- Bullish TOMO worth prediction ranges from $0.200 to $3.600

- Evaluation means that the TOMO worth may attain above $3.5905

- The TOMO bearish market worth prediction for 2023 is $0.2615

What’s TomoChain (TOMO)?

TomoChain is a public EVM (Ethereum Digital Machine)-compatible blockchain with low transaction charges, quick affirmation time, double validation, and randomization for safety ensures.

TOMO’s white paper proposes Proof-of-Stake Voting (PoSV) consensus, a Proof-of-Stake (PoS)-based blockchain protocol with a good voting mechanism, rigorous safety ensures, and quick finality.

Moreover, the TOMOchain whitepaper states: “We additionally current a novel reward mechanism and present that, with this mechanism, the blockchain has a low likelihood of forks, and quick affirmation occasions, plus the contributions and advantages of grasp nodes are truthful within the sense that the likelihood distribution operate is uniform ultimately”

As such, the TomoChain community helps 2,000 TPS and 2s block time. Moreover, it guarantees hundreds of transactions for as little as lower than $1. Furthermore, the TomoChain blockchain is secured by a extremely decentralized masternode community with a built-in randomization mechanism.

Analysts’ View on TomoChain (TOMO)

Magic Sq., an engagement platform for Internet 3 ecosystems tweeted that TomoChainANN’s LuaSwap, a multi-chain buying and selling, yield farming, and launchpad platform delivers a community-governed protocol through the LUA token.

TomoChain (TOMO)Present Market Standing

TOMO has a circulating provide of 101,082,726 TOMO cash, whereas its most provide is unavailable, based on CoinMarketCap. On the time of writing, TOMO is buying and selling at $1.47 representing 24 hours lower of three.66%. The buying and selling quantity of TOMO prior to now 24 hours is $39,970,979 which represents a 68.11% lower.

Some prime cryptocurrency exchanges for buying and selling TOMO are Binance, Deepcoin, BingX, Bitrue, and Bybit.

Now that TOMO and its present market standing, we will talk about the value evaluation of TOMO for 2023.

TomoChain (TOMO) Worth Evaluation 2023

At the moment, TomoChain (TOMO) ranks 176 on CoinMarketCap. Will TOMO’s most up-to-date enhancements, additions, and modifications assist its worth go up? First, let’s give attention to the charts on this article’s TOMO’s worth forecast.

TomoChain (TOMO) Worth Evaluation – Bollinger Bands

The Bollinger bands are a kind of worth envelope developed by John Bollinger. It provides a variety with an higher and decrease restrict for the value to fluctuate. The Bollinger bands work on the precept of normal deviation and interval (time).

The higher band as proven within the chart is calculated by including two occasions the usual deviation to the Easy Transferring Common whereas the decrease band is calculated by subtracting two occasions the usual deviation from the Easy Transferring Common. When the bands widen, it exhibits there’s going to be extra volatility and once they contract, there may be much less volatility.

When Bollinger bands are utilized in a cryptocurrency chart, we might anticipate the value of the cryptocurrency to reside inside the higher and decrease bounds of the Bollinger bands 95% of the time. The above thesis is derived from an Empirical legislation.

The sections highlighted by pink rectangles within the chart above present how the bands develop and contract. When the bands widen, we might anticipate extra volatility, and when the bands contract, it denotes much less volatility.

The inexperienced rectangles present how TOMO retraced after touching the higher band (overbought) and decrease band (oversold). Moreover, the blue rectangle exhibits how TOMO examined, and broke the higher bands on quite a few events after receiving assist on the Easy Transferring Common (SMA).

At the moment, TOMO appears to be shifting into the proximity of the bounds of the Bollinger bands, after being above the higher band. If TOMO strikes into the vary of the Bollinger bands, we might anticipate it to rebound off of the SMA and take a look at the higher band as soon as once more. Furthermore, the Bollinger Bandwidth indicator (BBW) exhibits a worth of 0.72, with the road nonetheless heading upwards.

The bands began squeezing solely after reaching 0.73, 0.75, and 0.78 on the indicator. Therefore, we may even see the bands gaping its jaws for a short time. As such, we may even see a giant drop in costs within the title of market correction.

Sellers could have to take precautions and brief their tokens on the nick of time earlier than TOMO additional depreciates. Nonetheless, some could maintain their tokens ready for the subsequent rally, because the Bollinger bands are dealing with upwards.

