Printed: November 09, 2023 at 9:30 am Up to date: November 09, 2023 at 9:51 am

Edited and fact-checked:

November 09, 2023 at 9:30 am

In Temporary

On this report, we discover all of the developments within the AI, crypto and web3 sectors and establish the Q3 2023’s most notable industries and key gamers.

Because the crypto panorama grapples with the continued bear market, its challenges have gotten visibly evident within the fundraising panorama. The development of decline, obvious for the reason that outset of 2022, endured in Q3 2023.

The quarter witnessed report lows in each whole funding and deal quantity, a phenomenon not noticed since This fall 2020. In particular figures, the quarterly mixture amounted to slightly below $2.1 billion, unfold throughout 297 transactions. This represented a considerable 36% lower in each funding and deal quantity in comparison with the previous quarter.

Metaverse Submit presents its Web3 Fundraising Report for the third quarter of 2023. On this report, we delve into the newest developments throughout the AI, crypto, and web3 sectors and establish the standout industries and key gamers for the quarter.

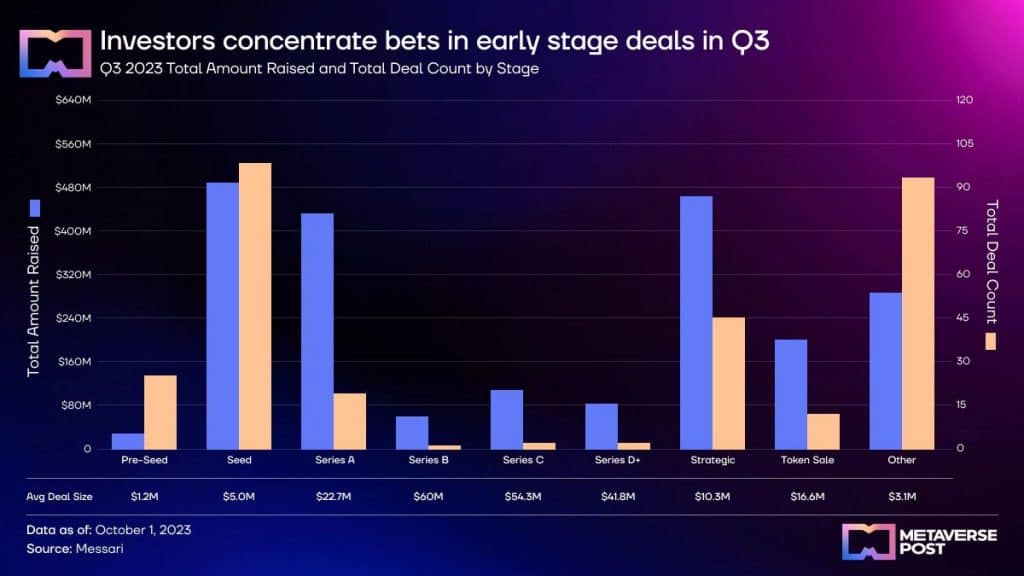

Analyzing Q3’s Fundraising & Funding Levels

Inspecting Q3 fundraising actions primarily based on their respective levels reveals a discernible emphasis on early-stage funding rounds. Seed funding, specifically, emerged because the predominant class, amassing a complete of $488 million throughout 98 rounds.

This notable shift in direction of earlier-stage initiatives has steadily gained prominence over the previous three years, accompanied by a noticeable decline in later-stage ventures.

The class of early-stage offers, encompassing Pre-Seed, Seed, and Collection A rounds, has progressively expanded its market share from 37% in This fall 2020 to a commanding 48% in Q3 2023. In distinction, later-stage offers, typified by Collection B or subsequent rounds, have markedly receded from an 8% market share in This fall 2020 to a mere 1.4% in Q3 2023.

This strategic realignment mirrors the dynamics of the bear market, as traders search initiatives providing the potential for important uneven returns, poised to ship substantial income when market sentiment ultimately shifts in direction of a extra favorable route.

