Bitcoin crossed $60,000 on Feb. 28 in a exceptional one-day candle, posting a 20% improve in simply three days. Nonetheless, the quick stint at this degree means we’ll have to attend one other 24 hours earlier than any significant on-chain knowledge turns into accessible.

Nonetheless, the potential for a correction throughout the subsequent 24 hours will be analyzed, given the quantity of unrealized earnings at the moment out there.

Unrealized earnings seek advice from the positive factors on Bitcoin holdings that haven’t but been offered or transformed into fiat or different property. These are calculated by the distinction between the present market worth and the acquisition worth of Bitcoin, supplied the present worth is increased.

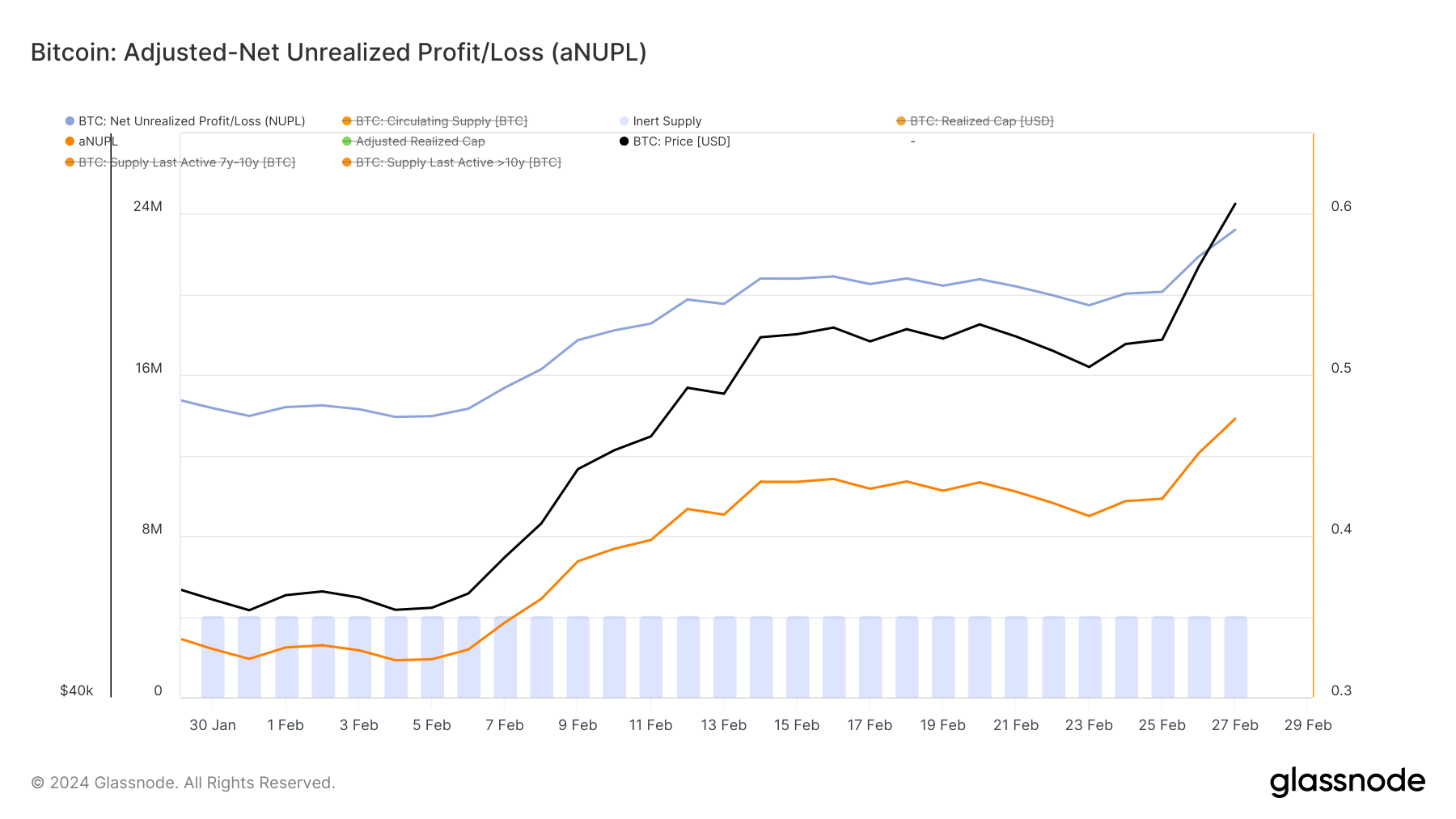

The Internet Unrealized Revenue/Loss (NUPL) metric affords insights into the general market sentiment by mapping out the distinction between unrealized revenue and loss throughout all the Bitcoin provide, expressed as a proportion of the market cap.

In the meantime, adjusted-NUPL (aNUPL) refines this evaluation by accounting for inert provide — cash misplaced or dormant for over seven years — thereby offering a clearer view of the energetic market’s profitability.

