- Bullish WAVES worth prediction ranges from $0.70 to $3

- Evaluation means that the WAVES worth would possibly attain above $2.975

- The WAVES bearish market worth prediction for 2023 is $0.799

Waves is a community-driven stack of decentralized open-source expertise for creating scalable, user-friendly functions. Waves cryptocurrency is a proof-of-stake blockchain community, decentralized trade, and pockets that permits customers to generate their very own cash and trade and commerce cryptocurrencies effortlessly. The Waves protocol additionally helps sensible contracts.

If you’re keen on the way forward for WAVES and need to know its predicted worth for 2023, 2024, 2025, and 2030, hold studying!

Waves (WAVES) Market Overview

| 🪙 Title | Waves |

| 💱 Image | waves |

| 🏅 Rank | #188 |

| 💲 Worth | $1.78 |

| 📊 Worth Change (1h) | -0.65361 % |

| 📊 Worth Change (24h) | -0.62371 % |

| 📊 Worth Change (7d) | 7.64063 % |

| 💵 Market Cap | $177609442 |

| 📈 All Time Excessive | $61.3 |

| 📉 All Time Low | $0.130878 |

| 💸 Circulating Provide | 100000000 waves |

| 💰 Whole Provide | 100000000 waves |

What’s Waves (WAVES)?

Waves is a worldwide open-source platform for decentralized functions that runs on a proof-of-stake consensus algorithm referred to as WavesNG. Waves expertise stack has been constructed to learn in any use instances that demand safety and decentralization. Be it in open finance, private identification, gaming, or delicate information, Waves is constructed resilient.

Launched in June 2016 following one of many cryptocurrency trade’s earliest preliminary coin choices (ICO), Waves initially got down to enhance the primary blockchain platforms by growing pace, utility, and user-friendliness.

As an entity endeavoring to attraction to potential enterprise purchasers trying to make use of blockchain to enhance processes or create new providers, Waves developed merchandise together with Gravity, a cross-chain and oracle community, and the decentralized finance (DeFi) targeted platform Neutrino.

Moreover, Waves supported sensible contract and DApp growth, guaranteeing that speeds and ease of use surpassed the competitors on the time.

Waves DEX is a decentralized cryptocurrency trade. In 2020, Waves introduced that its platform can be interoperable with the Ethereum community by releasing the WAVES token as an ERC-20 commonplace asset.

Waves’ native token is WAVES, an uncapped provide token used for normal funds corresponding to block rewards.

WAVES Present Market Standing

WAVES has a circulating provide of 111,521,152 WAVES cash, whereas its most provide shouldn’t be out there, in keeping with CoinMarketCap. On the time of writing, WAVES is buying and selling at $1.79 representing 24 hours lower of 0.52%. The buying and selling quantity of WAVES previously 24 hours is $35,135,242 which represents a 2.05% enhance.

Some high cryptocurrency exchanges for buying and selling WAVES are Binance, OKX, Deepcoin, Bitrue, and Bybit.

Now that you realize WAVES and its present market standing, we will focus on the value evaluation of WAVES for 2023.

WAVES Worth Evaluation 2023

Presently, WAVES ranks 149 on CoinMarketCap. Will WAVES’s most up-to-date enhancements, additions, and modifications assist its worth go up? First, let’s give attention to the charts on this article’s WAVES worth forecast.

WAVES Worth Evaluation – Bollinger Bands

The Bollinger bands are a sort of worth envelope developed by John Bollinger. It provides a spread with an higher and decrease restrict for the value to fluctuate. The Bollinger bands work on the precept of normal deviation and interval (time).

The higher band as proven within the chart is calculated by including two occasions the usual deviation to the Easy Shifting Common whereas the decrease band is calculated by subtracting two occasions the usual deviation from the Easy Shifting Common. When the bands widen, it reveals there’s going to be extra volatility and after they contract, there may be much less volatility.

When Bollinger bands are utilized in a cryptocurrency chart, we may count on the value of the cryptocurrency to reside inside the higher and decrease bounds of the Bollinger bands 95% of the time. The above thesis is derived from an Empirical regulation.

The sections highlighted by pink rectangles within the chart above present how the bands develop and contract. When the bands widen, we may count on extra volatility, and when the bands contract, it denotes much less volatility.

The inexperienced rectangle reveals how WAVES retraced after touching the higher band (overbought). When contemplating the bandwidth we may see that the bands expanded a big margin. Furthermore, the Bandwidth indicator states the worth 0.87.