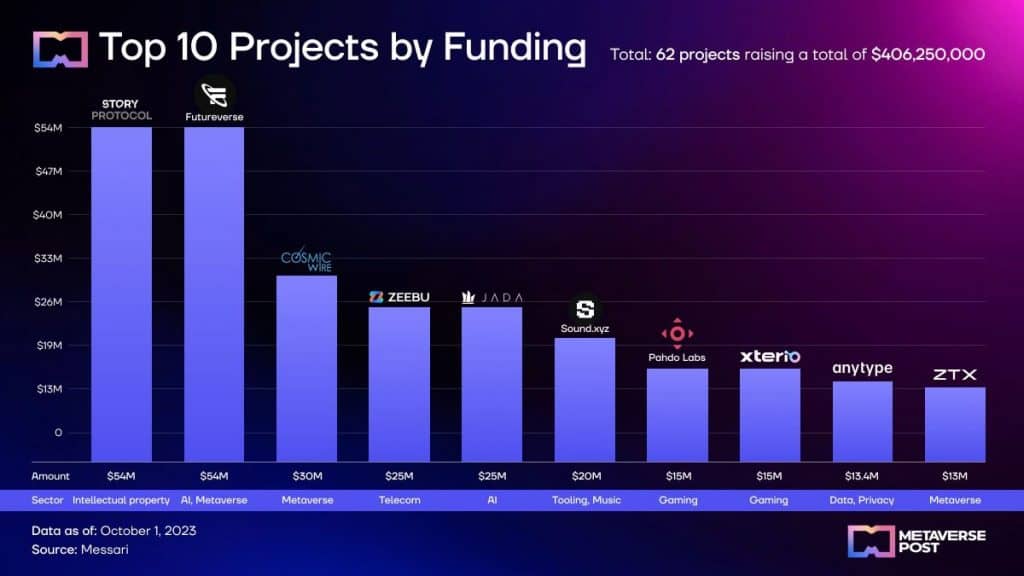

Market Class: Web3

Whole: 62 initiatives elevating a complete of $406,250,000

Prime 10 Tasks by Funding

| Undertaking | Spherical | Date | Quantity | Sector | Web site |

| Story Protocol | Unknown | 9/6/2023 | $54,000,000 | Mental property | https://www.storyprotocol.xyz/ |

| Futureverse | Collection A | 7/18/2023 | $54,000,000 | AI, Metaverse | https://www.futureverse.com/ |

| Cosmic Wire | Seed | 7/19/2023 | $30,000,000 | Metaverse | https://www.cosmicwire.com/ |

| Zeebu | Personal Token Sale | 9/7/2023 | $25,000,000 | Telecom | https://www.zeebu.com/ |

| Jada Ai | Unknown | 8/17/2023 | $25,000,000 | AI | https://jada-ai.com/ |

| Sound.xyz | Collection A | 7/12/2023 | $20,000,000 | Tooling, Music | https://www.sound.xyz/ |

| Pahdo Labs | Collection A | 9/11/2023 | $15,000,000 | Gaming | https://www.pahdolabs.com/ |

| Xterio | Strategic | 7/12/2023 | $15,000,000 | Gaming | https://xter.io/ |

| Anytype | Unknown | 8/23/2023 | $13,400,000 | Information, Privateness | https://anytype.io/ |

| ZTX | Seed | 8/15/2023 | $13,000,000 | Metaverse | https://ztx.io/ |

A Breakdown of Web3 Undertaking Ecosystem

1. Whole Tasks and Funding:

- Whole Tasks: 62

- Whole Funding: $406,250,000

2. Prime 10 Tasks by Funding:

- Highest Funded Tasks: “Story Protocol” and “Futureverse” lead with $54,000,000 every. Apparently, they signify totally different niches inside Web3, with the previous specializing in mental property and the latter on AI and the metaverse.

- Numerous Focus Areas: The highest 10 initiatives span a wide range of focus areas, together with Mental Property, AI, Metaverse, Telecom, Tooling, Music, Gaming, Information, and Privateness.

