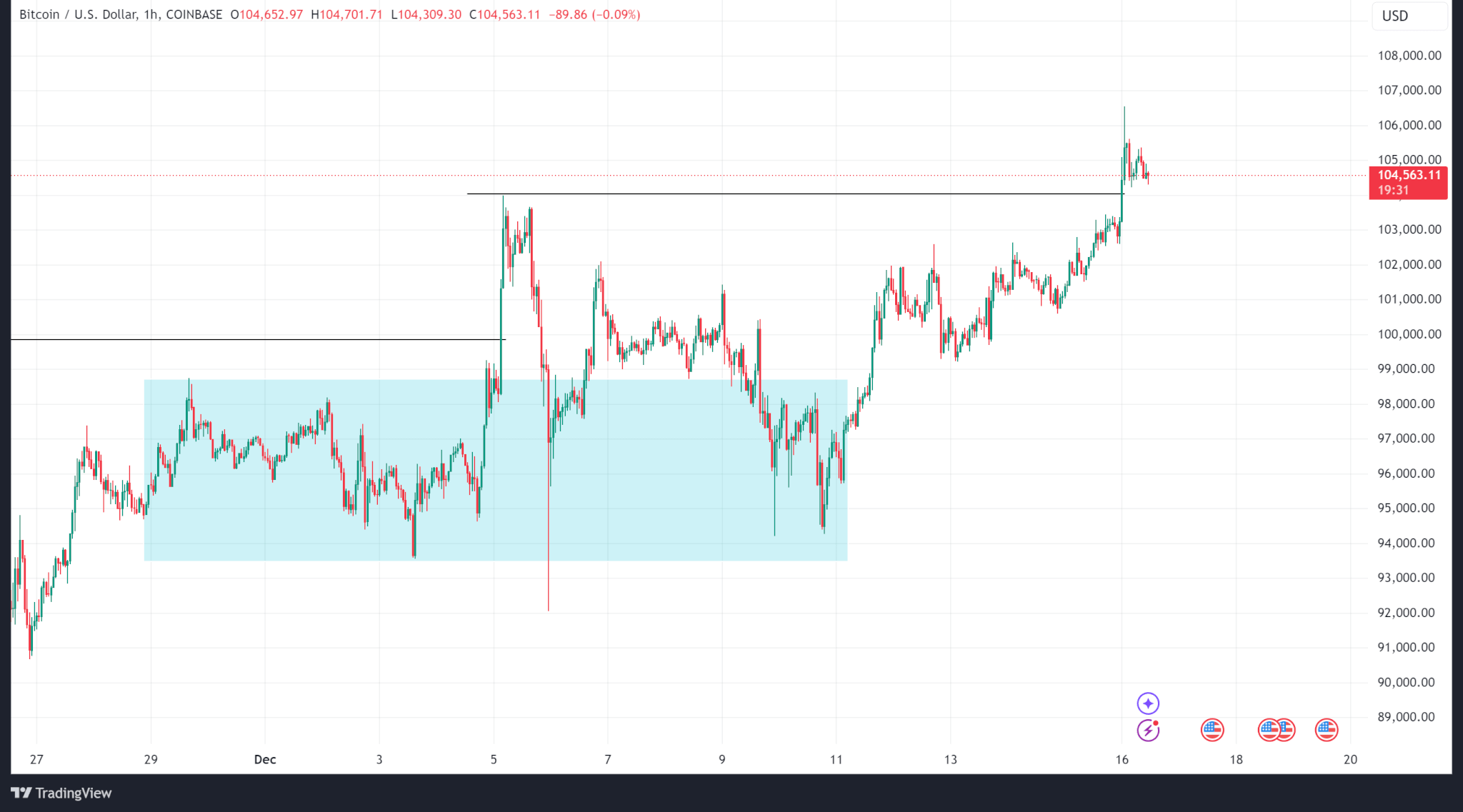

Bitcoin

Bitcoin has logged new highs of $106,400 since its dip final week to $94,000, pushed largely by optimistic ETF inflows as US spot Bitcoin ETFs file one other week of consecutively optimistic every day inflows.

From Dec. 9 to Dec. 13, $2.17 billion flowed into the highest 10 US spot BTC ETFs.

Present worth motion exhibits Bitcoin has damaged its earlier excessive of $104,000 and trades at $104,500 after reaching a brand new excessive of $106,600.

