- CoinMarketCap’s report showcased the difficult but thrilling dynamics of the worldwide crypto market.

- VR/AR and AI & Massive Information sectors witnessed astounding development.

- Memecoin’s frenzy was led by PEPE, reporting over a 3700X surge in worth.

In keeping with the newest analysis by CoinMarketCap, the primary half of 2023 (H1) proved to be each difficult and thrilling for the worldwide crypto market, with the market cap holding $1.17 trillion on the finish of Q2, indicating a 48% year-to-date improve.

The report famous that the primary quarter and the second quarter ended with related whole market caps, resulting in the labeling of Q2 as a “misplaced quarter.” Nonetheless, some sectors have witnessed outstanding development, propelling them into the highlight.

Amongst them was the Digital Actuality/Augmented Actuality (VR/AR) sector, which skilled an astonishing surge, with its market cap skyrocketing by a staggering 704%, in response to the report.

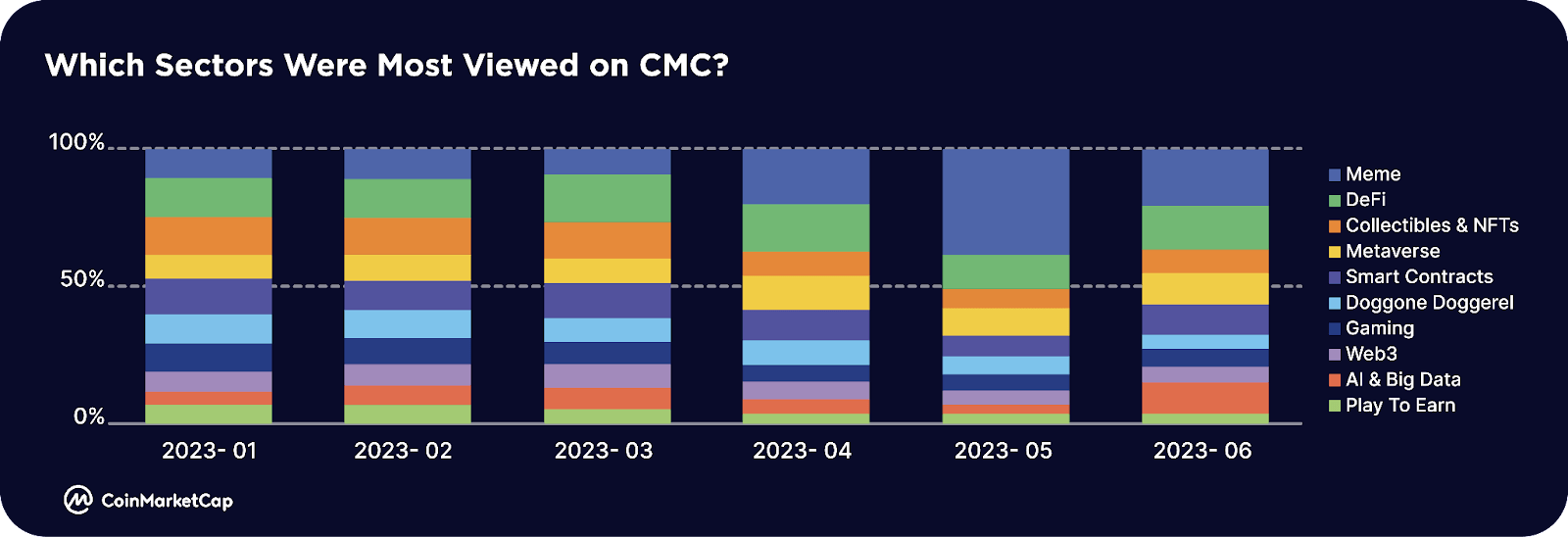

AI & Massive Information additionally emerged as a newcomer to the most-viewed sectors, with a placing surge of 323% in market cap in Q1 2023, following the launch of OpenAI’s ChatGPT. The report famous that June noticed a resurgence in curiosity in AI-related tokens like SingularityNET (AGIX) and Fetch.ai (FET), bouncing practically 40% from their mid-June lows.

Equally, the speculative frenzy surrounding meme cash intensified in H1, with over 260 added new cash, led by the long-lasting PEPE token. Particularly, PEPE reported greater than 3700 occasions its worth throughout the first half of 2023. Though PEPE skilled a retracement from its peak in Could, CoinMarketCap revealed the token rallied practically 100% from its mid-June lows.

Different famend meme cash from earlier cycles, together with DOGE, SHIB, and BabyDoge, have been among the many most seen on this sector. Moreover, the meme sector’s reputation translated into consumer engagement on CoinMarketCap’s group, with memes garnering probably the most engagement in likes, posts, and feedback.

In the meantime, Good Contracts remained predominantly linked to Ethereum (ETH), notably after the profitable Shapella improve, permitting staked ETH to be withdrawn from the beacon chain.

CoinMarketCap additionally highlighted that Liquid Staking Derivatives (LSDs) noticed a outstanding surge in exercise, fueled by Ethereum’s Shapella improve, with market leaders like Lido and Rocket Pool experiencing substantial development.

Cardano (ADA) additionally gained vital curiosity as a result of its technical developments just like the scaling answer Hydra and the governance proposal CIP 1694.

It’s price mentioning that Bitcoin stays the most-viewed crypto throughout completely different areas, dominating the market with its rising dominance over altcoins. Shiba Inu and Child Doge Coin have captured the eye of assorted areas. On the identical time, Ethereum stays a well-liked coin of curiosity in most areas besides Asia and Africa, the place scaling options like Polygon and Arbitrum have gained traction.