Circle’s USD Coin (USDC) stablecoin has crossed the $16 trillion mark in complete cumulative quantity.

Whereas this quantity falls wanting conventional monetary powerhouses like Visa, which processed over $12 trillion in funds simply final yr, it highlights the outstanding progress of stablecoins. Regardless of their comparatively brief existence, stablecoins have shortly established themselves as key gamers within the world monetary market.

Stablecoins play an important function within the crypto ecosystem. They facilitate the sleek switch of funds, help seamless buying and selling between tokens, and allow funds, particularly for cross-border transactions.

Launched in 2018, USDC is the second-largest stablecoin by market capitalization, with $34.6 billion at present in circulation. Circle has strategically positioned USDC as a extra regulatory-compliant stablecoin, differentiating it from rivals like USDT.

This strategy has contributed to USDC’s dominance in transactions this yr, surpassing Tether’s USDT regardless of having a smaller circulating provide. In keeping with Artemis, USDC now accounts for roughly 50% of the full stablecoin transaction quantity.

Solana fuelling USDC’s progress

USDC’s transaction quantity is primarily pushed by the Solana blockchain, which holds greater than three-quarters of the stablecoin market share. Knowledge from DeFiLlama signifies that USDC makes up about 65% of Solana’s $3.98 billion stablecoin provide.

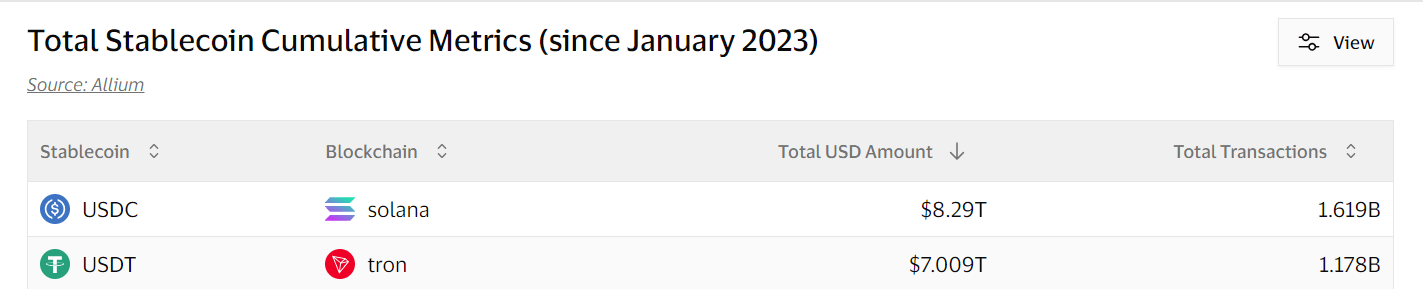

A stablecoin dashboard created by Visa Inc., in collaboration with Allium Labs, reveals that USDC’s transaction quantity on Solana has soared to roughly $8.29 trillion because the starting of final yr. Its nearest rival, USDT on TRON, noticed a quantity of $7 trillion throughout the identical timeframe.

This progress isn’t stunning, given Solana’s recognition for its velocity and decrease transaction prices, which have attracted curiosity from conventional monetary gamers like PayPal.

The current surge in memecoin buying and selling and DeFi actions on Solana has additional propelled its rise. Over the previous few months, the market has even seen cases when buying and selling exercise on Solana surpassed Ethereum’s.