- Whole Funding of Prime 10 Tasks: After we sum up the funds obtained by the highest 10 initiatives, it quantities to: $264,400,000

3. Implications and Observations:

- In Q3 2023, the highest 10 initiatives independently contributed 65.08% ($264,400,000 out of $406,250,000) to the entire funds raised throughout the Web3 class. This showcases a funding focus inside these outstanding initiatives.

- The Metaverse emerges as a prevalent theme, with a number of high 10 initiatives showcasing sturdy investor enthusiasm for this area.

- Substantial investments had been directed in direction of AI and gaming, underscoring the ever-evolving dynamics of the Web3 ecosystem.

In Q3 2023, the Web3 ecosystem secured a considerable funding of $406,250,000, distributed amongst 62 initiatives. Though the highest 10 initiatives command the vast majority of funding, indicating a notable capital focus, there may be clear and numerous curiosity.

This curiosity extends throughout a number of Web3 sub-domains, together with AI, Metaverse, Gaming, and Mental Property.

The sturdy monetary assist for these main initiatives underscores traders’ confidence sooner or later potential of Web3 applied sciences and their transformative influence within the years forward.

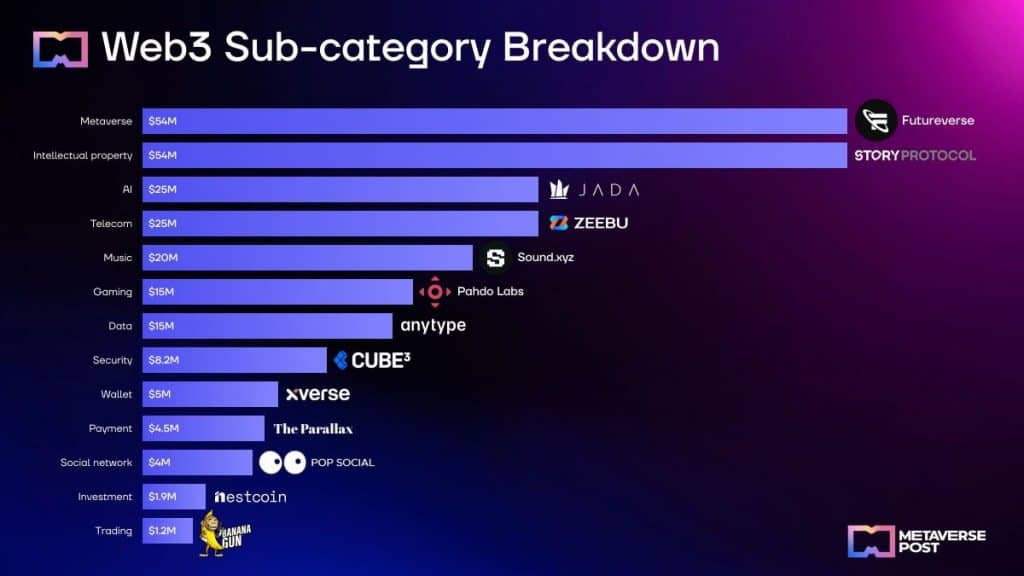

Web3 Sub-category Breakdown

| Sub-Class | Variety of Tasks | Whole Funding | Prime Undertaking | Its Funding | % of Whole Funding |

| Gaming | 9 | $56,900,000 | Pahdo Labs | $15,000,000 | 14% |

| Buying and selling | 1 | $1,200,000 | Banana Gun | $1,200,000 | 0% |

| Pockets | 2 | $9,000,000 | Xverse | $5,000,000 | 2% |

| Funding | 1 | $1,900,000 | Nestcoin | $1,900,000 | 0% |

| Fee | 1 | $4,500,000 | Parallax | $4,500,000 | 1% |

| Metaverse | 7 | $103,000,000 | Futureverse | $54,000,000 | 25% |

| Music | 1 | $20,000,000 | Sound.xyz | $20,000,000 | 5% |

| AI | 6 | $36,100,000 | Jada Ai | $25,000,000 | 9% |

| Mental property | 1 | $54,000,000 | Story Protocol | $54,000,000 | 13% |

| Information | 8 | $32,000,000 | Anytype | $13,400,000 | 8% |

| Telecom | 1 | $25,000,000 | Zeebu | $25,000,000 | 6% |

| Safety | 3 | $23,400,000 | Cube3 | $8,200,000 | 6% |

| Social community | 2 | $5,400,000 | Pop Social | $4,000,000 | 1% |

Mental Property

Within the area of Mental Property, Story Protocol secured a formidable $54,000,000 in funding throughout Q3 2023. Whereas the precise particulars of the funding spherical stay unknown, Story Protocol’s deal with mental property is obvious. Its substantial funding hints on the intriguing potential it holds on this area.