Throughout the market correction, we may even see an excellent magnitude of worth fall. Nonetheless, the query is, will the Easy Transferring Common come to TOMO’s rescue as a assist degree identical to at different occasions? If it does, then it might current a wonderful entry level for long-position holders.

TomoChain (TOMO) Worth Evaluation – Relative Power Index

The Relative Power Index is an indicator that’s used to seek out out whether or not the value of a safety is overvalued or undervalued. As per its title, RSI indicators assist decide how the safety is doing at current, relative to its earlier worth.

Furthermore, it has a sign line which is a Easy Transferring Common (SMA) that acts as a yardstick or reference to the RSI line. Therefore, at any time when the RSI line is above the SMA, it’s thought-about bullish; if it’s beneath the SMA, it’s bearish.

When contemplating the primary inexperienced rectangle from the left of the chart beneath we are able to see that the RSI is above the sign. Therefore, TOMO is bullish and consequently, it’s making larger highs.

The second inexperienced rectangle exhibits that the RSI line (purple) is beneath the Sign line (yellow). As such, TOMO is bearish or shedding worth. Due to this fact it’s reaching decrease lows as proven within the chart.

Furthermore, the RSI is also used to seek out out the divergence. As an illustration, when the token is making larger highs then the RSI must also be making larger highs in unison with it for it to be known as a bull run. Nonetheless, if the RSI doesn’t make larger highs with the token, then let’s imagine that there might be a development reversal, because the token is shedding worth regardless of making larger highs.

At the moment, the RSI of TOMO is extraordinarily overbought. On the RSI indicator, it exhibits a worth of 76.41 whereas the Stochastic indicator additionally states that TOMO is overbought. Furthermore, each indicators present that the traces are heading in the direction of the traditional area from being overbought. As such, we could anticipate a worth correction.

Throughout this worth correction, we could TOMO reaching for assist on the Crossover Overbought (inexperienced line). Nonetheless, within the occasion that TOMO doesn’t obtain assist at this level then it might crash additional to the Crossunder Overbought area (blue line). Because the blue line has been a great spot for locating assist we may even see TOMO fall until this line.

As such, these shorting TOMO could think about shorting it earlier than reaching the Crossunder Overbought area. Furthermore, since TOMO could ricochet off of the blue line and rise, this might current a wonderful entry level for consumers.

The above thesis might be proved following the TOMO token’s conduct of reaching for Help on the blue line throughout its exponential rise.

TomoChain (TOMO) Worth Evaluation – Transferring Common

The Exponential Transferring averages are fairly much like the straightforward shifting averages (SMA). Nonetheless, the SMA equally distributes down all values whereas the Exponential Transferring Common provides extra weightage to the present costs. Since SMA undermines the weightage of the current worth, the EMA is utilized in worth actions.

The 200-day MA is taken into account to be the long-term shifting common whereas the 50-day MA is taken into account the short-term shifting common in buying and selling. Primarily based on how these two traces behave, the power of the cryptocurrency or the development might be decided on common.

Particularly, when the short-term shifting common (50-day MA) approaches the long-term shifting common (200-day MA) from beneath and crosses it, we name it a Golden Cross.

Contrastingly, when the short-term shifting common crosses the long-term shifting common from above then, a dying cross happens.

Normally, when a Golden Cross happens, the costs of the cryptocurrency will shoot up drastically, however when there’s a Dying Cross, the costs will crash.

Each time the value of cryptocurrency is above the 50-day or 200-day MA, or above each we could say that the token is bullish (Gray Arc). Contrastingly, if the token is beneath the 50-day or 200-day, or beneath each, then we might name it bearish (Blue triangle part).

The chart above exhibits how the stranglehold of the bears the place negated by the bulls throughout the daybreak of 2023. As such, we might see TOMO rise exponentially. Moreover, the Golden Cross that occurred additionally gave extra momentum to TOMO’s rise.

Furthermore, the 50-day MA has been good assist for TOMO when it had small corrections whereas it was rising. Nonetheless, when TomoChain reached the very best level and began tumbling down, the 50-day MA wasn’t in a position to assist it.

As such, it is very important adjudicate whether or not TOMO is now making small corrections or whether or not it’s falling after reaching its highest degree. To seek out out his dealer could wish to use quantity, bear bull energy, and different indicators or a mix of indicators as per their discretion.

TomoChain (TOMO) Worth Evaluation – Elder Pressure Index

Elder Pressure Index is an indicator that was invented by Alexander Elder, who was an entrepreneur. The indicator primarily makes use of two parameters to adjudicate the shopping for and promoting power and thereby predicts the market development. Particularly, it depends on worth change and quantity. As such the power of the shopping for power or promoting power depends on both the value change or the quantity.