The aNUPL values noticed over the previous three days — 0.4232 on Feb. 25, 0.4515 on Feb. 26, and 0.4729 on Feb. 27 — present {that a} rising portion of the Bitcoin provide is worthwhile.

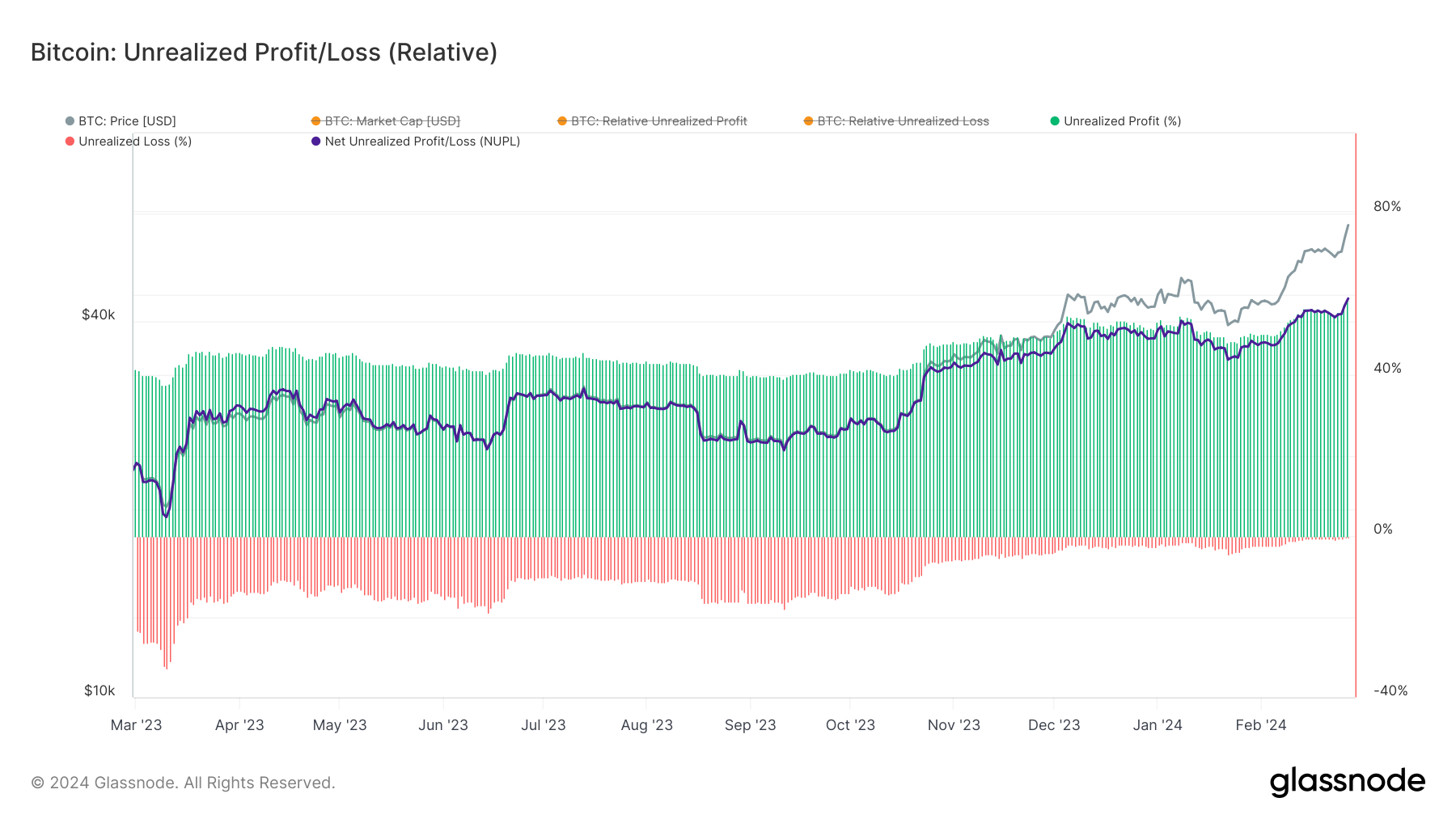

That is additional seen within the improve in revenue proportion from 55.795% to 59.174% and the lower in loss proportion from -0.682% to -0.155% over the identical interval. Like aNUPL, this metric reveals that the majority of Bitcoin’s provide is held at a revenue, with minimal losses.

