- TrueUSD will use Chainlink Proof of Reserve (PoR) in minting the TUSD stablecoin.

- It’s the first stablecoin to make use of Chainlink PoR in controlling the minting course of.

- The PoR will examine the steadiness between the entire provide of TUSD and US {dollars} held in reserve.

TrueUSD has as we speak introduced that it is going to be utilizing Chainlink (LINK) Proof of Reserve (PoR) to safe the minting of its absolutely collateralized USD-backed stablecoin TUSD. The information comes after TrueUSD launched TCNH, a TRON-Primarily based stablecoin pegged to offshore Chinese language Yuan in December 2022.

This makes TrueUSD the primary stablecoin to programmatically management minting utilizing real-time on-chain verification of off-chain reserves. It is a paradigm shift in decentralization, transparency, and unbiased verification.

How the programmed minting course of will work

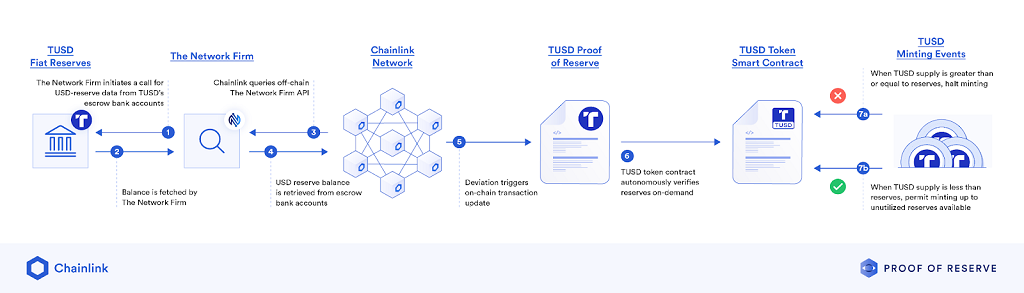

The TUSD reserve information is aggregated by The Community Agency LLP (TNF), which is an unbiased industry-specialized accounting agency within the US. TNF will mixture all reserve information of US {dollars} held at monetary establishments in real-time and serve that data on-chain by means of Chainlink’s oracle community. That is what’s known as proof of reserve.

TUSD good contract will then use this Proof of Reserve information feed to routinely examine whether or not the entire provide of TUSD would exceed the entire quantity of US {dollars} held in reserve earlier than a brand new stablecoin is minted.

The automated workflow is clear within the good contract code and supported by open unbiased information feeds thus affirming TUSD’s dedication to making sure the steadiness of the ecosystem and the redeemability of the underlying {dollars} for purchasers.

TUSD customers can really feel assured that they’ve an correct and clear supply of details about the reserves backing the TUSD stablecoin.

Commenting on the event, the co-founder of Chainlink Sergey Nazarov mentioned:

“We’re proud to assist TUSD in its efforts to carry new layers of transparency, danger administration, and safety to its stablecoin minting course of. With Chainlink Proof of Reserve, TUSD is ready to present higher ranges of assurance and confidence to its customers, and assist carry higher stability to stablecoins and the broader crypto {industry}.”