Bitcoin’s rally previous the $34,000 mark has additionally triggered an identical rally within the DeFi sector. Virtually all cash have witnessed a notable value enhance and rising exercise since Bitcoin’s rally, with Solana experiencing a major resurgence. Acknowledged for its environment friendly transaction speeds, Solana has emerged as a pivotal participant within the DeFi market.

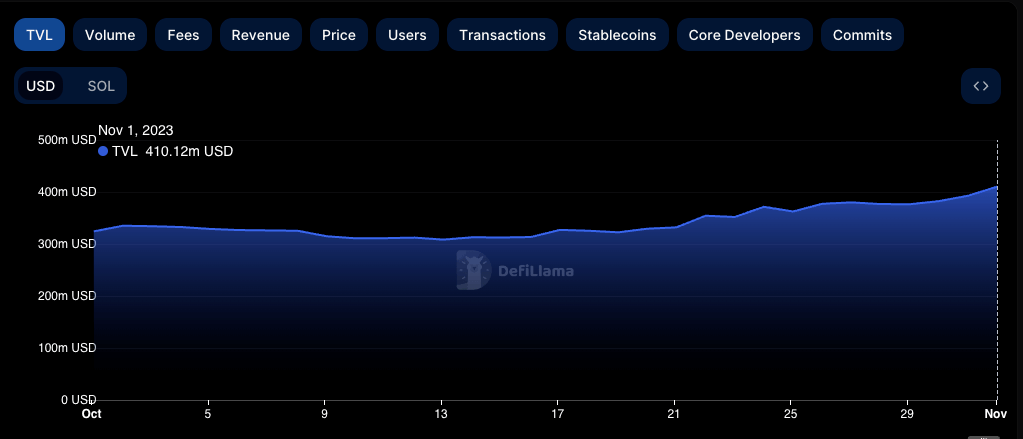

Information from DefiLlama confirmed a major surge in Solana’s TVL. On Oct. 1, the TVL stood at $324.27 million, which rose to $410.12 million by Nov. 1, marking a 26.5% enhance.

Complete worth locked (TVL) refers back to the complete quantity of property presently being held in a blockchain protocol. It’s a metric that signifies the liquidity and recognition of a DeFi platform. Put merely, the next TVL means extra individuals are utilizing that individual platform, demonstrating utility.

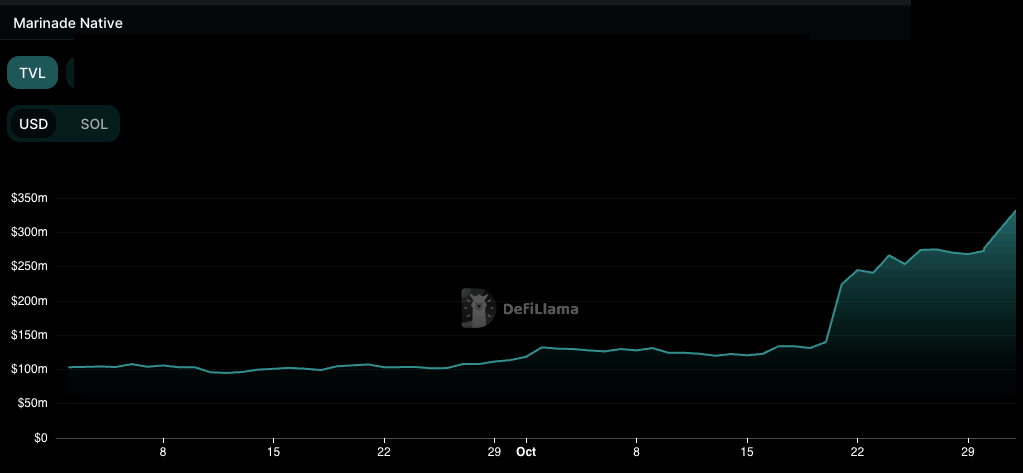

A lot of this TVL development may be attributed to Marinade Finance, a staking protocol launched earlier this yr on Solana. Marinade noticed a 180% enhance in TVL in October, rising from $118.47 million on Oct. 1 to $331.8 million on Nov. 1.

Marinade Finance gives a pretty staking Annual Share Yield (APY) of 8.81%. APY is the actual price of return earned on an funding, contemplating the impact of compounding curiosity. It represents the potential earnings a consumer can anticipate over a yr from staking their property. Moreover, Marinade’s rising recognition is clear, with 74,873 accounts utilizing its providers as of Nov. 1.

