Most crypto buying and selling quantity has traditionally come from outdoors the U.S., with Asia being the biggest cryptocurrency market. Nevertheless, there was a notable shift on this dynamic prior to now a number of months, with the U.S. returning to its place because the dominant power within the Bitcoin market.

This shift is obvious when analyzing Bitcoin’s worth and provide distribution adjustments throughout Asia and the U.S.

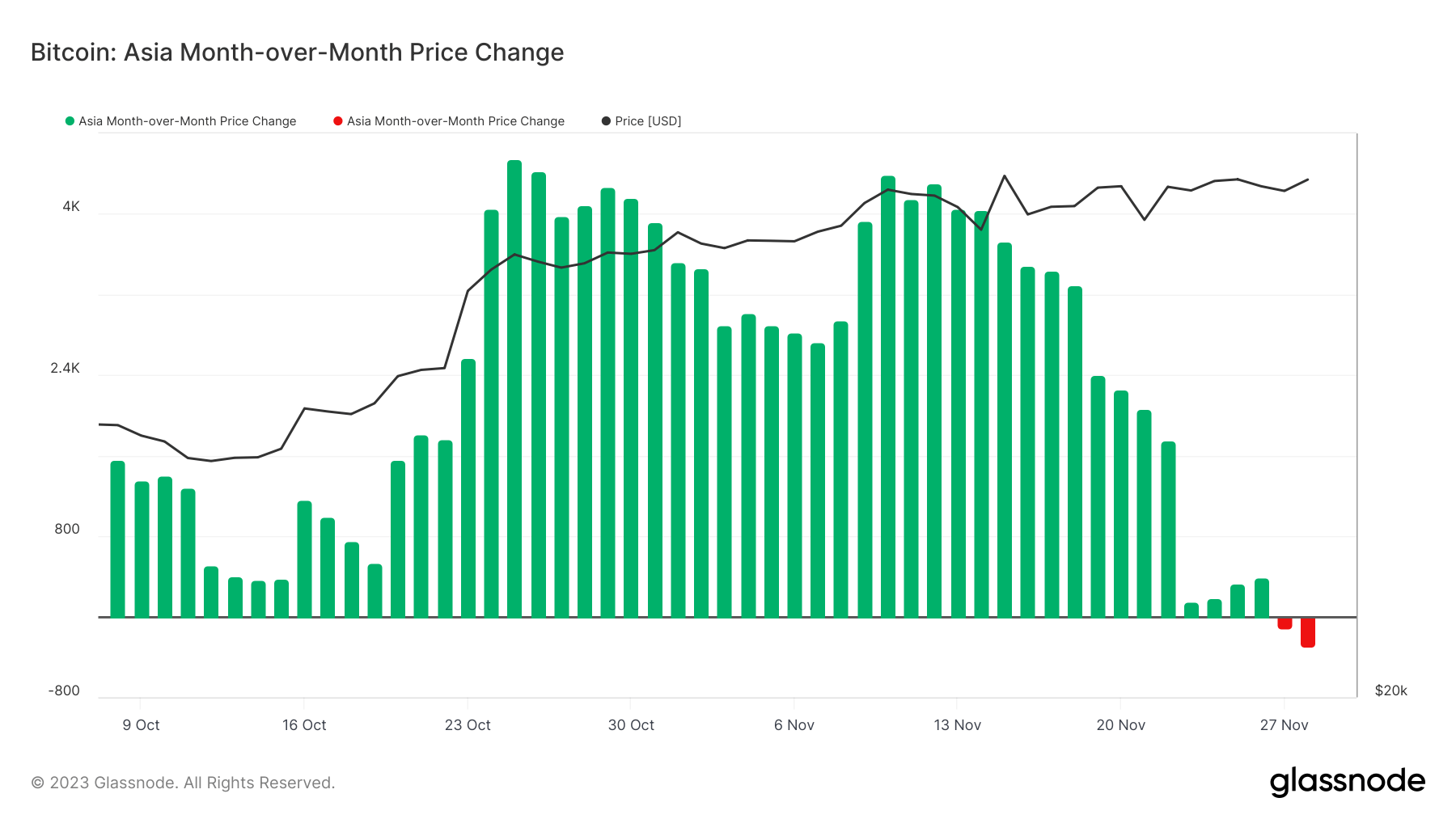

Wanting on the month-over-month worth change of Bitcoin throughout Asian working hours exhibits the regional fluctuations in Bitcoin’s worth, reflecting the market’s response to numerous financial and political stimuli particular to Asia. The traits noticed right here point out the extent of market exercise and investor sentiment throughout the area, providing a glimpse into the regional affect on Bitcoin’s international pricing.

