- Curve’s 3pool and Uniswap V3 USDT pool expertise huge selloffs as merchants dump the stablecoin.

- A Kaiko report signifies that the current selloffs haven’t any clear catalyst, elevating questions.

- The report additionally finds no proof supporting a declare by Tether’s CTO that the dump may have been foul play.

Amid the current market slowdown, USDT continues to face huge sell-offs on main crypto alternate platforms. Notably, Curve’s 3pool and Uniswap V3 have been majorly affected as merchants ditch the main stablecoin.

The USDT dump, which began in July, noticed a selloff of over $100m of USDT on Uniswap. Despite the fact that the stress eased off in the direction of the top of July, it has since picked again up. Since final weekend, the alternate’s USDT pool has turn into imbalanced as its USDT swimming pools proceed to undergo huge depletion.

Equally, Curve has seen a selloff of about $35 million value of USDT because the begin of the month. Consequently, the Curve’s pool is closely imbalanced, holding 60% USDT.

A Kaiko report signifies that there isn’t a obvious bearish catalyst for the questionable USDT dump, an argument which is supported by the large Q2 revenues just lately reported by Tether. Nevertheless, Tether’s CTO claims the selloffs may have been foul play and “intently timed” with Binance’s itemizing of FDUSD, in response to the report.

The FDUSD stablecoin issued by Hong Kong-based First Digital was listed on Binance on July twenty sixth. Nevertheless, regardless of the claims by Tether’s CEO, the Kaiko report claims there isn’t a proof to hyperlink FDUSD’s Binance itemizing and USDT selloffs.

Moreover, the report reveals that FDUSD quantity had struggled to take off regardless of its Binance itemizing. Likewise, FDUSD being listed with zero-fee buying and selling pairs doesn’t appear to have positively affected the token’s value, which is shocking. In keeping with the report, the low buying and selling quantity reveals merchants have little curiosity within the stablecoin.

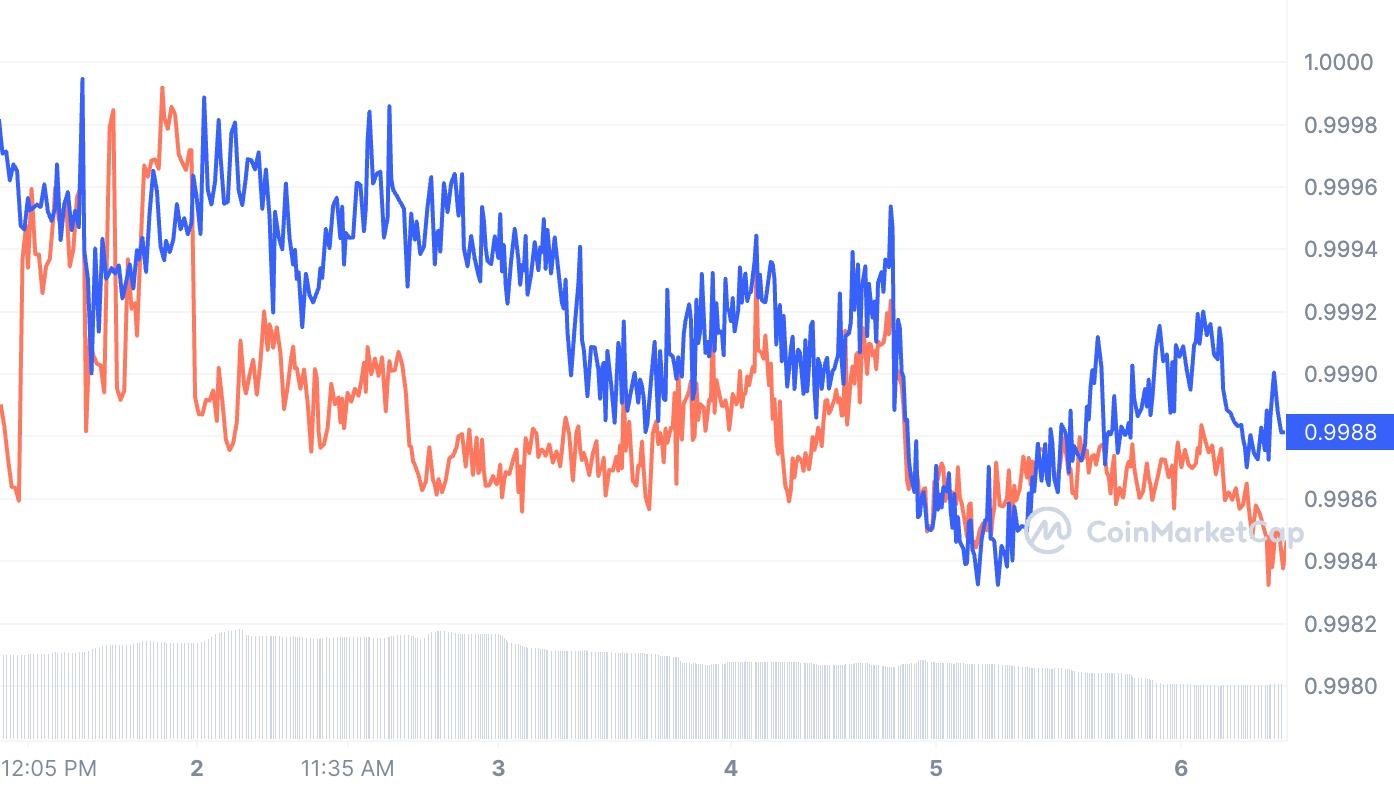

Because of the large selloffs, USDT has depegged barely from the US Greenback in current days on main exchanges. Knowledge from CoinMarketCap present that the stablecoin is at present priced at $0.9987, a 0.10% decline previously seven days. Likewise, FDUSD is promoting at $0.9994, a 0.06% decline in the identical interval.