- The crypto market shed 6.48% (roughly $240 billion) yesterday as Bitcoin’s fall from $101,000 to a each day low of $93,000 sparked $750 million in liquidations.

- Main cryptos have begun to recuperate, with some alts already logging double-digit value will increase.

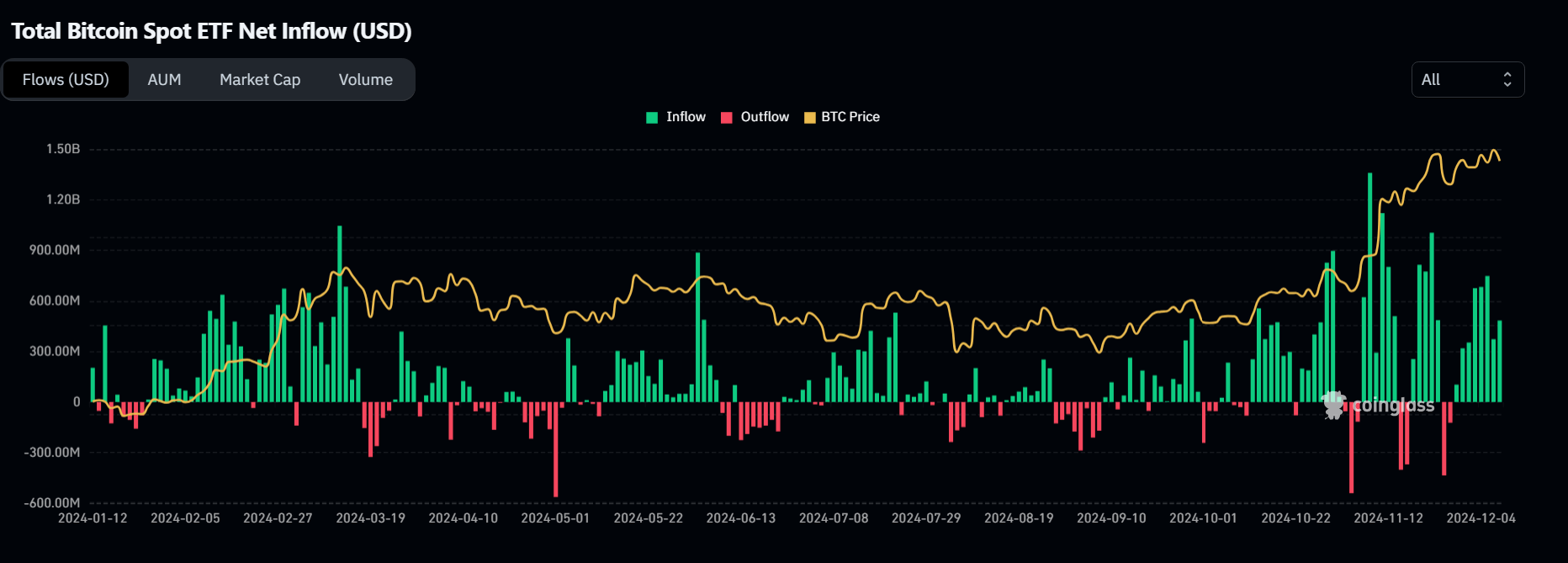

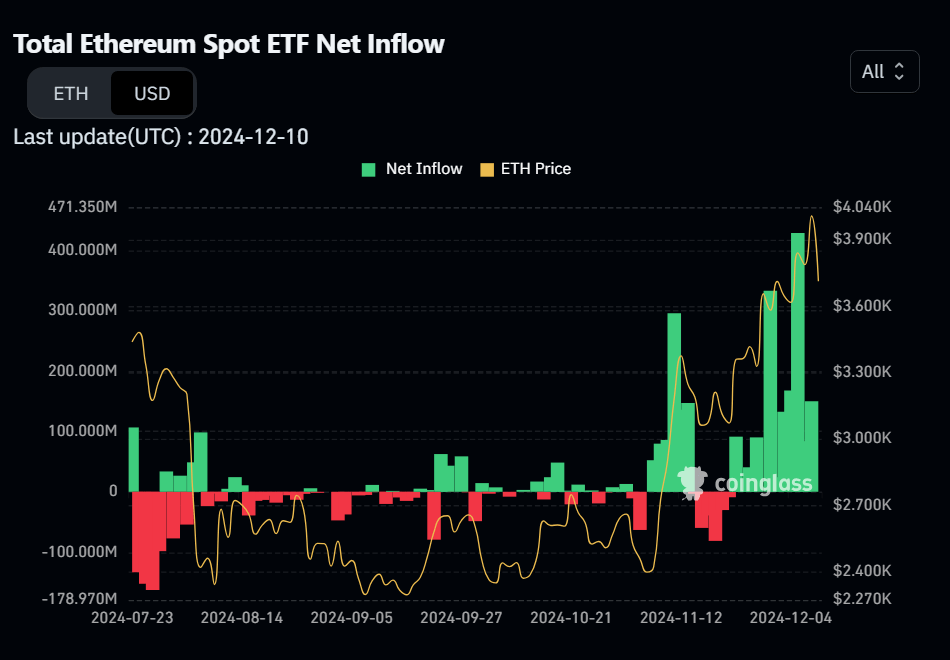

- In the meantime, Bitcoin and Ethereum spot ETFs proceed to log constructive inflows.