Each time the EFI is larger than zero, or constructive, let’s imagine that the development is bullish, as there may be extra shopping for strain. Nonetheless, when the EFI is within the unfavourable zone, let’s imagine that the cryptocurrency is within the unfavourable zone and the promoting strain is extra.

Furthermore, the Elder Pressure is also used to determine development reversals and breakouts. As an illustration when the EFI is making decrease highs whereas the cryptocurrency is making larger highs, then let’s imagine that it is a bearish divergence. Nonetheless, within the occasion that the cryptocurrency is making decrease lows whereas the EFI is making larger lows, then it’s a bullish divergence represented within the chart.

At the moment, the Elder Pressure Index indicator exhibits a worth of 1.036M with the road heading in the direction of the zero line. Furthermore, the Bear-Bull Energy(BBP) indicator additionally exhibits that the ability of the bull is lowering as the road at 0.7476 on the BBP indicator is heading towards zero.

Furthermore, when contemplating the previous events when the EFI retraced after reaching this excessive constructive area, we might see that there’s just one level of EFI going bullish. Now that the EFI of TOMO is shifting from 1.04M, we might anticipate it to rise once more after reaching 701.9K.

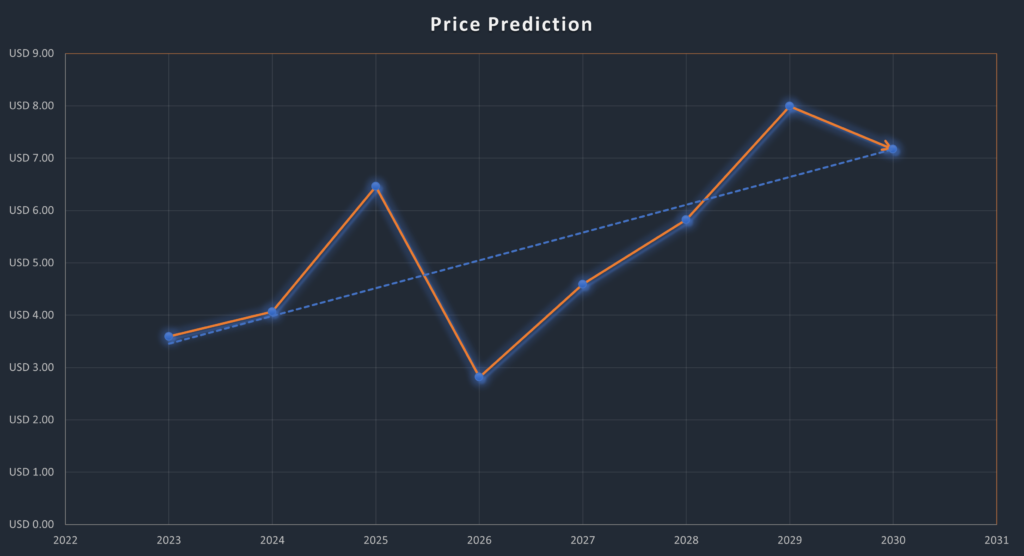

TomoChain (TOMO) Worth Prediction 2023-2030 Overview

| 12 months | Minimal Worth | Common Worth | Most Worth |

| 2023 | $2.912 | $3.5905 | $3.7812 |

| 2024 | $3.9125 | $4.0667 | $4.5870 |

| 2025 | $5.912 | $6.4587 | $5.781 |

| 2026 | $1.9721 | $2.8156 | $3.1251 |

| 2027 | $4.2153 | $4.589 | $4.9251 |

| 2028 | $5.2510 | $5.8236 | $6.2150 |

| 2029 | $6.9102 | $7.9927 | $8.5211 |

| 2030 | $6.5251 | $7.1696 | $7.5321 |

| 2040 | $11.971 | $12.7023 | $13.251 |

| 2050 | $17.251 | $18.2872 | $19.250 |

TomoChain (TOMO) Worth Prediction 2023

When contemplating the chart above, we might see that TomoChain has been rising exponentially because the starting of 2023. After reaching Resistance 1 at $2.185 it corrected its costs because the market deemed it as overbought. Nonetheless, based mostly on previous observations, we might see that from this explicit worth vary, TOMO surged to succeed in Resistance 4 at $3.59.