The Fed fee coverage choice arising on Dec. 18 may considerably affect worth motion. Expectations are hawkish with extra managed slashes shifting into subsequent 12 months, which may negatively affect dangerous belongings like Bitcoin.

Value technicals help a hawkish stance as Bitcoin’s worth may push downward to seize liquidity at decrease ranges round $100,000.

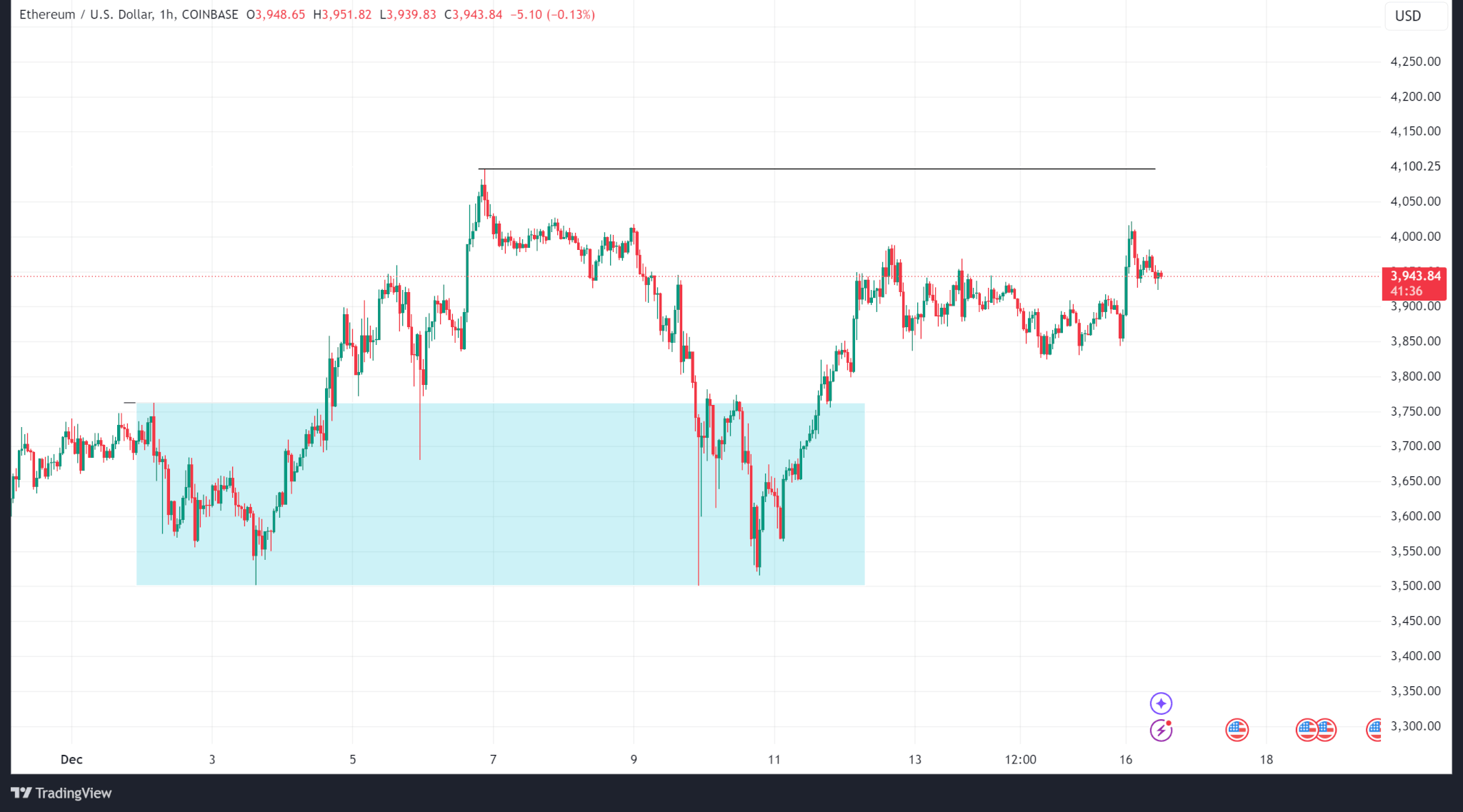

Ethereum

The second-largest crypto rebounded from a weekly low of $3,500 to an area excessive of $4,000. In contrast to Bitcoin, it has not damaged the earlier excessive shaped on the $4,100 degree.

In the meantime, Ethereum spot ETF inflows remained optimistic all through final week, totalling $854.8 million.