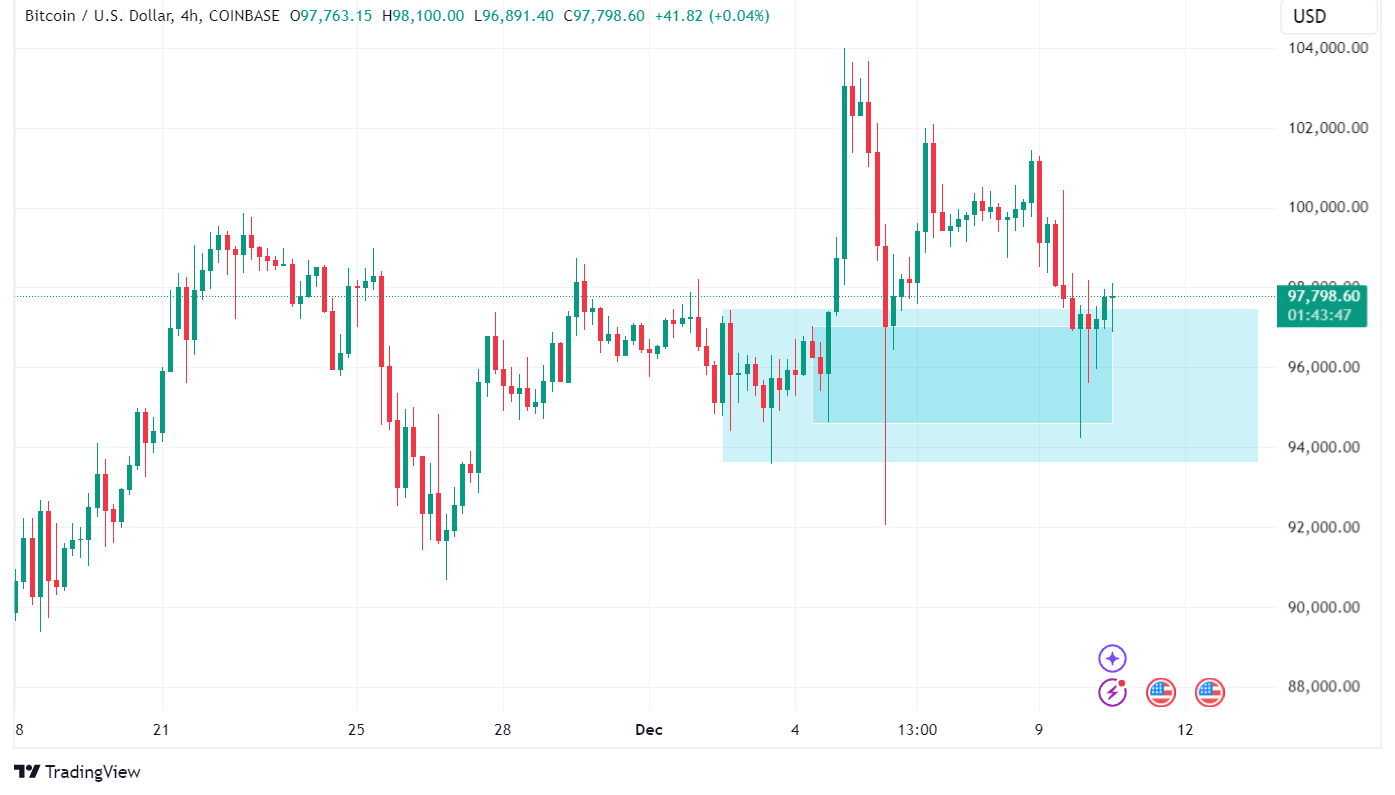

Bitcoin bled in yesterday’s buying and selling session, falling from a each day opening value of $101,151 to a low of $94,270 throughout the US afternoon session earlier than closing increased at $97,314. With a market dominance above 56%, the biggest crypto by market cap weighed on your entire market as main altcoins logged double-digit losses.