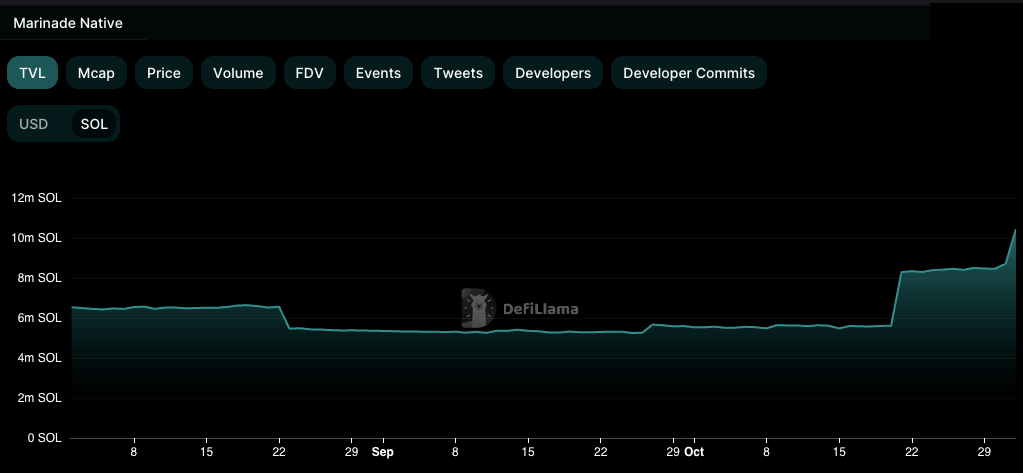

When it comes to SOL denomination, Marinade’s TVL skilled a outstanding surge in October, escalating from 5.54 million SOL on Oct. 1 to 10.45 million SOL by Nov. 1, practically doubling its worth.

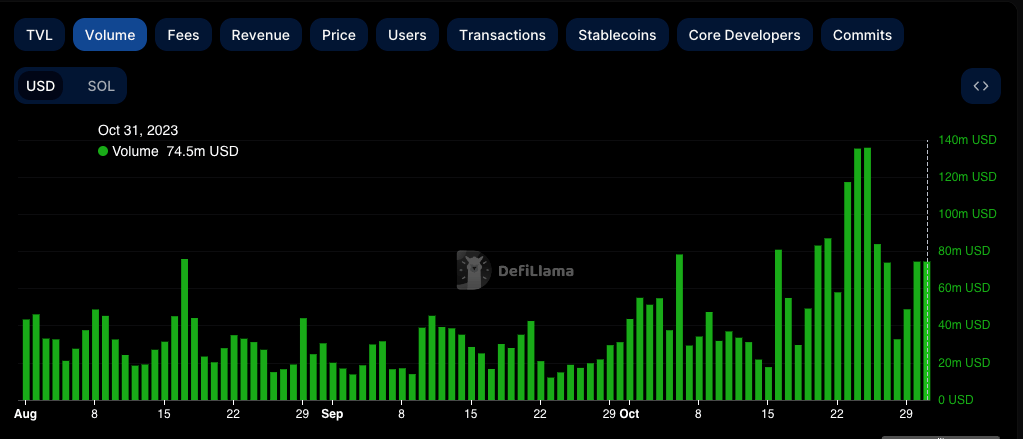

Concerning buying and selling quantity, Solana noticed a considerable rise from $43.6 million on Oct. 1 to $135.8 million on Oct. 25, marking a 211% enhance. This was the 4th highest quantity for the reason that starting of the yr.

Solana’s native token, SOL, additionally witnessed spectacular development. The value of SOL elevated from $21.4 on Oct. 1 to $38.5 by Nov. 1, marking an 80% enhance. This value was the best for the reason that collapse of FTX and the best it has been in 2023.

Moreover, Solana noticed $24 million in inflows within the final week of October. This influx was considerably larger than different altcoins and Ethereum, emphasizing the rising belief and funding in Solana’s ecosystem.

Whereas the info showcases Solana’s spectacular strides within the DeFi panorama, it’s essential to strategy these figures with a level of skepticism. The numerous development in TVL, primarily pushed by Marinade Finance, does spotlight Solana’s potential, however it additionally raises questions concerning the platform’s reliance on just a few main protocols.

The swift enhance in TVL denominated in SOL inside a month is noteworthy, but such speedy ascents usually warrant scrutiny for sustainability within the unstable world of crypto. The rise in buying and selling quantity and SOL’s value does mirror rising curiosity, however whether or not it is a signal of long-term confidence or a short-lived development stays to be seen.

Whereas Bitcoin’s rally has undoubtedly boosted the whole DeFi sector, together with Solana, it’s important to discern between real development and mere market euphoria. Because the DeFi narrative unfolds, Solana’s true place and lasting affect might be decided by its capacity to innovate, adapt, and reply to market challenges.

The put up Unpacking Solana’s surge within the shadow of Bitcoin rally appeared first on starcrypto.