- Uniswap value reached highs of $10.99 on Could 25, rising greater than 20% in 24 hours.

- UNI gained amid whale exercise, Ethereum ecosystem developments and Uniswap Labs’ response to SEC’s Wells Discover.

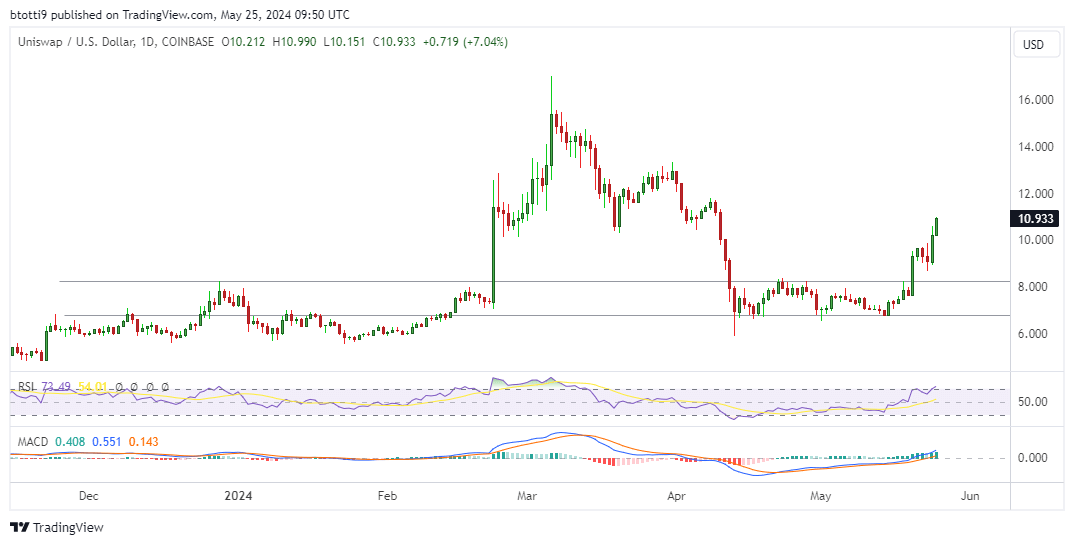

- The technical image additionally hints at a breakout that might push UNI value to $15.40 and in direction of $2.

Uniswap value jumped greater than 20% in 24 hours to commerce at $10.99, its highest degree since early April.

A bullish outlook suggests elevated shopping for strain may push UNI in direction of highs of $15.40 reached in March.

Uniswap value and the ETH ecosystem

UNI is the native token of the main DEX platform, possible one of many prime beta performs across the spot Ethereum ETF approval.

On Friday, Uniswap value defied marketwide consolidation, with the worth of Ethereum (ETH) hovering above $3,700. As most altcoins regarded to bounce off key assist ranges, UNI value rose greater than 20% to the touch a multi-week peak of $10.95.

This comes as whales more and more withdraw UNI from exchanges. Based on on-chain particulars shared by Lookonchain on X, one such whale withdrew $1.96 million in UNI from Binance as value rose.

Uniswap’s upside momentum has additionally strengthened amid the revealing of ERC-7683. This new token normal is a collaboration between Uniswap Labs and Throughout Protocol and goals at streamlining cross-chain buying and selling through a “unified framework for cross-chain intents techniques.”

UNI surges after Uniswap response to SEC

Breaching the important $10 mark additionally got here amid a rising bullish sentiment round Uniswap’s regulatory outlook.

Earlier this week, Uniswap Labs’ reiterated its readiness to battle the SEC’s potential lawsuit following a current Wells Discover.

Based on Uniswap, the SEC is “unsuitable” in its assertions that the DEX platform is an unregistered securities change and broker-dealer. The allegation that UNI is a safety can be unsuitable, with SEC’s theories round it “weak” Uniswap wrote in a response to the regulator.

Uniswap value chart

Uniswap’s surge prior to now 24 hours sees UNI breakout of a consolidation section that had costs capped beneath the $8 degree.

Elevated whale exercise and the present projections for the ETH ecosystem favour UNI bulls.

The technical image additionally helps an upside continuation. On this case, the RSI and MACD indicators on the day by day chart counsel bulls are in management.

If this outlook holds, UNI value may eye the important thing resistance ranges at $12.96 and $15.40. An essential brief time period goal lies at $2