AI

Futureverse, a forward-thinking undertaking bridging the realms of AI and the Metaverse, made waves with a Collection A funding spherical on July 18, 2023, accumulating $54,000,000 in funding. Futureverse’s substantial funding showcases the rising curiosity in these transformative applied sciences.

Jada Ai, a outstanding participant within the AI sector, additionally secured a considerable of $25,000,000 in funding throughout Q3 2023, with actual particulars concerning the funding spherical remaining unknown.

Metaverse

Within the Metaverse sector, Cosmic Wire launched into its journey with a Seed spherical on July 19, 2023, securing $30,000,000 in funding. Cosmic Wire’s substantial funding highlights the attract of this rising area.

Likewise, ZTX additionally raised $13,000,000 in a Seed spherical on August 15, 2023.

Telecom

Zeebu, a B2B crypto agency working within the Telecom sector, carried out a Personal Token Sale on September 7, 2023, elevating a noteworthy $25,000,000. The corporate’s deal with Telecom and its important funding spotlight its potential on this subject.

Music

Sound.xyz, a undertaking encompassing Web3 Instruments and Music, efficiently raised $20,000,000 in a Collection A spherical on July 12, 2023. The infusion of instruments and music throughout the Web3 realm is obvious within the substantial funding secured by Sound.xyz.

Gaming

Pahdo Labs, a key participant within the Gaming sector, secured $15,000,000 in a Collection A funding spherical on September 11, 2023. Gaming’s rising affect within the Web3 ecosystem is exemplified by Pahdo Labs’ notable funding.

Xterio, one other contender within the Gaming area, garnered $15,000,000 in strategic funding on July 12, 2023. Xterio goals to amplify its deal with Web3 gaming by means of the substantial funding on this sector.

Information and Privateness

Information and Privateness Web3 firm Anytype, secured $13,400,000 in funding throughout Q3 2023, with the precise particulars of the funding spherical remaining undisclosed.

Web3’s monetary panorama is as numerous because it’s revolutionary. Whereas the metaverse and mental property are grabbing the headlines, different areas equivalent to gaming, AI and information aren’t far behind. The figures reveal a transparent narrative: Web3 is huge, various and right here to remain.