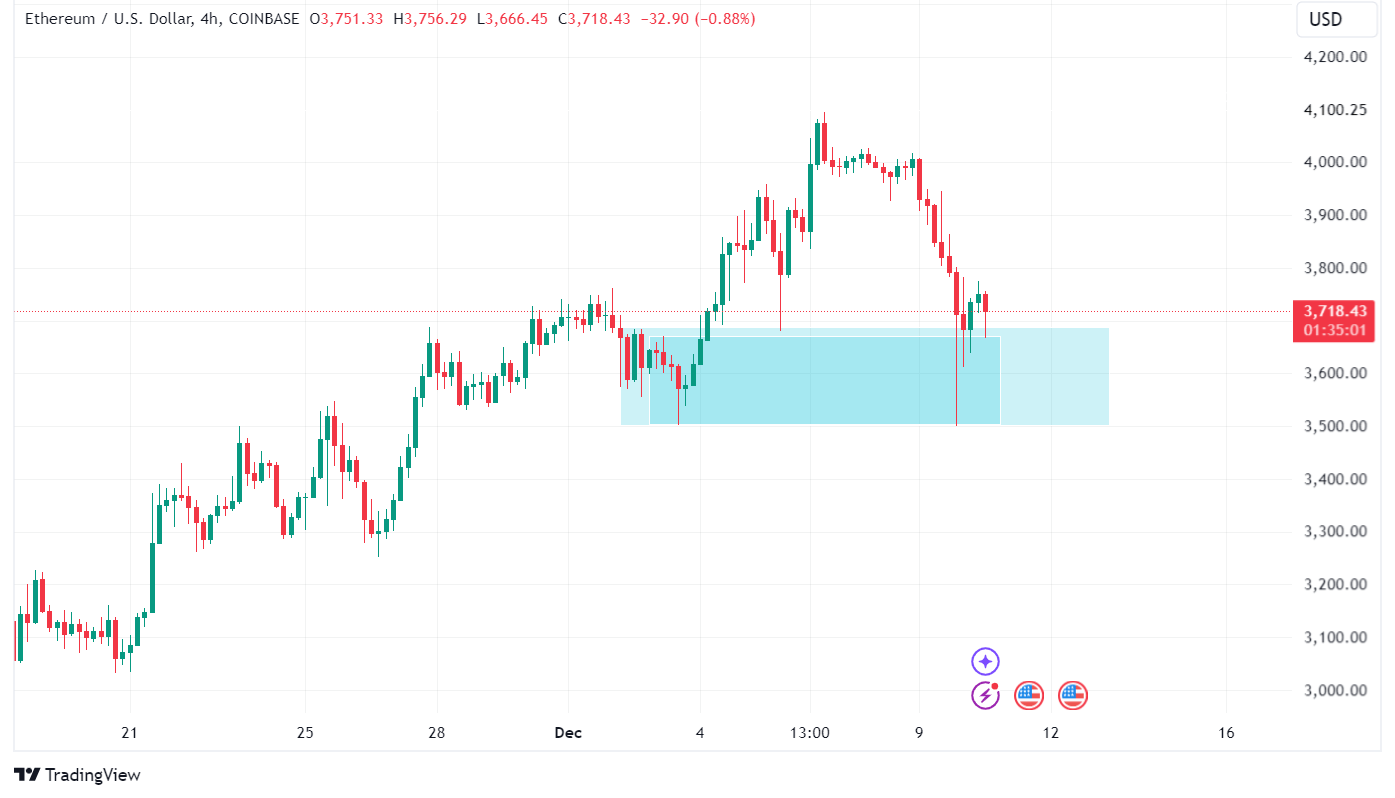

Nevertheless, at first of at this time’s US buying and selling session, some main altcoins seem to have discovered help. Ethereum reached a each day low of $3,506 yesterday and is up 5% from that degree as of writing, whereas Solana is up 6.9% from yesterday’s lows.

