- Vitalik Buterin disclosed that 36.5% of the Ethereum Basis’s 2023 price range was allotted to new foundations.

- Buterin’s annual wage is about at SGD 182,000, roughly $134,000, offering transparency on Ethereum’s monetary operations.

- Ethereum’s market exhibits blended alerts with a 4.94% worth drop and a 62.47% rise in choices buying and selling quantity.

Ethereum (ETH) co-founder Vitalik Buterin shared new details about the Ethereum Basis’s 2023 bills and his personal wage. Buterin, recognized for influencing the market along with his posts, supplied an in depth breakdown of the Basis’s spending.

In a publish on his X account, Buterin outlined the first spending classes. The most important portion; 36.5%, was allotted to “New Foundations,” together with organizations such because the Nomic Basis, The DRC, L2Beat, and 0xPARC. In addition to this, investments had been directed in the direction of tier-1 analysis and growth, accounting for twenty-four.9% of the price range, and neighborhood growth, which acquired 12.7%.

Buterin additionally disclosed his annual wage, set at SGD 182,000, equal to roughly $134,000. This disclosure gives a glimpse into the monetary operations of the Ethereum Basis.

The crypto market reacted to Buterin’s publish, and Ethereum is presently buying and selling at $2,589.24, with a 24-hour buying and selling quantity of $14.09 billion. The worth dropped by 4.94% up to now 24 hours, bringing Ethereum’s market cap to $311.48 billion. Ethereum’s circulating provide stands at 120.30 million ETH cash.

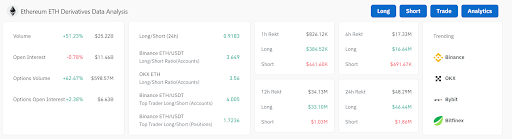

Ethereum derivatives buying and selling knowledge additionally confirmed a surge in exercise. Buying and selling quantity elevated by 51.23% to $25.22 billion, though open curiosity noticed a slight lower. Choices buying and selling skilled a considerable 62.47% rise in quantity. Moreover, the lengthy/brief ratios replicate a usually bullish sentiment, particularly on Binance and OKX, the place lengthy positions dominate.

Nevertheless, the general 24-hour lengthy/brief ratio stands at 0.9183, indicating a slight desire for brief positions throughout the market. Binance’s high merchants show a powerful lengthy bias, suggesting confidence in Ethereum’s potential regardless of latest worth declines.

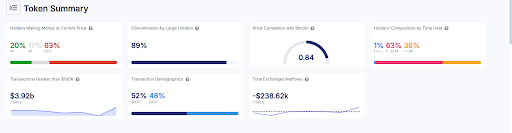

Moreover, Ethereum’s present market standing presents blended alerts. ETH trades at $2,588.92, down 2.16% within the final 24 hours, with a market cap of $326.69 billion. Solely 20% of holders are presently profiting, whereas 63% are at a loss. Massive holders management 89% of the provision, signifying excessive centralization. Furthermore, ETH exhibits a powerful correlation (0.84) with Bitcoin’s worth actions.

Regardless of short-term bearish tendencies, the info signifies ongoing curiosity and potential for Ethereum within the broader market. The unfavourable alternate web circulation of $238.62K over the previous week might trace at accumulation. Subsequently, these metrics would recommend Ethereum stays a key participant within the crypto market, with its future outlook carefully tied to broader market circumstances.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be liable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.