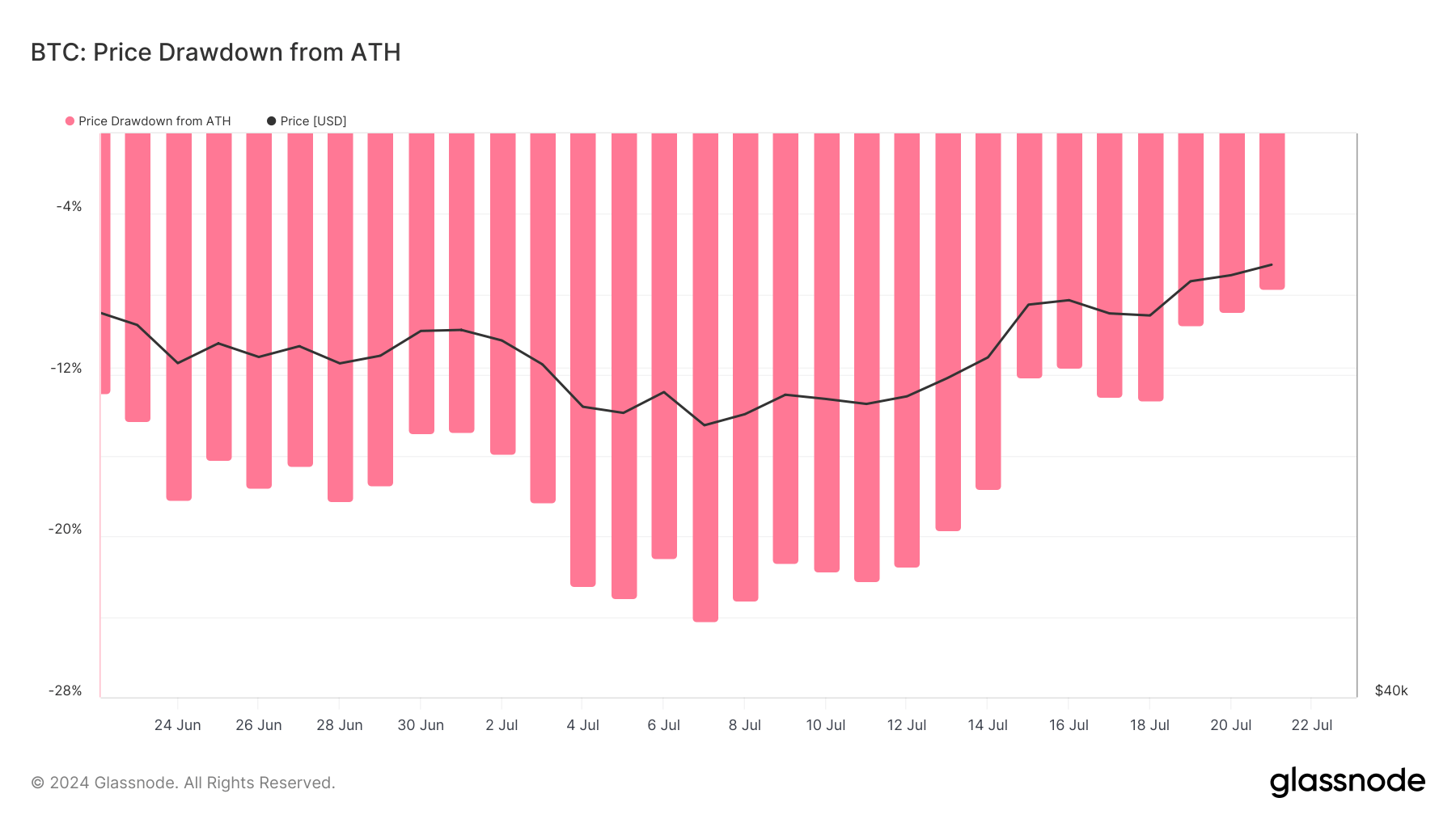

Bitcoin crossed the $68,000 mark in the course of the weekend after President Joe Biden introduced his exit from the presidential race for the upcoming elections in November 2024.

The occasion confirmed simply how delicate the worldwide crypto market is to US political occasions. The discrepancy between America’s affect on the worldwide crypto market and its share of the worldwide market turns into evident when analyzing buying and selling volumes.