Ethereum trades at $3,950 on the time of publishing.

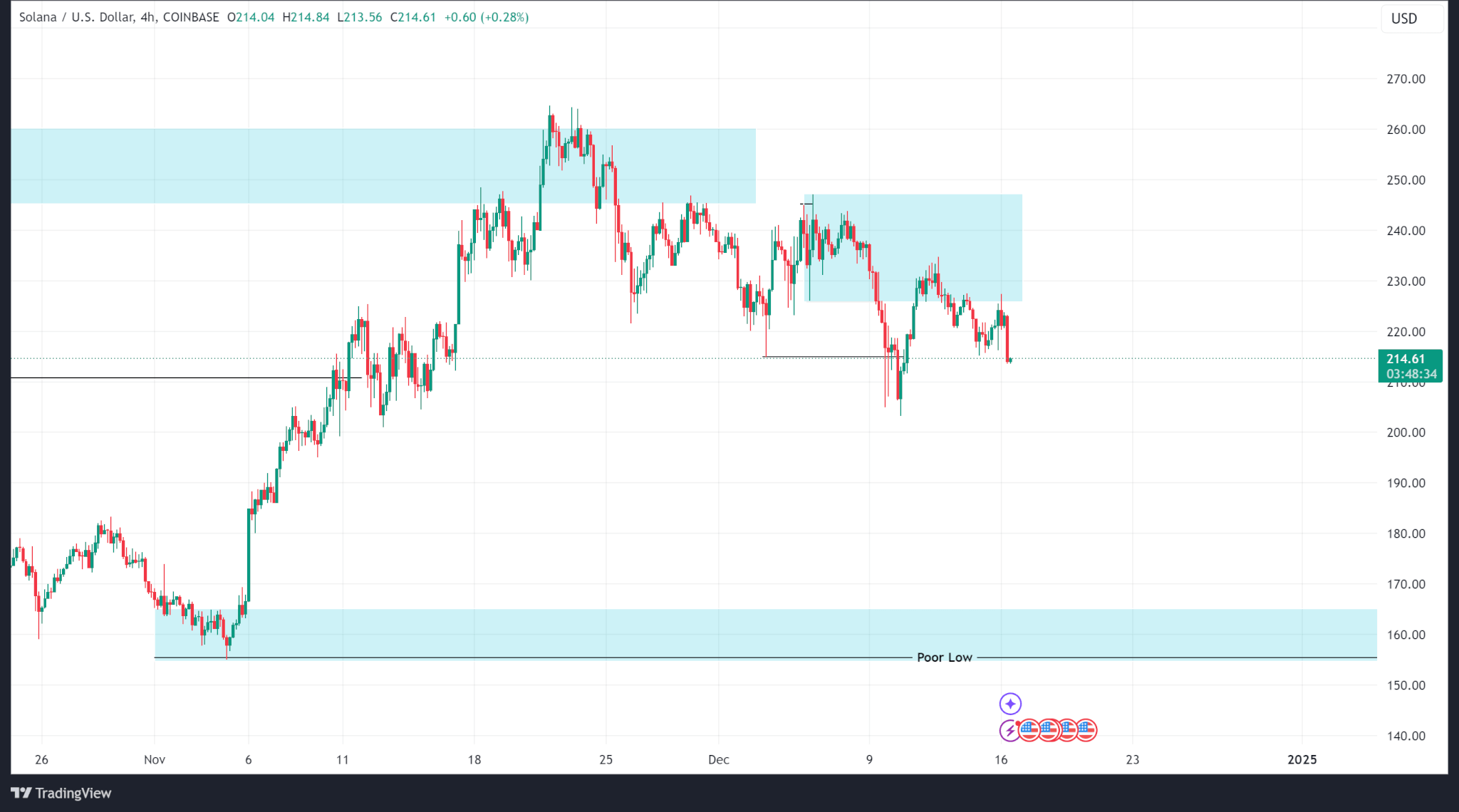

Solana

In contrast to Bitcoin and Ethereum which have rebounded since final week, Solana’s worth has declined since failing to shut above its all-time excessive of $260 on the every day time-frame.

Value motion on intermediate time frames (H4/H1) exhibits rejection and sells from native provide zones which can proceed till a logical demand zone at $160. Solana’s worth might want to break above $247 on the H4 and ultimately shut above the all-time excessive on the every day time-frame to renew its bullish movement.

Solana trades at $214 on the time of publishing.