Is the promoting over?

Bitcoin’s value pushed all the way down to a help zone with an higher boundary of $97,463 and whereas a lot of the promoting stress seems to have abated, its value nonetheless hovers across the help as definitive initiative purchase motion is but to happen.

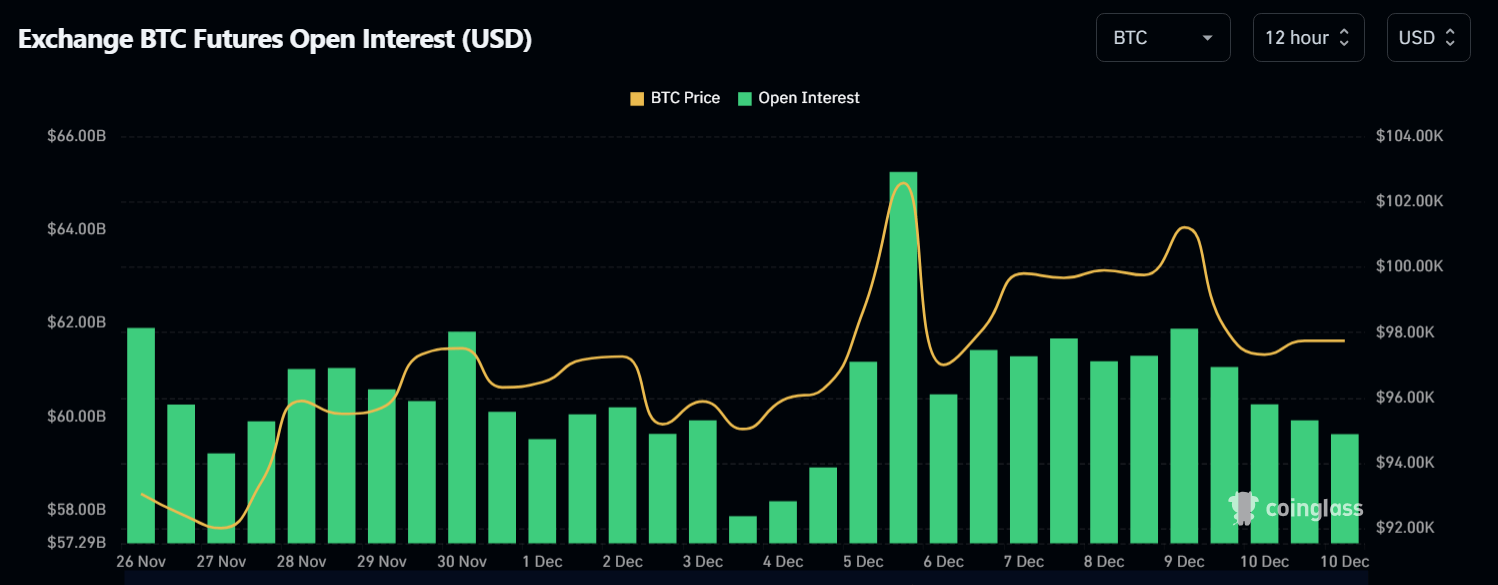

Open Curiosity trended decrease since yesterday as liquidations and taking revenue led to extra positions being closed. Nevertheless, a tell-tale signal of a resumption within the uptrend can be mounting open curiosity mixed with constructive value motion, indicating new positions being opened.

Ethereum’s value motion is comparable because the second largest cryptocurrency by market cap hovers round a help degree awaiting both initiative purchase motion to push costs increased or sellers to push value decrease.