Nevertheless, after this growth, the Bollinger band’s expansions and contractions have been little or no. As such the costs of WAVES has been shifting inside a constricted vary. Nonetheless, there appears to be some hope arising on the horizon for WAVES.

It comes within the type of the bandwidth indicator (BBW) denoting that the BBW worth at 0.27. This place at 0.27 is sort of a well-liked spot for the indicator to rebound and begin rising. If this occurs then we may even see the bands widen and there may very well be extra volatility out there within the coming days. As such, merchants could must hold a vigilant eye to enter the market within the nick of time.

WAVES Worth Evaluation – Relative Power Index

The Relative Power Index is an indicator that’s used to seek out out whether or not the value of a safety is overvalued or undervalued. As per its title, RSI indicators assist decide how the safety is doing at current, relative to its earlier worth.

Furthermore, it has a sign line which is a Easy Shifting Common (SMA) that acts as a yardstick or reference to the RSI line. Therefore, every time the RSI line is above the SMA, it’s thought of bullish; if it’s under the SMA, it’s bearish.

When contemplating the primary inexperienced rectangle from the left of the chart under we will see that the RSI is above the sign. Therefore, WAVES is bullish and consequently, it’s making greater highs.

The second inexperienced rectangle reveals that the RSI line (purple) is under the Sign line (yellow). As such, WAVES is bearish or shedding worth. Due to this fact it’s reaching decrease lows as proven within the chart.

Furthermore, the RSI is also used to seek out out the divergence. For example, when the token is making greater highs then the RSI also needs to be making greater highs in unison with it for it to be referred to as a bull run. Nevertheless, if the RSI doesn’t make greater highs with the token, then lets say that there may very well be a development reversal, because the token is shedding worth regardless of making greater highs.

Presently, the RSI of WAVES is at 49.93. We may name the development sturdy as it’s neither overbought nor oversold. Furthermore, when taking the RSI Help and Resistance indicator into consideration we may see that WAVES has fallen out of the bull zone and is heading in the direction of the cross-bear zone Gray line). If it breaks the gray line, it could land on the white crossed line (Crossover oversold). Nevertheless, the possibilities of the previous occurring are slim since WAVES has been rebounding off of the gray line recently. As such it could reciprocate this habits.

Merchants seeking to go lengthy could need to place their entry level at $1.677 and hold their cease loss near 1.5 whereas the take revenue may very well be near the inexperienced line above.

In the meantime, Stochastic RSI is heading into the conventional vary after being overbought for fairly a while. As such the Stochastic RSI could proceed taking place.

Nevertheless, on a earlier event in September 2022, when the Stochastic RSI was simply crossing the overbought zone and getting into the conventional zone, we may see that the Stochastic RSI rebounded off it and began ascending. It might reciprocate this habits as soon as once more.

WAVES Worth Evaluation – Shifting Common

The Exponential Shifting averages are fairly much like the straightforward shifting averages (SMA). Nevertheless, the SMA equally distributes down all values whereas the Exponential Shifting Common provides extra weightage to the present costs. Since SMA undermines the weightage of the current worth, the EMA is utilized in worth actions.

The 200-day MA is taken into account to be the long-term shifting common whereas the 50-day MA is taken into account the short-term shifting common in buying and selling. Based mostly on how these two traces behave, the power of the cryptocurrency or the development might be decided on common.

Particularly, when the short-term shifting common (50-day MA) approaches the long-term shifting common (200-day MA) from under and crosses it, we name it a Golden Cross.

Contrastingly, when the short-term shifting common crosses the long-term shifting common from above then, a dying cross happens.

Often, when a Golden Cross happens, the costs of the cryptocurrency will shoot up drastically, however when there’s a Demise Cross, the costs will crash.

Every time the value of cryptocurrency is above the 50-day or 200-day MA, or above each we could say that the token is bullish (Purple rectangle). Contrastingly, if the token is under the 50-day or 200-day, or under each, then we may name it bearish (Blue triangle part).

Presently, it appears that evidently the bears have taken over the market. This may very well be proved as each the shifting averages are sloping downwards. Notably, the 50-day MA was recovering and rising in the direction of the 200-day MA which was above it from the start of 2023.

Nevertheless, the rise of the 50-day MA was disturbed originally of March. We may see the 50-day MA slant downwards and transfer parallel to the 200-day MA. Presently, WAVES has been rejected after testing the 50-day MA. As such it could kind for assist at $1.522.