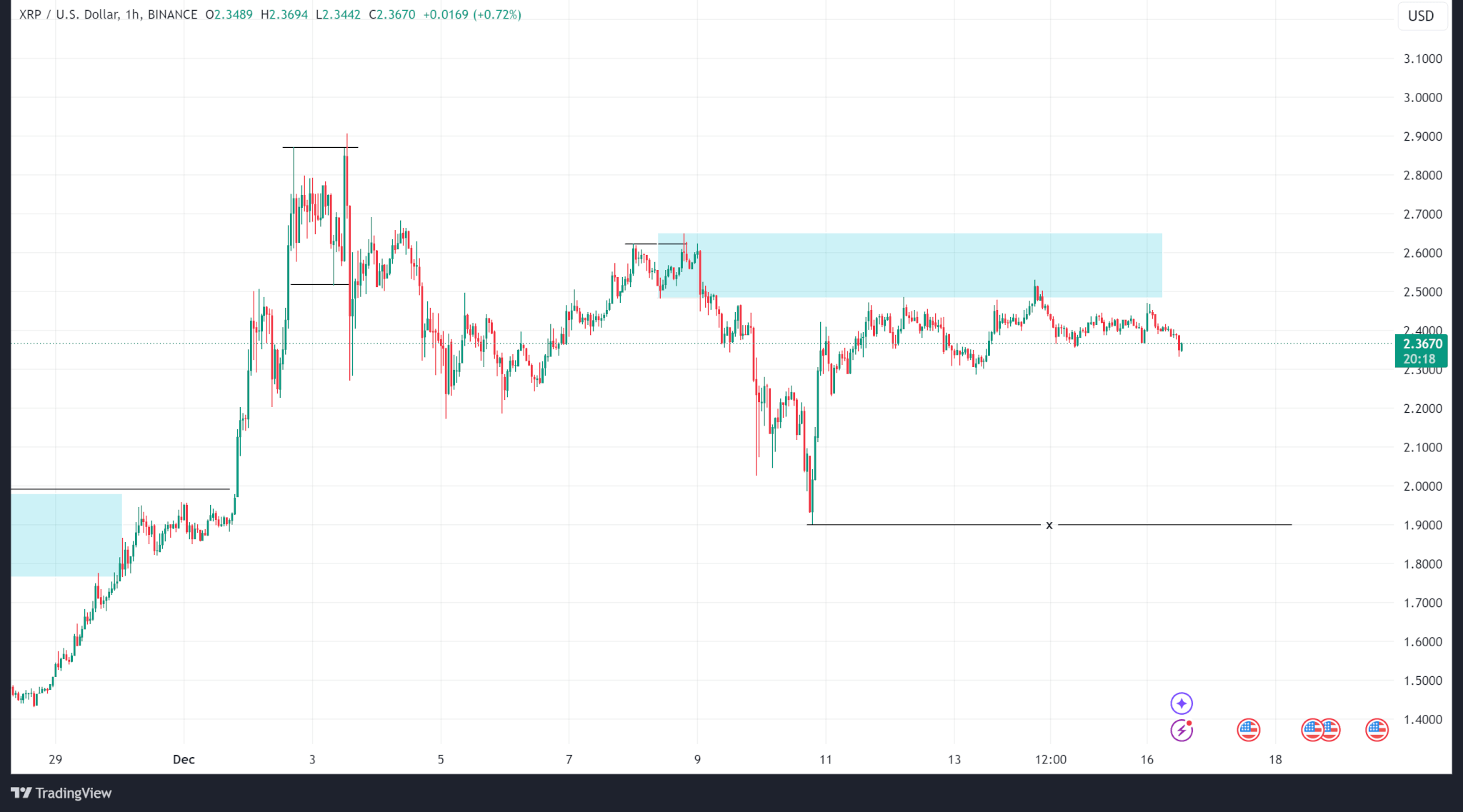

Ripple

Ripple’s worth motion has been extremely bullish following its authorized wins and anticipated adjustments to the US regulatory panorama. The crypto surpassed its former all-time excessive of $1.99 and shaped a brand new ATH of $2.90 on Dec. 3.

More moderen worth motion exhibits a pullback from highs as the value shaped a brand new native provide zone, rejected, and bought from it. A continuation of the present pattern would see worth take liquidity on the $1.90 degree whereas a reversal would see worth break above $2.65.

Ripple trades at $2.36 on the time of publishing.