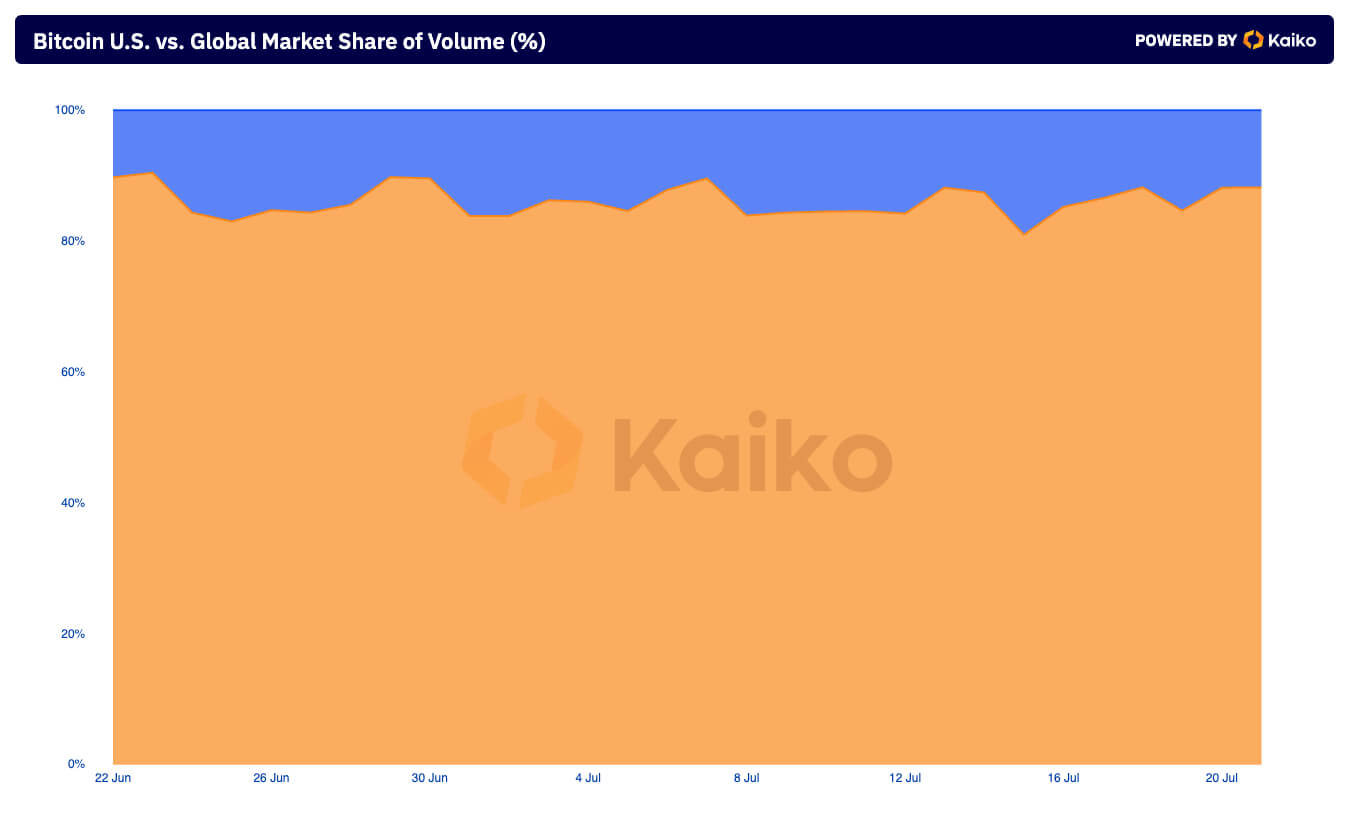

Kaiko knowledge reveals that the market share of US exchanges when it comes to buying and selling quantity at present stands at 11.79%. World exchanges, then again, dominate with 88.12%.

The disparity reveals that the majority crypto buying and selling exercise on centralized exchanges occurs exterior the US. Whereas quite a few causes have contributed to this discrepancy, the regulatory setting within the US stands out as essentially the most vital issue.

The regulatory panorama within the nation is way harsher in comparison with different areas. The SEC’s strict oversight and enforcement actions have led to cautious participation by retail and institutional traders. US-based exchanges have needed to implement rigorous compliance measures that differ from state to state, deterring a big portion of retail merchants.