Furthermore, we may count on WAVES to rebound off of the above-mentioned assist and take a look at the 50-day MA. As such, merchants may have to contemplate having their entry level near the above-mentioned assist degree.

WAVES Worth Evaluation – Elder Power Index

Elder Power Index is an indicator that was invented by Alexander Elder, who was an entrepreneur. The indicator primarily makes use of two parameters to adjudicate the shopping for and promoting drive and thereby predicts the market development. Particularly, it depends on worth change and quantity. As such the power of the shopping for drive or promoting drive relies on both the value change or the amount.

Every time the EFI is larger than zero, or constructive, lets say that the development is bullish, as there may be extra shopping for stress. Nevertheless, when the EFI is within the adverse zone, lets say that the cryptocurrency is within the adverse zone and the promoting stress is extra.

Furthermore, the Elder Power is also used to determine development reversals and breakouts. For example when the EFI is making decrease highs whereas the cryptocurrency is making greater highs, then lets say that it is a bearish divergence, as proven within the chart. Nevertheless, within the occasion that the cryptocurrency is making decrease lows whereas the EFI is making greater lows, then it’s a bullish divergence represented within the chart.

Presently, the Elder Power Index(EFI) line which is at 212.77K is heading in the direction of the zero line. Nevertheless, beforehand on an event, when the EFI was crashing identical to this, the bull’s stress made the road rebound off of 154.31K. We may count on the bulls to chip in as soon as the EFI reaches near the above-mentioned determine. Furthermore, to strengthen this thesis, the Bear-Bull Energy indicator additionally reveals that its line which was sloping down has recovered and is now shifting parallel to the horizontal.

Because the bulls energy is growing we may even see extra consumers be part of the bandwagon. And when extra consumers be part of the shopping for frenzy, we could witness the value of WAVES going up by a big margin whereas the amount too will enhance. As such we may count on the EFI to rise.

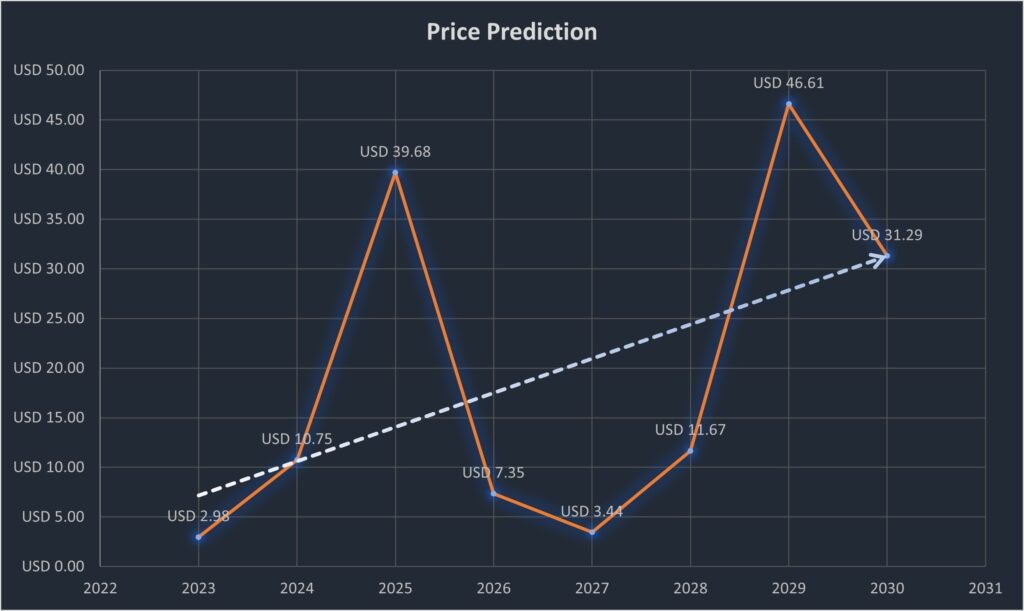

WAVES Worth Prediction 2023-2030 Overview

| Yr | Minimal Worth | Common Worth | Most Worth |

| 2023 | $1.291 | $2.975 | $3.526 |

| 2024 | $8.795 | $10.746 | $12.451 |

| 2025 | $37.982 | $39.683 | $42.198 |

| 2026 | $6.584 | $7.352 | $8.914 |

| 2027 | $2.921 | $3.444 | $5.645 |

| 2028 | $10.2854 | $11.668 | $13.521 |

| 2029 | $42.125 | $46.613 | $48.982 |

| 2030 | $28.758 | $31.2857 | $34.265 |

| 2040 | $55.6521 | $58.5894 | $62.351 |

| 2050 | $80.2651 | $85.7844 | $89.9815 |

WAVES Worth Prediction 2023

When contemplating the chart above, we may see that WAVES is buying and selling contained in the falling wedge since February. It has been descending from Resistance 3 at ≈$3.00 and proper now it has rebounded after receiving assist at Help 1 ($1.50). Since WAVES has been stringently following the development traces we may count on WAVES to rebound off of each development traces earlier than breaking out.