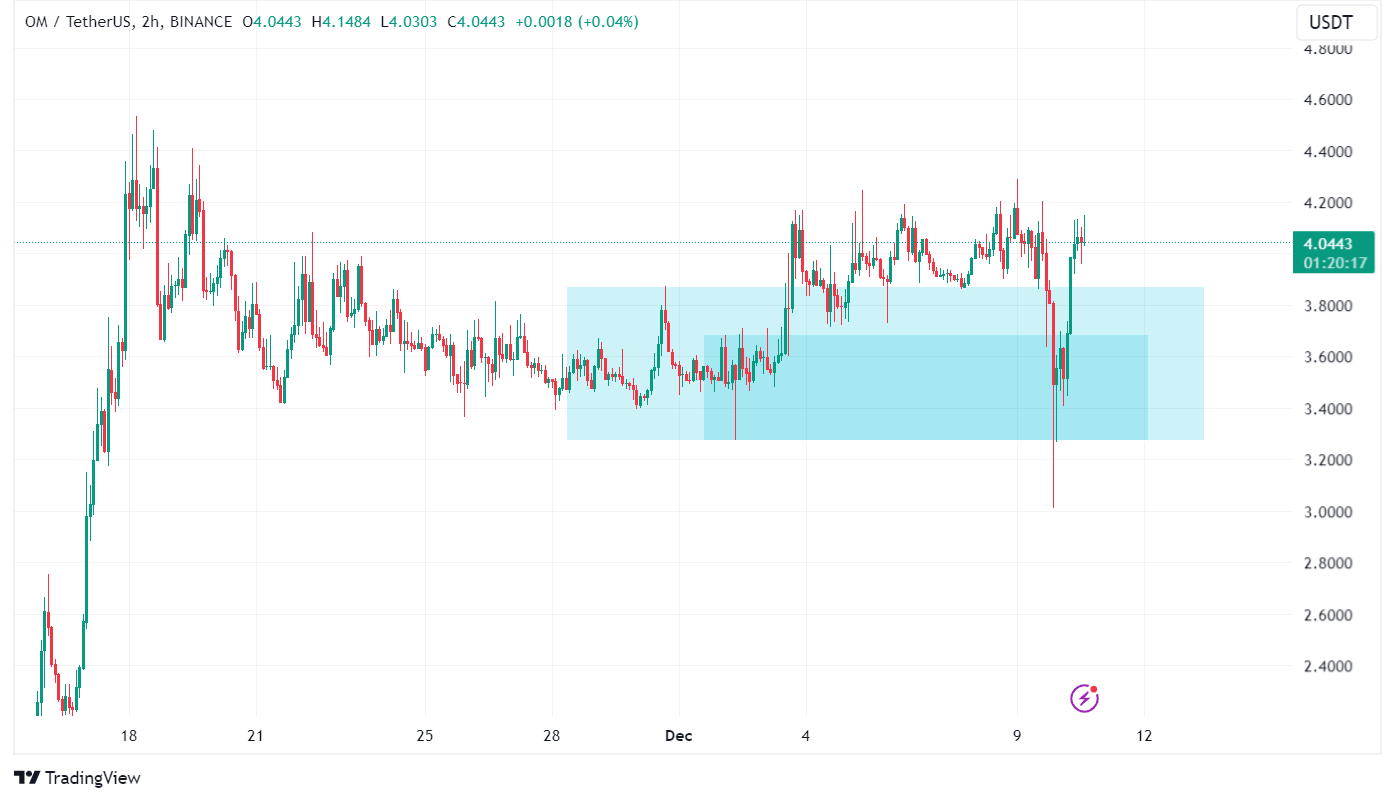

Elsewhere, some altcoins have nearly fully shaken off yesterday’s stoop, logging double-digit each day beneficial properties as of writing. Mantra is a superb instance of this as its value has climbed 14.11% since yesterday’s shut as of writing.

Spot crypto ETF inflows stay regular

Yesterday’s stoop isn’t indicative of a wider bearish sentiment as inflows into US crypto spot ETFs stay constructive. US spot Bitcoin ETFs recorded $2.77 billion in inflows final week and $483.60 million yesterday.

Ethereum ETFs adopted the same sample, recording weekly inflows of $836.8 million and $149.80 million yesterday.

Bitcoin trades at $97,900 as at publishing whereas Ethereum trades at $3,600.