- TON dropped 11% to $5.12 amid Pavel Durov’s arrest, lowest since Might 1.

- Metcalfe valuation suggests TON is likely to be undervalued with sturdy community exercise.

- Technical indicators present bearish momentum, with potential for additional value decline.

Toncoin (TON) has skilled a decline in worth following the arrest of Telegram’s Founder and CEO, Pavel Durov, in France. On August 26, TON’s value dropped by 11%, closing at $5.12, the bottom degree recorded since Might 1. The decline raised questions concerning the forex’s future however can also current a powerful risk-reward scenario for buyers.

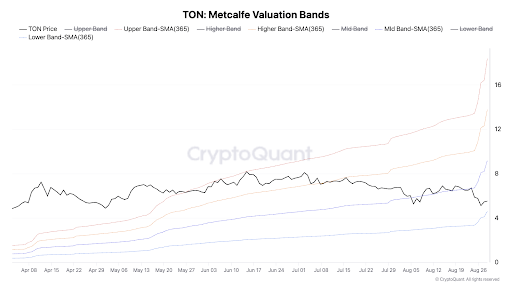

TON had beforehand reached an all-time excessive of $8.17 on June 14. Nevertheless, the latest fall to $5.12 marks a downturn for the forex. Even with this decline, the present value of $5.37 locations TON nearer to the decrease band of its Metcalfe valuation, which at present stands at $4.60. The higher Metcalfe valuation band, in the meantime, is about at $18.40.

The Metcalfe valuation bands, calculated primarily based on the variety of energetic distinctive addresses on the TON community, present a strategy to assess TON’s worth in relation to its consumer base.

Curiously, the TON community noticed a document excessive of 1.93 million energetic addresses on August 28, indicating sturdy consumer engagement even with the latest value decline.

With TON nearing the decrease Metcalfe valuation band, it seems the forex could also be undervalued in comparison with its community’s exercise, probably offering a positive funding alternative.

Nevertheless, Toncoin’s value actions present that bearish sentiment is extra widespread. The value momentum indicator, Transferring Common Convergence Divergence (MACD), is beneath the sign line and steadily heading downwards.

This downward motion follows the downtrend of the MACD histogram, which strengthens the bearish argument as the amount of the bearish bars of the MACD histogram will increase.

Moreover, the Relative Energy Index (RSI), which measures the velocity and alter of value actions, is at present close to the 40 mark. This place means that TON is neither oversold nor overbought however is leaning towards a weaker market place.

The mixture of those indicators factors to the probability of continued downward strain on TON’s value except a major reversal sample emerges.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t liable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.