Particularly, now that WAVES is shifting near the higher development line, the possibilities of it rebounding off of it are excessive for the reason that Higher Bollinger band additionally intersects with the higher development line right here.

As soon as WAVES completes forming the falling wedge sample it could get away. Nevertheless, there may be additionally the opportunity of WAVES breaking out earlier than finishing forming the sample.

Merchants could need to observe WAVES intently and do their due diligence earlier than getting into the market. As such, these hoping to go lengthy could need to await WAVES to breakout out of the wedge and set the entry level simply above the higher development line whereas having their cease loss on the newest lowest.

In the case of setting the take revenue, these going lengthy could need to have it at Resistance 2 ($2.975). The thesis to WAVES reaching Resistance may very well be derived from its earlier hike from this very worth. Moreover, as per the e-book, we may count on WAVES to extend by the peak of the wedge at its early stage. Furthermore, when the peak of the wedge is positioned on the higher development line as proven within the chart, it reaches Resistance 2.

Nevertheless, on its method to Resistance 2, it could face some friction at Resistance 1 ($2.453). Therefore, we may count on some rebound off of Resistance 1. For many who missed out on getting into the market on the breakout, these rebounds off of Resistance 1 could current a wonderful entry level. All of the above predictions are legitimate on condition that WAVES is held up by Help 1 at $1.492. Nonetheless, within the unlikely occasion that Whales enter the market and disrupt WAVES actions with a dump, we could count on WAVES to crash under Help 1 and attain Help 2 at $0.799.

WAVES Worth Prediction – Resistance and Help Ranges

When contemplating the chart we may observe that WAVES was closely depending on the three:1 Gann line for assist from October 2020 to late 2021 whereas it examined and broke the two:1 Gann line on quite a few events. Nevertheless, in the course of the aforementioned time-frame, WAVES additionally did search assist from the 4:1 Gann line a couple of occasions.

Nonetheless, the extra essential side to note in regards to the WAVES motion is its transient rise above the 1:1 Gann line. Particularly, in Might 2021, it rose above the 1:1 Gann line briefly which is taken into account bullish. Nevertheless, shortly after this WAVES fell again to the three:1 Gann line for assist.

After October 21, WAVES upward rise was barred by the two:1 Gann line. Being rejected by the two:1 Gann line, WAVES didn’t obtain assist on the 3:1, or 4:1 Gann traces. Nevertheless, the 8:1 Gann line was capable of rescue WAVES from its additional fall. After receiving assist at 8:1, WAVES rose vertically and reached its all-time excessive of $63. Nevertheless, this too was short-lived, as WAVES crashed vertically and didn’t discover assist on the 8:1 Gann line. Therefore it’s presently buying and selling under the 8:1 Gann line.

Within the occasion that WAVES receives assist from the 8:1 Gann line, we may count on it to achieve the three:1 Gann line and rise alongside it.

WAVES Worth Prediction 2024

There can be Bitcoin halving in 2024, and therefore we must always count on a constructive development out there as a result of person sentiments and the search by traders to build up extra of the coin. Nevertheless, the 12 months of BTC halving didn’t yield the utmost WAVES based mostly on the earlier halving. Therefore, we may count on WAVES to commerce at a worth not under $10.746 by the tip of 2024.

WAVES Worth Prediction 2025

WAVES could expertise the after-effects of the Bitcoin halving and is predicted to commerce a lot greater than its 2024 worth. Many commerce analysts speculate that BTC halving may create a big impact on the crypto market. Furthermore, much like many altcoins, WAVES will proceed to rise in 2025 forming new resistance ranges. It’s anticipated that WAVES would commerce past the $39.683 degree.