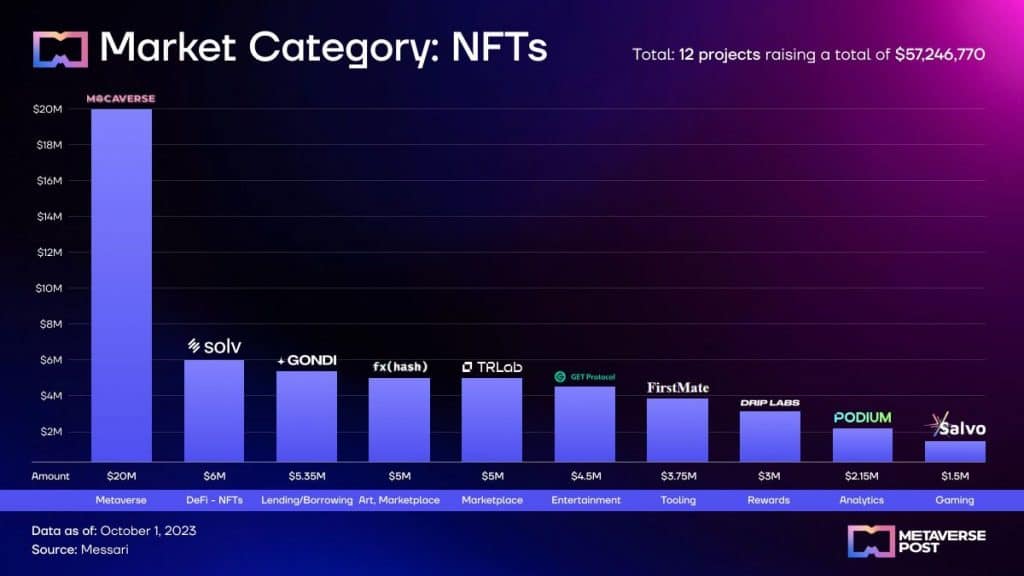

Market Class: NFTs

Whole: 12 initiatives raised a complete of $57,246,770

| Undertaking | Quantity | Sub-Class | % of Whole Funding |

| Mocaverse | $20,000,000 | Metaverse | 35% |

| Solv Protocol | $6,000,000 | DeFi – NFTs | 10% |

| Gondi | $5,350,000 | Lending/Borrowing | 9% |

| fxhash | $5,000,000 | Artwork, Market | 9% |

| TRLAB | $5,000,000 | Market | 9% |

| Get Protocol | $4,500,000 | Leisure, Ticketing | 8% |

| FirstMate | $3,750,000 | Market, Tooling | 7% |

| Drip Labs, Inc. | $3,000,000 | Rewards | 5% |

| Podium | $2,146,770 | Analytics | 4% |

| Salvo | $1,500,000 | Gaming | 3% |

| Moonbox | $1,000,000 | AI, Mental property | 2% |

Amid the widespread pleasure surrounding Non-Fungible Tokens (NFTs), it’s crucial to discern the trajectory of funding inside this area. Notably, this class has witnessed a considerable inflow of funds, reaching $57,246,770, distributed amongst 12 promising initiatives.

Main Tasks in NFTs:

- Mocaverse ($20 Million, 35%): Working within the metaverse sub-category, Mocaverse captures a major chunk of the NFT investments.

- Solv Protocol ($6 Million, 10%): Venturing into the fusion of DeFi and NFTs, Solv Protocol grabbed a noteworthy slice.

- Gondi ($5.35 Million, 9%): Specializing in lending/borrowing, Gondi represents a wider facet of the NFT ecosystem.

- Marketplaces: Tasks like fxhash ($5 Million, Artwork and Market) and TRLAB ($5 Million) emphasize the expansion of platforms facilitating NFT buying and selling.

The NFT sector encompasses a wide selection of functions, spanning metaverses, marketplaces, analytics and leisure. With an general funding approaching $60 million, the NFT panorama is barely starting to unveil its full potential.

The big range of initiatives and their funding emphasize that the NFT ecosystem extends past digital artwork. It represents a swiftly increasing realm of digital possession and innovation.

Notable Buyers of Q3 2023

A number of notable traders confirmed important curiosity by actively taking part in varied fundraising rounds. Listed here are a number of the outstanding traders and their contributions to the Web3 ecosystem throughout Q3 2023:

- Cogitent Ventures and Polygon: Cogitent Ventures and Polygon each emerged as energetic traders in Web3 initiatives, with every taking part in 4 totally different fundraising rounds. Their numerous portfolios mirror their dedication to fostering innovation within the Web3 area.

- AllianceDAO, Andreessen Horowitz, Base Ecosystem Fund, Binance Labs, Collab+Foreign money, Foresight Ventures, Hashed, Hashkey Capital, NGC Ventures, Robotic Ventures, and Shima Capital: These traders have every engaged in three Web3 fundraising rounds throughout Q3 2023. Their collective assist underscores the dynamism and progress potential of the Web3 sector.

Distinguished NFT Tasks Buyers

Within the thriving realm of Non-Fungible Tokens (NFTs), a number of traders made a major influence by backing promising NFT initiatives. Listed here are some notable NFT traders and their contributions in Q3 2023:

- sixth Man Ventures and Dragonfly Capital: Each sixth Man Ventures and Dragonfly Capital have actively invested in two NFT initiatives, demonstrating their perception within the transformative energy of NFTs.