TOMO’s path to Resistance 4 was not simple because it was obstructed by hurdles at Resistance 1 ($2.185), Resistance 2 ($2.73), and Resistance 3 ($3.220). We might see that TOMO examined the above-mentioned resistance a number of occasions when it stumbled upon it.

As a dealer, this a number of testing of TOMO might current a wonderful alternative to those that want to enter the market mid-way by means of the surge. The sample of fluctuation can be a scalper’s and intraday merchants’ haven. It is because the candlesticks are lengthy, which implies the value motion or the vary of worth motion is excessive.

Contrastingly, if TOMO begins to crash it’ll look to land on Help 1 at $0.98. Within the occasion that Help 1 is breached, TOMO might crash to Help 2 at $0.44. Nonetheless, Help 1 and Help 2 are nothing in comparison with Help 3. As such, TOMO would search assist from Help 3 at $0.261, which has been a fortress for TomoChain.

Within the occasion that TOMO crashes to Help 3, it might current a wonderful alternative for consumers to enter the market. The above notion might be proved by the truth that TOMO gained momentum to rise exponentially two occasions after being supported by Help 3.

TomoChain (TOMO) Worth Prediction – Resistance and Help Ranges

When contemplating the conduct of TOMO was buying and selling above the 1:8 Gann line in its early phases. Nonetheless, inside a short time period, TomoChain reached for assist from 1:4, 1:3,1:2 and thereafter it crashed beneath the 1:1. Normally if a cryptocurrency trades above the 1:1 Gann line it’s thought-about bullish, and when it crashes beneath this line, it’s thought-about bearish.

And thereafter TOMO was closely reliant on the 1:8 Gann line for assist from April 2020 to early 2021. The daybreak of 2021 noticed TOMO rise above the two:1 Gann line and fluctuate just below the 1:1 Gann line.

Nonetheless, this loft abode of TOMO was short-lived. As such it got here crashing down and tried to seek out assist alongside the two:1 Gann line however the bears have been too sturdy. Therefore, it fell beneath 2:1 and in some way discovered a second to rise alongside the 4:1 Gann line.

In July 2021, TOMO discovered momentum and reached its highest worth nearly in a close to vertical surge. After testing its highest worth vary yet another time, TomoChain began to fall alongside the two:1 Gann line.

The chart above exhibits how TOMO examined the sixth Fibonacci arc from the middle in early 2020. Nonetheless, after breaking and receiving assist off of the identical arc, TOMO broke the 78.6% baseline arc. After breaking into that TOMO begin descending alongside that arc.

Nonetheless, the daybreak of 2021 led to a bull run that helped TOMO ascend to the primary arc (23.6% arc). Shortly after reaching the primary arc, TomoChain began descending and located assist on the 50% arc, which catapulted TOMO again into the 23.6% arc. Nonetheless, this too was short-lived as TOMO crashed as soon as extra and located assist at 38.2% arc.

The development reversed at 38.2% arc as TOMO began ascending and reached the 23.6% arc as soon as once more however fell brief as at different occasions. This time TOMO fell to 61.8% arc and was solely in a position to take a look at the 50% arc however was rejected.

As such, TOMO additional fell and obtained assist from 78.6% arc for a while. Nonetheless, the constructing bear strain was an excessive amount of for that baseline to carry on to. Due to this fact, presently, TOMO is rising exponentially alongside the 100% arc line.

We might anticipate it to check obtain assist from the 8:1 Gann line if it goes by means of a market correction. Furthermore, if TOMO is ready to maintain its exponential form, we might anticipate it to succeed in the 4:1 Gann line whereas it rises alongside the 100% arc.

TomoChain (TOMO) Worth Prediction 2024

There shall be Bitcoin halving in 2024, and therefore we must always anticipate a constructive development available in the market on account of person sentiments and the hunt by buyers to build up extra of the coin. Nonetheless, the 12 months of BTC halving didn’t yield the utmost TOMO based mostly on the earlier halving. Therefore, we might anticipate TOMO to commerce at a worth not beneath $4.0667 by the top of 2024.

TomoChain (TOMO) Worth Prediction 2025

TOMO could expertise the after-effects of the Bitcoin halving and is anticipated to commerce a lot larger than its 2024 worth. Many commerce analysts speculate that BTC halving might create a huge effect on the crypto market. Furthermore, much like many altcoins, TOMO will proceed to rise in 2025 forming new resistance ranges. It’s anticipated that TOMO would commerce past the $6.4587 degree.

