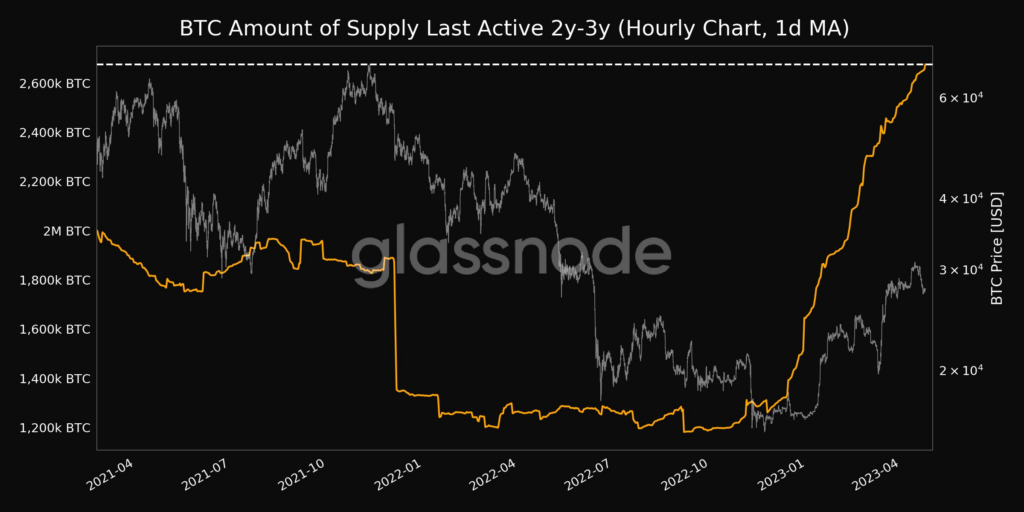

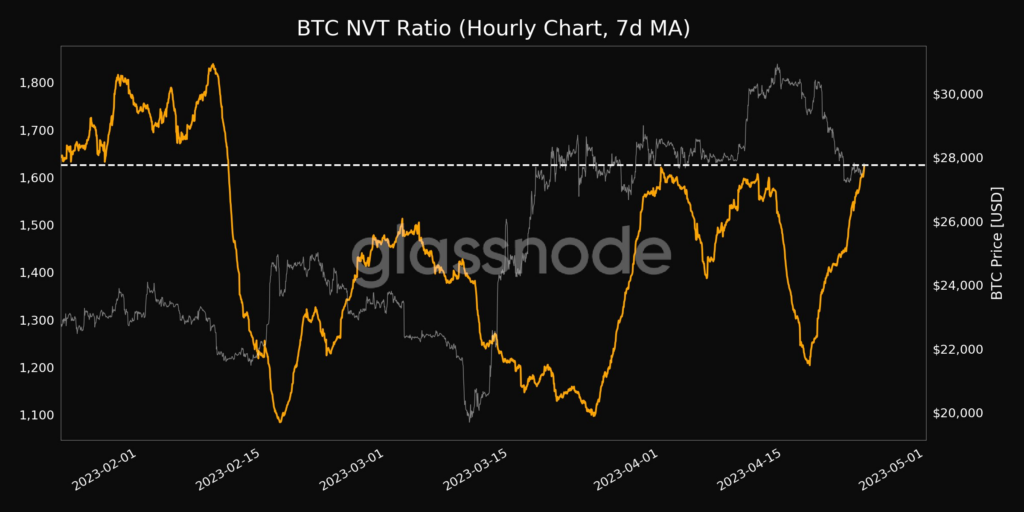

- Glassnode shared that two on-chain metrics for BTC have reached new highs not too long ago.

- BTC’s Quantity of Provide Final Lively 2y-3y (1d MA) has reached a 2-year excessive of two,675,323.424 BTC.

- BTC is at present buying and selling arms at $27,462.55 after a 1.03% value drop.

The on-chain evaluation platform glassnode alerts (@glassnodealerts) took to Twitter this morning to share some current on-chain metrics for the crypto market chief Bitcoin (BTC). Based on these tweets, two of BTC’s metrics reached new highs not too long ago.

The primary put up by glassnode revealed that BTC’s Quantity of Provide Final Lively 2y-3y (1d MA) has reached a 2-year excessive of two,675,323.424 BTC. In the meantime, the second put up by the evaluation platform revealed that BTC’s NVT Ratio (7d MA) has simply reached a 1-month excessive of 1,625.697. The earlier 1-month excessive for BTC’s NVT Ratio was 1,620.904, and was noticed on the primary day of April 2023.

As well as, the crypto market monitoring web site CoinMarketCap signifies that BTC is at present buying and selling arms at $27,462.55 after a 1.03% value drop over the past 24 hours. Regardless of this, BTC was in a position to strengthen towards its competitor Ethereum (ETH) by roughly 0.49%.

This 24-hour efficiency from the crypto king pushed its weekly efficiency even additional into the purple. At press time, BTC is down greater than 8% over the past seven days. BTC’s 24-hour buying and selling quantity additionally at present stands at $14,258,856,974 after a greater than 7% enhance since yesterday.

The current value motion for BTC has introduced down its market cap to $531,670,140,785 at press time. However, BTC was nonetheless in a position to outperform the altcoin market over the past 24 hours, as its market dominance has elevated round 0.09% throughout this era.

Disclaimer: The views and opinions, in addition to all the knowledge shared on this value evaluation, are revealed in good religion. Readers should do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates won’t be held answerable for any direct or oblique injury or loss.