Information from Glassnode has proven a pointy lower within the 30-day change in Bitcoin’s worth set throughout Asian working hours in November.

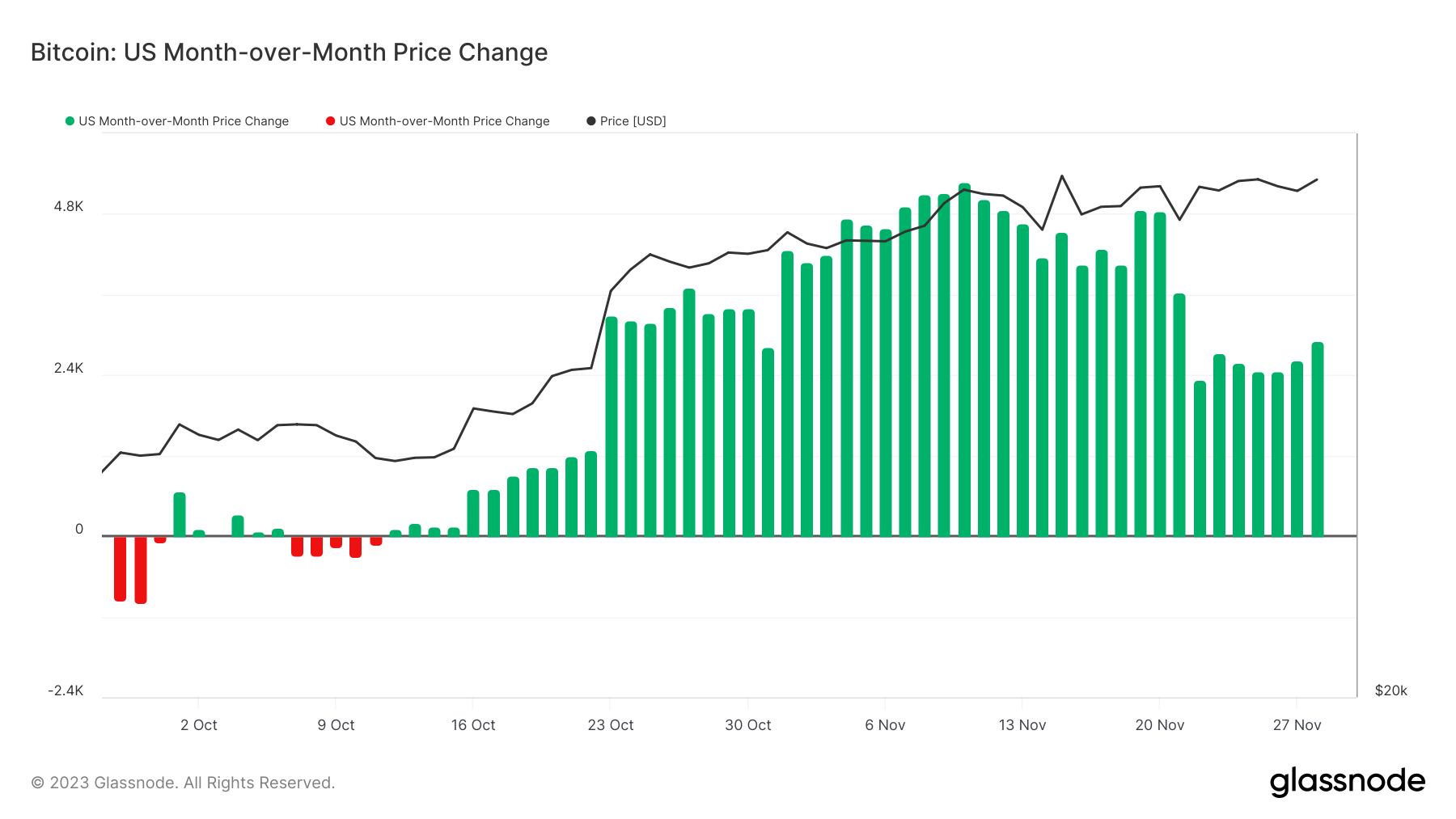

The month-over-month worth change throughout U.S. working hours contrasts with the Asian market knowledge, revealing a unique market conduct and investor perspective. The U.S. market exhibits a big affect over Bitcoin’s worth regardless of variations in buying and selling volumes and market participation in comparison with its Asian counterpart.