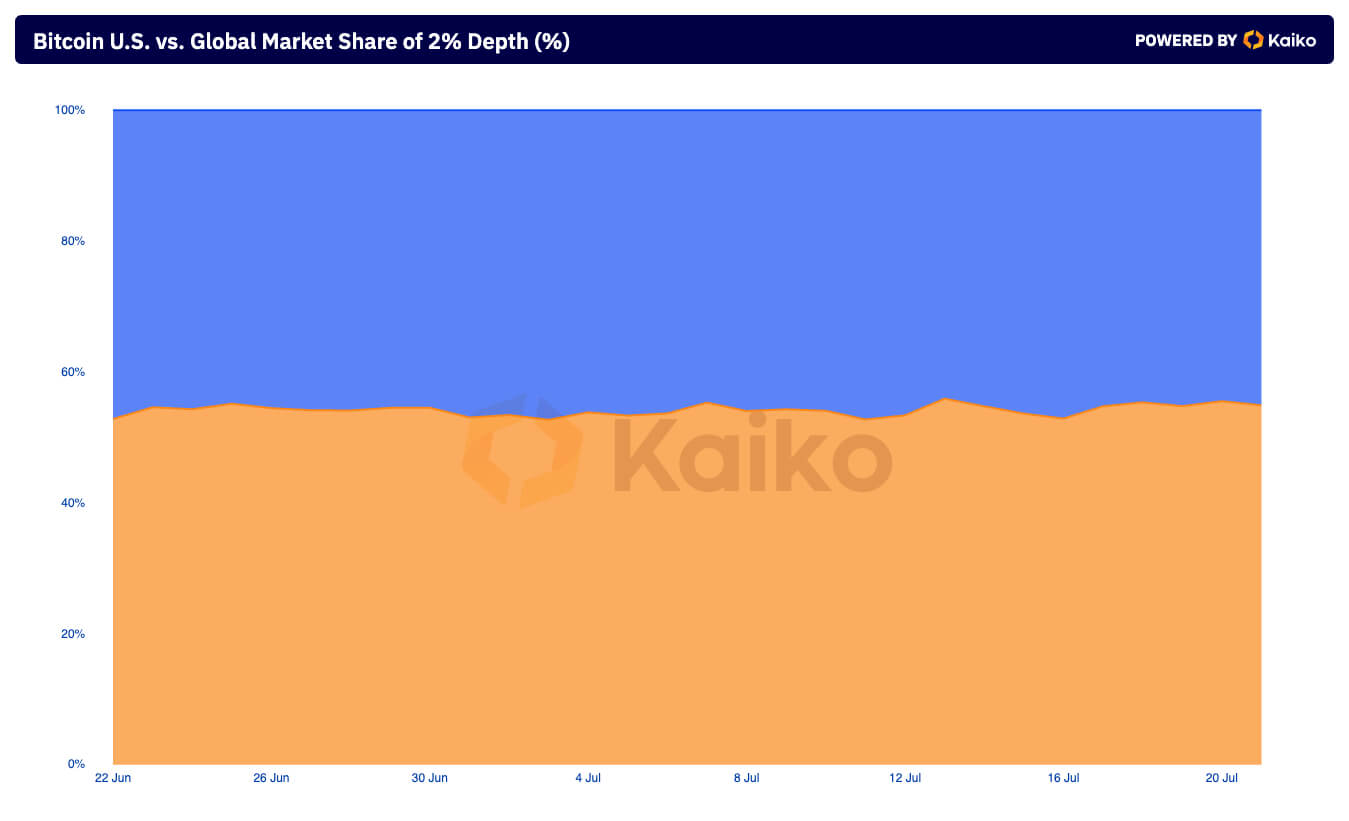

Nonetheless, regardless of the low quantity share, the US accounts for nearly half of the market’s liquidity. Kaiko knowledge reveals that US-based exchanges account for a considerable 45.09% of the worldwide market depth on the 2% stage.

Market depth reveals the market’s common potential to maintain comparatively giant orders with out considerably impacting worth. This is a crucial metric because it acts as an indicator of total liquidity. A deep market with substantial orders throughout the 2% vary reveals that enormous orders can happen with out inflicting vital worth fluctuations. This excessive liquidity then helps scale back worth volatility, which is especially necessary for institutional traders who take care of giant purchase and promote orders.

