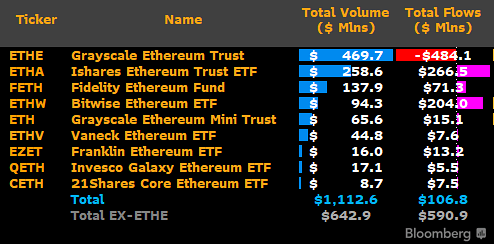

- The US spot Ethereum exchange-traded funds market noticed $106.7 million in internet inflows on their first buying and selling.

- BlackRock’s ETHA led with $266.5 million in inflows, whereas Grayscale’s ETHE recorded probably the most outflows.

Having acquired the nod from the Securities and Trade Fee following remaining regulatory filings, 9 spot ETFs went stay on July 23.

Collectively, they raked in additional than $1 billion in buying and selling quantity as BlackRock led inflows with its iShares Ethereum Belief fund. As anticipated, Grayscale’s Ethereum Belief recorded important outflows.

ETH spot ETFs see $106 million in internet inflows

In response to market knowledge, BlackRock’s ETHA registered most demand with traders scooping $266.5 million on day one.

Meawhile, Bitwise had the second most inflows with $204 million for its ETHW product. Constancy noticed the third highest inflows for its FETH, with $71.3 million recorded on the ETFs buying and selling debut.

Whereas Grayscale’s ETHE noticed outflows of $484.1 million, the agency’s Ethereum Mini Belief ETH recorded a modest $15.1 million in inflows. The opposite 4 funds noticed $13.2 million for Franklin Templeton’s EZET, $7.6 million for VanEck’s ETHV, $7.5 million for 21Shares’ CETH and $5.5 million for Invesco Galaxy’s QETH.

Buying and selling quantity surpassed $1 billion

The ETFs noticed a mixed complete quantity of over $1.1 billion, knowledge that Bloomberg ETF analyst James Seyffart shared confirmed. Excluding ETH buying and selling quantity of over $469 million, the overall for the opposite eight that every one noticed inflows involves round $642 million.

In the meantime, complete inflows minus the ETH outflows reached over $590.9 million.

Commenting on the general efficiency of the US Ethereum spot ETFs, Seyffart known as it a “very stable first day,”

In response to knowledge from SoSoValue, the overall internet property within the ETFs was $10.24 billion as of July 23. The worth accounted for about 2.45% of the Ethereum market cap, which stood at $413 billion on the time of writing.