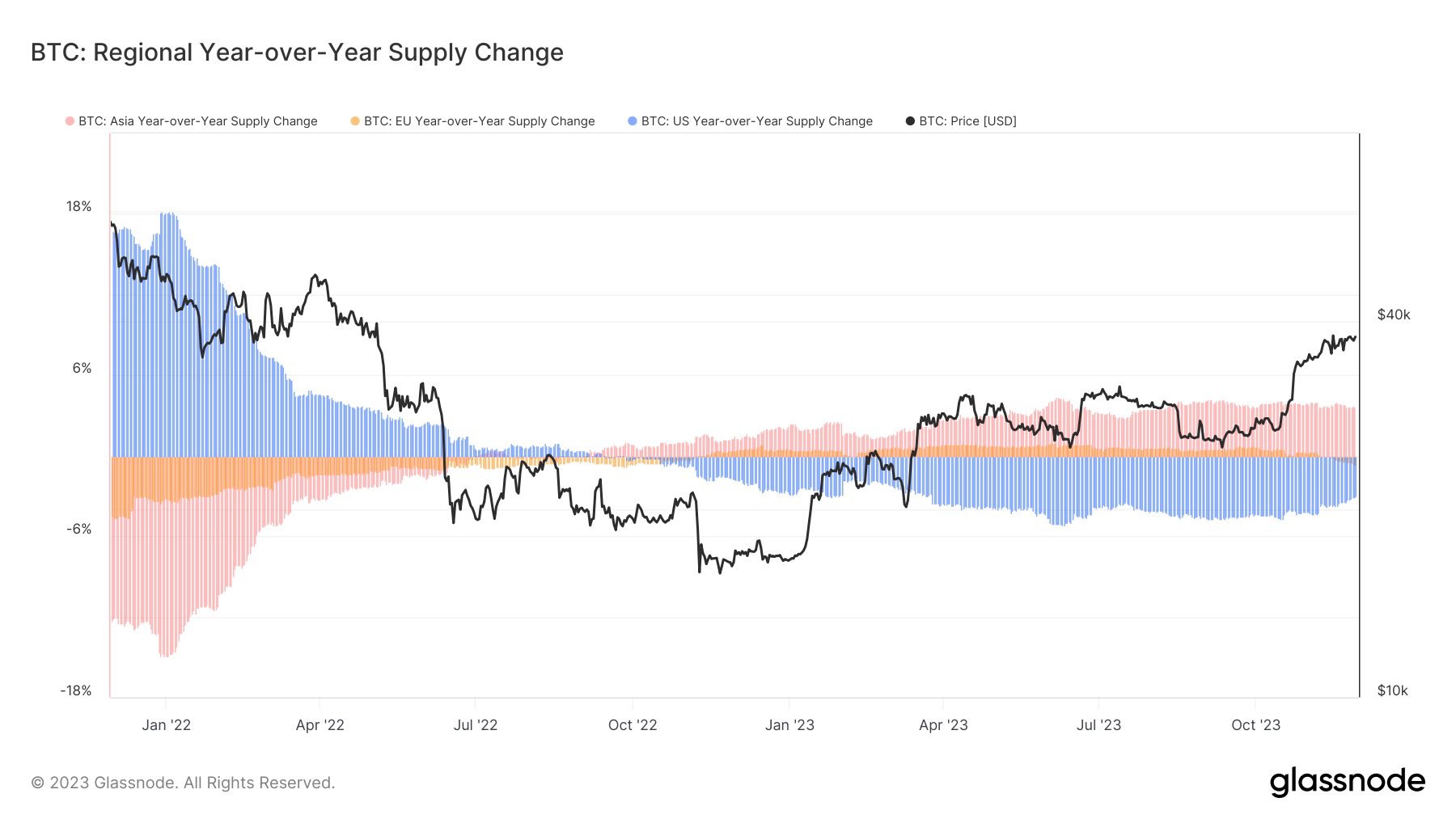

The year-over-year change in Bitcoin’s provide throughout totally different areas is essential in understanding the shifts in regional dominance or decline regarding Bitcoin holdings. A key remark from this dataset is the development in U.S. holdings, which have been lowering since September 2022. In distinction, the provision held by buyers in Asia has been rising, recording a 3.7% year-over-year development as of Nov. 28.