- Cloth Ventures, OKX Ventures, and Tezos Basis: These traders have additionally performed an important position by taking part in two NFT fundraising rounds every, additional highlighting the diversification and potential of the NFT ecosystem.

These traders haven’t solely supplied essential monetary assist however have additionally contributed to the continued improvement and innovation throughout the Web3 and NFT sectors. Their portfolios embody a variety of initiatives, reflecting the multifaceted nature of the Web3 and NFT landscapes.

Decoding the Persistent Challenges of Q3 2023

Within the third quarter of 2023, the crypto group skilled a relatively quieter part in distinction to the sooner tumultuous first quarter. Nonetheless, it confronted challenges primarily arising from a surge in scams and fraudulent actions.

OpenSea’s “Offers” Function Fails to Make an Affect

OpenSea, one of many main NFT marketplaces, launched a brand new characteristic referred to as “Offers.” The characteristic aimed to allow customers to commerce NFTs by providing their very own NFTs as barter, moderately than relying solely on cryptocurrencies.

Whereas the idea of “Offers” sought to reinforce safety and function an middleman in transactions, it obtained combined critiques. Many customers expressed disappointment, citing that it arrived late. It additionally coincided with a interval when the NFT market was not performing properly.

Rise in QR Code-Linked Phishing Scams

The surge within the recognition of QR codes has introduced alongside an unlucky rise in QR-linked phishing scams. Menace actors have embraced QR codes in a development often called ‘Qishing,’ utilizing them to hide malicious URLs.

These attackers mimic multi-factor authentication processes. They trick victims into scanning QR codes with their cellular units, unknowingly granting entry to malicious hyperlinks. This rising development poses new challenges in cybersecurity and highlights the significance of person vigilance.

Google Adverts Scheme Exposes Cryptocurrency Customers to Rip-off Vulnerability

Cryptocurrency customers confronted a regarding vulnerability by means of a fraudulent Google Adverts scheme. Scammers have been buying advertisements on Google that redirect clicks to fraudulent cryptocurrency domains. Regardless of a number of stories to Google, the tech large has but to take decisive motion in opposition to these malicious actors.

Conclusion

In abstract, analyzing Web3 initiatives in Q3 2023 reveals a number of key findings:

- The quarter confirmed a complete of 62 initiatives collectively elevating $406,250,000 in funding.

- The highest 10 initiatives cowl numerous areas inside Web3, securing substantial funding and showcasing various pursuits throughout the ecosystem.

- Prime 10 initiatives accounted for a major 65.08% ($264,400,000) of the entire Web3 funding. This means a focus of capital in main endeavors.

- Notable developments included a powerful deal with the Metaverse and substantial investments in AI and gaming.

In abstract, Q3 2023 showcased substantial funding exercise throughout the Web3 sector, attracting a wide range of initiatives.

Whereas outstanding initiatives safe the vast majority of funding, the sector’s expansive scope highlights its promise. Buyers keep their perception within the transformative capabilities of Web3 applied sciences, laying the groundwork for future growth and innovation.

Disclaimer

Any information, textual content, or different content material on this web page is supplied as common market data and never as funding recommendation. Previous efficiency will not be essentially an indicator of future outcomes.

![]()

![]()

The Belief Undertaking is a worldwide group of reports organizations working to determine transparency requirements.

Nik is an achieved analyst and author at Metaverse Submit, specializing in delivering cutting-edge insights into the fast-paced world of know-how, with a selected emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain improvement. His articles interact and inform a various viewers, serving to them keep forward of the technological curve. Possessing a Grasp’s diploma in Economics and Administration, Nik has a strong grasp of the nuances of the enterprise world and its intersection with emergent applied sciences.

Extra articles

Nik Asti

Nik is an achieved analyst and author at Metaverse Submit, specializing in delivering cutting-edge insights into the fast-paced world of know-how, with a selected emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain improvement. His articles interact and inform a various viewers, serving to them keep forward of the technological curve. Possessing a Grasp’s diploma in Economics and Administration, Nik has a strong grasp of the nuances of the enterprise world and its intersection with emergent applied sciences.