Speculators on crypto derivatives suffered vital losses prior to now day, totaling round $774 million, marking the best single-day lack of the yr because of risky market swings.

Bitcoin, the bellwether digital asset, surged to its highest degree since November 2021, surpassing the $63,000 mark in a outstanding rally. Nevertheless, the euphoria was short-lived as the worth swiftly plummeted under $60,000, triggered, partly, by concern created by technical glitches on main exchanges like Coinbase and Binance.

Including to the volatility, observers famous sizable Bitcoin transfers from wallets linked to funds seized by US authorities within the Bitfinex hack. The almost $1 billion motion to undisclosed addresses fueled hypothesis that authorities may capitalize available on the market surge to dump their holdings. Nevertheless, StarCrypto evaluation suggests the motion was probably UTXO administration.

Regardless of the turbulence, Bitcoin regained floor, rallying to $62,530 on the time of reporting, marking a 7% acquire over the day before today.

In the meantime, different outstanding cryptocurrencies adopted go well with with spectacular good points. Ethereum, as an example, surged 5% to almost $3,500, reaching its highest worth since April 2022. Solana additionally skilled a resurgence, hitting round $130, its highest degree in 22 months, in line with StarCrypto information.

Among the many high 10 cryptocurrencies by market capitalization, Cardano and Dogecoin stood out with outstanding double-digit good points of 11.78% and 39.16%, respectively.

Virtually 190,000 merchants liquidated for $774 million

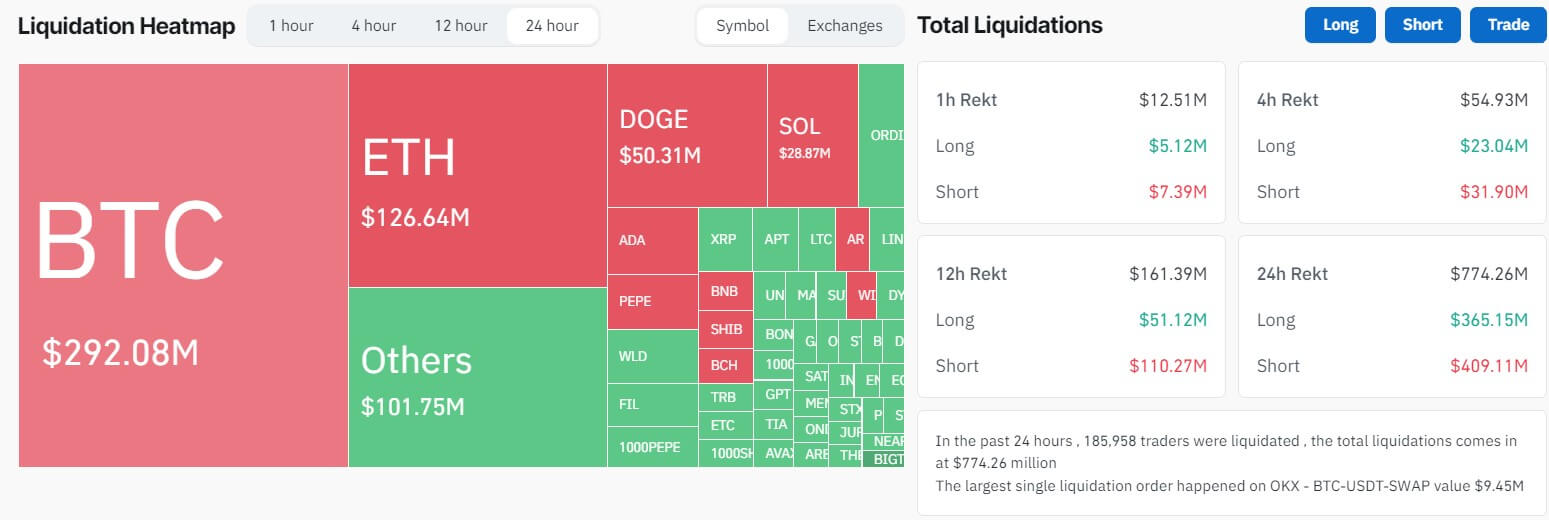

Prior to now 24 hours, the inexperienced market’s strong efficiency resulted within the liquidation of 189,679 merchants, amounting to a staggering $774 million, per Coinglass information.

Quick merchants dominate the present liquidation panorama, accounting for a good portion of the overall losses. These betting in opposition to value hikes confronted a collective lack of $409 million, whereas lengthy merchants, anticipating value will increase, incurred losses totaling roughly $365.48 million.

Bitcoin merchants bore the brunt of the losses throughout this era, with a considerable $292.09 million downturn. Quick merchants skilled losses of $187.83 million, whereas lengthy merchants noticed a lower of $104.26 million.

Equally, Ethereum skilled losses totaling $126.64 million, whereas merchants in DOGE and Solana suffered losses of $50.3 million and roughly $29 million, respectively.

In the meantime, probably the most vital particular person liquidation occurred on OKX, totaling $9.45 million from a BTC-USDT-SWAP.

Throughout exchanges, Binance and OKX reported the best liquidations, constituting 35.57% and 35.31% of the overall, respectively. These losses translated to $275.46 million and $275.43 million, as reported by Coinglass. Conversely, Huobi, Bybit, and Bitmex witnessed liquidations amounting to $79.40 million, $72.21 million, and $51.75 million, respectively.