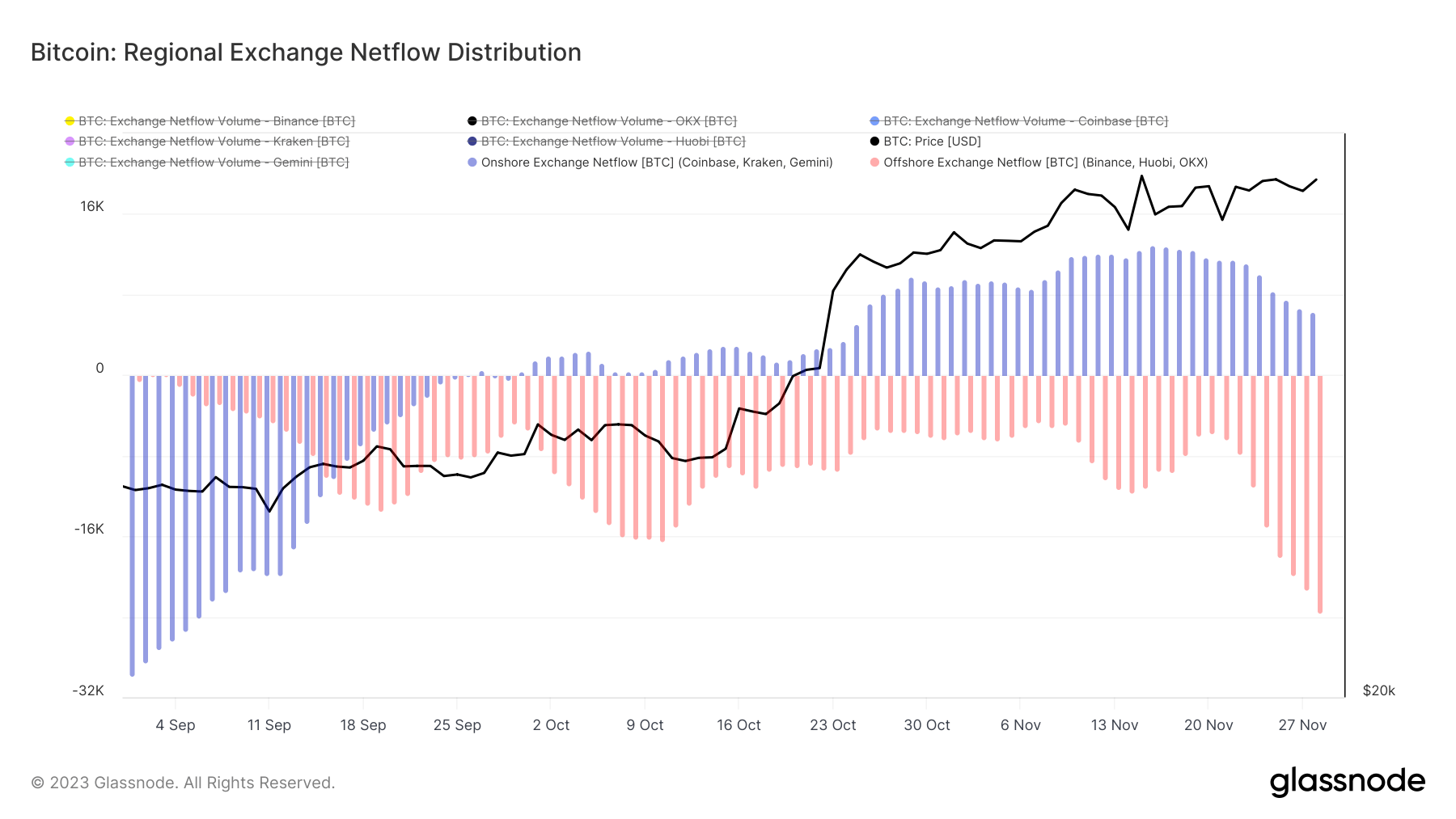

Furthermore, the web movement of Bitcoin into and out of exchanges, each within the U.S. and offshore, is a powerful indicator of investor sentiment and market exercise. As an example, a web influx would possibly recommend a bullish market sentiment, with buyers shopping for or holding Bitcoin. In distinction, a web outflow might point out bearish sentiment, with promoting or a insecurity prevailing.

Up to now two months, U.S. exchanges Coinbase, Kraken, and Gemini have seen their inflows improve drastically. Offshore exchanges Binance, Huobi, and OKX have all registered web outflows for the reason that starting of September.

Regardless of a lower within the year-over-year provide of Bitcoin within the U.S., the nation’s affect over Bitcoin’s worth stays pronounced. This phenomenon means that the remaining Bitcoin provide within the U.S. is doubtlessly managed by influential market gamers or establishments able to considerably impacting market costs. This paradoxical development underscores the U.S. market’s vital position within the Bitcoin ecosystem. The lowering provide could possibly be attributed to numerous components, together with regulatory environments and strategic funding selections. Concurrently, the rising worth affect factors to a market the place decision-making and market energy are concentrated amongst a restricted variety of U.S.-based buyers or establishments.

The put up U.S. reclaims dominance in Bitcoin market regardless of provide shift appeared first on StarCrypto.