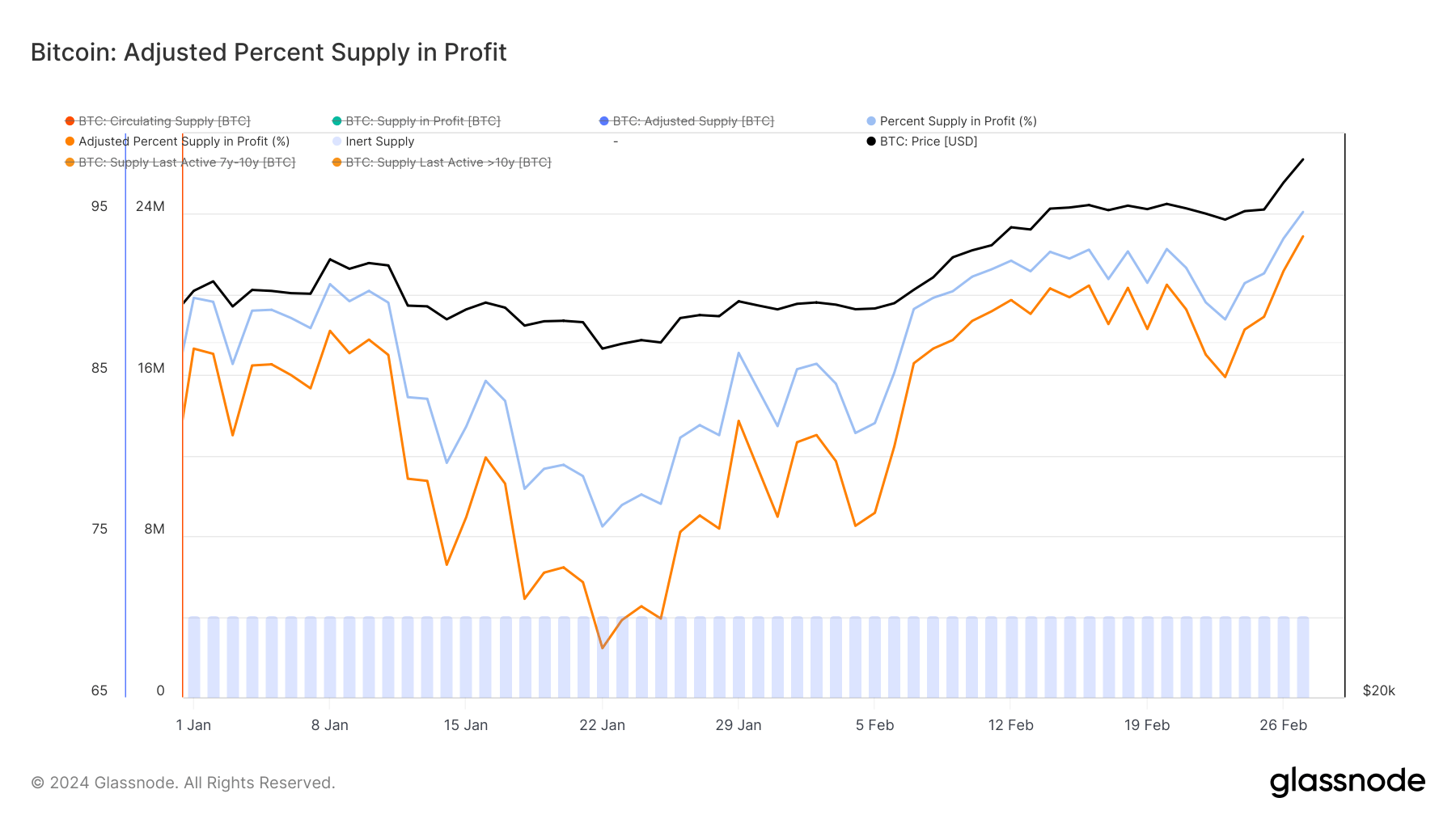

The % provide in revenue, reaching 95.12% on Feb. 27, and the adjusted % provide in revenue at 93.6% present this profitability from a barely completely different angle.

If Bitcoin continues to extend within the coming weeks, this present state of widespread profitability can translate to diminished promoting stress. Anticipating additional development, holders is likely to be much less inclined to promote their property, resulting in diminished volatility and making a basis for a extra secure worth improve.

The present state of profitability might reinforce bullish sentiment amongst traders if there are additional worth will increase. The numerous inflows into spot Bitcoin ETFs within the US, particularly BlackRock’s IBIT, recommend a section of the market — comprising institutional and complex traders — is poised to deploy capital into Bitcoin, buoyed by the optimistic tendencies and the worry of lacking out (FOMO).

Nonetheless, uneven and sideways worth actions can result in increased volatility. With a good portion of the market in revenue, the temptation to comprehend these positive factors might set off large-scale sell-offs, particularly if fears of a market peak or unfavourable information emerge within the coming days.

Whereas the prevailing sentiment is bullish — pushed by widespread profitability and institutional curiosity — the market should navigate the potential challenges posed by unrealized positive factors. The next 24 hours are essential in figuring out whether or not Bitcoin can preserve its foothold at $60,000 or if the stress to comprehend earnings will catalyze volatility.

The submit The Bitcoin market faces a important second amid hovering unrealized earnings appeared first on StarCrypto.