- Securitize companions with Wormhole to allow seamless cross-chain transfers for tokenized property.

- The collaboration enhances liquidity and accessibility, notably for institutional buyers.

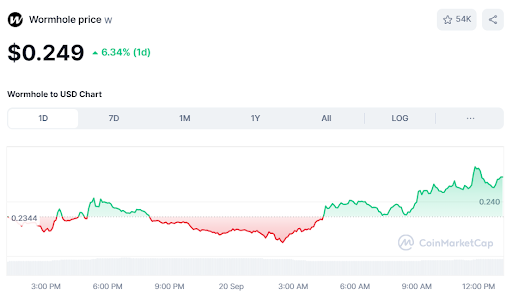

- W token surged 6.35% following the announcement, signaling robust market curiosity.

Securitize, a significant participant in real-world asset tokenization, partnered with the Wormhole Basis to make cross-chain interoperability a actuality for all property tokenized on its platform. The purpose of this partnership is to combine with Wormhole’s interoperability options, permitting tokenized property to maneuver seamlessly throughout totally different blockchain ecosystems.

With this integration, Securitize will use Wormhole as its go-to supplier for blockchain interoperability. This ensures that every one present and future tokenized property on the platform can move throughout a number of blockchain networks simply.

This transfer is especially essential for institutional buyers who need extra flexibility in managing their property throughout a greater variety of compliant digital asset ecosystems. Carlos Domingo, CEO of Securitize, underscored the significance of this integration:

“Tokenized securities have to thrive on public, permissionless blockchains to unlock the potential of blockchain know-how.”

He identified that working with Wormhole will enable for fast, inexpensive transactions, pushing the trade nearer to a cross-chain ecosystem for tokenized property.

Partnership Opens Doorways for Asset Issuers and Traders

This collaboration brings new alternatives for each asset issuers and buyers. It strengthens the safety, belief, and adaptability of cross-chain operations. Combining Securitize’s experience in compliance with Wormhole’s safe, open-source messaging protocol, the partnership helps in larger institutional adoption of tokenized property.

Robinson Burkey, co-founder of Wormhole, praised the collaboration as a pivotal second for bridging conventional finance and decentralized finance.

Wormhole’s Token Sees Worth Bounce

The announcement has had a optimistic impact on the platform’s native token, “W.” As of now, W has surged by 6.35%, buying and selling at $0.249. Most of those positive aspects occurred only a few hours after the announcement, following a interval of declines earlier within the day.

Even earlier than becoming a member of forces with Wormhole, Securitize had fashioned strategic partnerships with main asset managers like BlackRock, Hamilton Lane InvestCorp, and KKR to bridge the hole between conventional finance and digital property.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be answerable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.