WAVES Worth Prediction 2026

It’s anticipated that after an extended interval of bull run, the bears would come into energy and begin negatively impacting the cryptocurrencies. Throughout this bearish sentiment, WAVES may tumble into its assist areas. Throughout this era of worth correction, WAVES may lose momentum and be manner under its 2025 worth. As such it may very well be buying and selling at $7.352 by 2026.

WAVES Worth Prediction 2027

Naturally, merchants count on a bullish market sentiment after the crypto trade was affected negatively by the bears’ claw. Furthermore, the build-up to the subsequent Bitcoin halving in 2028 may evoke pleasure in merchants. Nevertheless, there can be a dip earlier than WAVES really surges, as such we may count on WAVES to commerce at round $3.444 by the tip of 2027.

WAVES Worth Prediction 2028

Because the crypto group’s hope can be re-ignited trying ahead to Bitcoin halving like many altcoins, WAVES could reciprocate its previous habits in the course of the BTC halving. Therefore, WAVES can be buying and selling at $11.668 after experiencing a substantial surge by the tip of 2028.

WAVES Worth Prediction 2029

2029 is predicted to be one other bull run as a result of aftermath of the BTC halving. Nevertheless, merchants speculate that the crypto market would regularly grow to be steady by this 12 months. In tandem with the steady market sentiment, WAVES may very well be buying and selling at $46.613 by the tip of 2029.

WAVES Worth Prediction 2030

After witnessing a bullish run out there, WAVES and plenty of altcoins would present indicators of consolidation and would possibly commerce sideways and transfer downwards for a while whereas experiencing minor spikes. Due to this fact, by the tip of 2030, WAVES may very well be buying and selling at $31.285

WAVES Worth Prediction 2040

The long-term forecast for WAVES signifies that this altcoin may attain a brand new all-time excessive(ATH). This might be one of many key moments as HODLERS could count on to promote a few of their tokens on the ATH level.

If they begin promoting then WAVES may fall in worth. It’s anticipated that the common worth of WAVES may attain $58.5894 by 2040.

WAVES Worth Prediction 2050

The group believes that there can be widespread adoption of cryptocurrencies, which may keep gradual bullish features. By the tip of 2050, if the bullish momentum is maintained, WAVES may hit $.85.7844

Conclusion

If traders proceed exhibiting their curiosity in WAVES and add these tokens to their portfolio, it may proceed to rise. WAVES’s bullish worth prediction reveals that it may attain the $3 degree.

FAQ

Waves is a blockchain platform that helps a wide range of use instances, corresponding to decentralized functions (dApps) and sensible contracts. With Waves, customers can construct and launch their very own crypto tokens. Waves allow the creation and buying and selling of cryptocurrency tokens with out the necessity for complicated, revolutionary contract programming. Tokens might be created and managed by scripts run beneath Waves person accounts.

WAVES tokens might be traded on many exchanges like Binance, OKX, BTCEX, Deepcoin, and Bitrue.

WAVES has a chance of surpassing its current all-time excessive (ATH) worth of $62.36 in 2022.

WAVES is without doubt one of the few cryptocurrencies that has proven resilience. As such, we may count on it to burst out with a big spike. If it does spike after breaking out of the wedge, then, it would attain $3 quickly after it breaks the Resistance 1 degree.

WAVES has been one of the appropriate investments within the crypto house. It’s extremely risky, as such, it has fairly a margin when its worth fluctuates. Therefore, merchants could also be allured to put money into WAVES. It’s an excellent funding within the brief time period and in the long run as properly.

The current all-time low worth of WAVES is $0.1227.

The utmost provide of WAVES is unavailable.

WAVES was launched in June 2016.

Ukrainian-born scientist Alexander Ivanov (also referred to as Sasha Ivanov) is the founding father of WAVES.

WAVES might be saved in a chilly pockets, scorching pockets, or trade pockets.

WAVES is predicted to achieve $2.975 by 2023.

WAVES is predicted to achieve $10.746 by 2024.

WAVES is predicted to achieve $39.683 by 2025.

WAVES is predicted to achieve $7.352 by 2026.

WAVES is predicted to achieve $3.444 by 2027.

WAVES is predicted to achieve $11.668 by 2028.

WAVES is predicted to achieve $46.613 by 2029.

WAVES is predicted to achieve $31.285 by 2030.

What would be the WAVES token’s worth in 2040?

WAVES is predicted to achieve $85.7844 by 2050.

Disclaimer: The views and opinions, in addition to all the data shared on this worth prediction, are printed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and associates won’t be held answerable for direct harm or loss.