TomoChain (TOMO) Worth Prediction 2026

It’s anticipated that after a protracted interval of bull run, the bears would come into energy and begin negatively impacting the cryptocurrencies. Throughout this bearish sentiment, TOMO might tumble into its assist areas. Throughout this era of worth correction, TOMO might lose momentum and be method beneath its 2025 worth. As such it might be buying and selling at $2.8156 by 2026.

TomoChain (TOMO) Worth Prediction 2027

Naturally, merchants anticipate a bullish market sentiment after the crypto trade was affected negatively by the bears’ claw. Furthermore, the build-up to the subsequent Bitcoin halving in 2028 might evoke pleasure in merchants. Nonetheless, there shall be a dip earlier than TOMO really surges, as such we might anticipate TOMO to commerce at round $4.589 by the top of 2027.

TomoChain (TOMO) Worth Prediction 2028

Because the crypto neighborhood’s hope shall be re-ignited trying ahead to Bitcoin halving like many altcoins, TOMO could reciprocate its previous conduct throughout the BTC halving. Therefore, TOMO can be buying and selling at $5.8236 after experiencing a substantial surge by the top of 2028.

TomoChain (TOMO) Worth Prediction 2029

2029 is anticipated to be one other bull run as a result of aftermath of the BTC halving. Nonetheless, merchants speculate that the crypto market would regularly turn out to be steady by this 12 months. In tandem with the steady market sentiment, TOMO might be buying and selling at $7.9927 by the top of 2029.

TomoChain (TOMO) Worth Prediction 2030

After witnessing a bullish run available in the market, TOMO and lots of altcoins would present indicators of consolidation and may commerce sideways and transfer downwards for a while whereas experiencing minor spikes. Due to this fact, by the top of 2030, TOMO might be buying and selling at $7.1696

TomoChain (TOMO) Worth Prediction 2040

The long-term forecast for TOMO signifies that this altcoin might attain a brand new all-time excessive(ATH). This could be one of many key moments as HODLERS could anticipate to promote a few of their tokens on the ATH level.

If they begin promoting then TOMO might fall in worth. It’s anticipated that the common worth of TOMO might attain $12.7023 by 2040.

TomoChain (TOMO) Worth Prediction 2050

The neighborhood believes that there shall be widespread adoption of cryptocurrencies, which might keep gradual bullish positive aspects. By the top of 2050, if the bullish momentum is maintained, TOMO might hit $18.2872

Conclusion

If buyers proceed exhibiting their curiosity in TOMO and add these tokens to their portfolio, it might proceed to rise. TOMO’s bullish worth prediction exhibits that it might attain the $3.5 degree.

FAQ

TomoChain is a public EVM (Ethereum Digital Machine)-compatible blockchain with low transaction charges, quick affirmation time, double validation, and randomization for safety ensures.

TOMO tokens might be traded on many exchanges like Binance, BingX, Deepcoin, Bitrue, and Bybit.

TOMO has a risk of surpassing its current all-time excessive (ATH) worth of $3.9177 in 2021.

TOMO is among the few cryptocurrencies that has proven resilience. If TOMO continues its exponential rise then, it’d attain $3.5 quickly after it breaks the Resistance 1,2 and three ranges.

TOMO has been one of the appropriate investments within the crypto house. It’s extremely unstable, as such, it has fairly a margin when its worth fluctuates. Therefore, merchants could also be allured to spend money on TOMO. It’s an excellent funding within the brief time period and in the long run as effectively.

The current all-time low worth of TOMO is $0.1407.

The utmost provide of TOMO is unavailable.

TOMO might be saved in a chilly pockets, scorching pockets, or alternate pockets.

TomoChain was co-founded by Lengthy Vuong, who can be the CEO of TomoChain Pte. Ltd.

TOMO is anticipated to succeed in $3.5905 by 2023.

TOMO is anticipated to succeed in $4.0667 by 2024.

TOMO is anticipated to succeed in $6.4587 by 2025.

TOMO is anticipated to succeed in $2.8156 by 2026.

TOMO is anticipated to succeed in $4.589 by 2027.

TOMO is anticipated to succeed in $5.8236 by 2028.

TOMO is anticipated to succeed in $7.9927 by 2029.

TOMO is anticipated to succeed in $7.1696 by 2030.

TOMO is anticipated to succeed in $12.7023 by 2040.

TOMO is anticipated to succeed in $18.2872 by 2050.

Disclaimer: The views and opinions, in addition to all the data shared on this worth prediction, are revealed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates is not going to be held chargeable for any direct or oblique injury or loss.