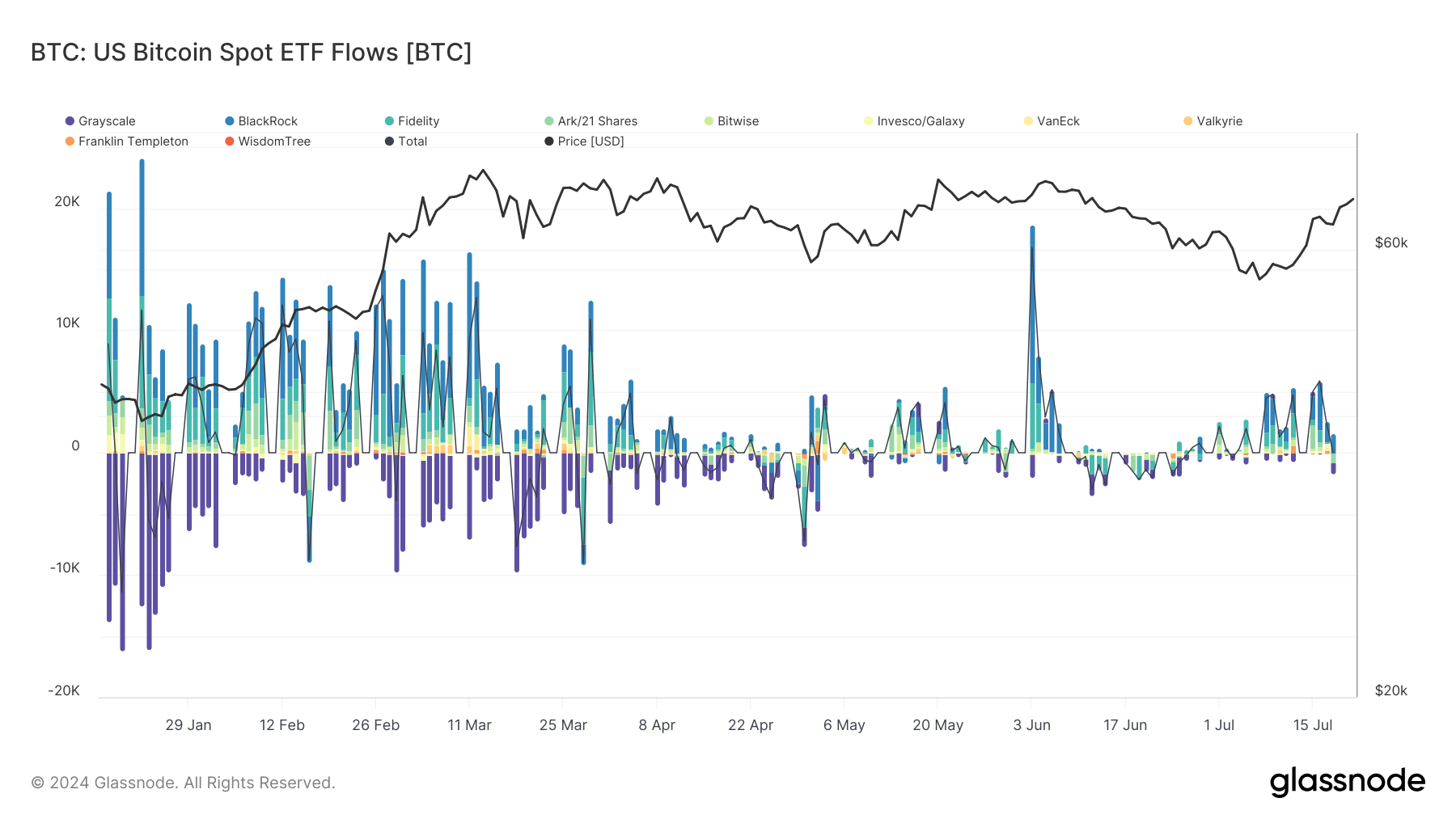

Excessive liquidity within the US may be attributed to the massive presence of institutional traders. Their presence has elevated drastically for the reason that launch of spot Bitcoin ETFs this yr, as these merchandise contribute to larger liquidity and deeper order books on exchanges the place these ETFs are traded or tracked.

The creation and redemption processes of spot Bitcoin ETFs contain large-scale transactions within the underlying Bitcoin market. When new ETF shares are created, approved individuals (often exchanges like Coinbase) buy the equal quantity of Bitcoin from the market, contributing to market depth. Conversely, when ETF shares are redeemed, the underlying Bitcoin is offered, additional including to the liquidity and depth of the market.

The sheer dimension of this market is why information coming from the US can transfer Bitcoin’s worth lower than 8% away from its ATH regardless of accounting for such a small share of quantity.

The put up US strikes world markets due to liquidity, not quantity appeared first on StarCrypto.