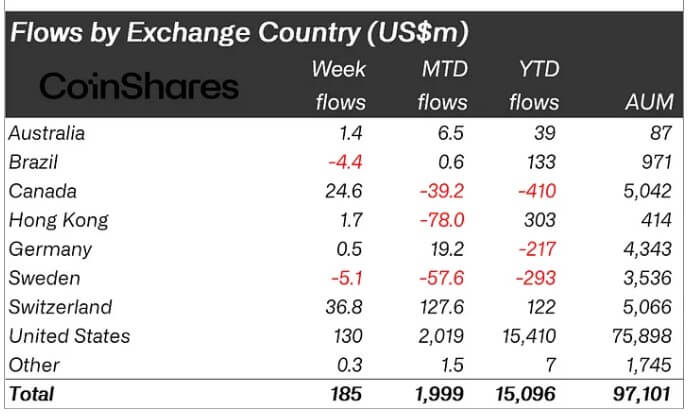

World digital asset funding merchandise recorded their fourth consecutive week of inflows, totaling $185 million, in response to CoinShares’ weekly report.

The report acknowledged that these inflows pushed Might’s whole to $2 billion, bringing the year-to-date inflows to over $15 billion for the primary time. Nevertheless, buying and selling quantity dropped to $8 billion from $13 billion the earlier week.

Bitcoin, US leads

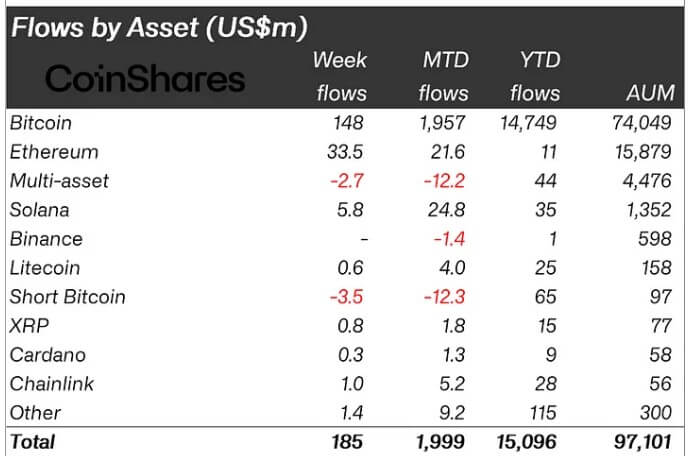

Traders’ curiosity in BTC stays largely constructive as Bitcoin continues to drive the flows in crypto funding merchandise. Through the previous week, the flagship digital asset recorded inflows totaling $148 million, whereas brief BTC merchandise noticed outflows of $3.5 million.

Regionally, the US maintained its lead with $130 million in inflows regardless of a $260 million outflow from Grayscale’s GBTC. Through the interval, spot Bitcoin ETFs from BlackRock and Constancy recorded important inflows totaling $475 million.

In the meantime, Switzerland noticed its second-largest inflows of the 12 months, amounting to $36 million. Canada, recovering from the earlier weeks’ outflows, contributed $25 million in inflows regardless of a web month-to-month outflow of $39 million.

Remarkably, Hong Kong has been in a position to stem its outflow pattern, recording modest inflows of $1.7 million final week.

Ethereum ETF approval turns investor sentiment

In the meantime, crypto-products associated to Ethereum have seen their second consecutive week of inflows, with traders pouring $34.5 million into these monetary devices. Final week, ETH noticed its highest inflows at $36 million since March.

CoinShares attributed this turnaround to the Securities and Change Fee’s (SEC) resolution to approve the 19b-4 filings of a number of spot Ethereum ETF merchandise. Earlier than this approval, ETH was on a 10-week run of outflows totaling $200 million.

A number of consultants have predicted that the Ethereum ETFs may start buying and selling as early as July, however Bloomberg ETF analyst James Seyffart mentioned there isn’t any definitive timeline for the launch as a result of the monetary regulator has but to approve the issuers’ S-1 filings.

In the meantime, the constructive sentiments in Ethereum additionally prolonged investments into different large-cap altcoins like Solana, which noticed $5.8 million in inflows. Different belongings like Chainlink, XRP, and Litecoin recorded minor inflows of lower than $1 million.