- Bullish XTZ value prediction ranges from $0.6 to $1.8.

- Evaluation means that the XTZ value may attain above $1.455.

- The XTZ bearish market value prediction for 2023 is $0.649.

What’s Tezos (XTZ)?

Tezos is a generic and self-amending crypto-ledger that may instantiate any blockchain-based ledger. The operations of an everyday blockchain are carried out as a purely useful module abstracted right into a shell accountable for community operations. Bitcoin, Ethereum, Cryptonote,

and many others. can all be represented inside Tezos by implementing the correct interface to the community layer.

Nevertheless, not like BTC and Ethereum which wants a tough fork for enchancment, Tezos goals to supply infrastructure that’s extra superior — that means it could actually evolve and enhance over time with out the need of a tough fork.

One of many important makes use of of Tezos blockchain native token Tez (XTZ) is to work together with decentralized purposes (DApps), pay for charges, safe the community by staking, and supply a primary accounting unit on the Tezos platform. Tezos blockchain is among the main good contracts that use the Proof of Stake (PoS) consensus mechanism. This ensures that good contracts may be dependable, safe, and mathematically verified.

Tezos (XTZ) Market Overview

| 🪙 Identify | Tezos |

| 💱 Image | xtz |

| 🏅 Rank | #57 |

| 💲 Worth | $0.736836 |

| 📊 Worth Change (1h) | -1.03351 % |

| 📊 Worth Change (24h) | 3.77009 % |

| 📊 Worth Change (7d) | -13.07309 % |

| 💵 Market Cap | $687544518 |

| 📈 All Time Excessive | $9.12 |

| 📉 All Time Low | $0.350476 |

| 💸 Circulating Provide | 933311127.698 xtz |

| 💰 Whole Provide | xtz |

Analysts’ View on Tezos (XTZ)

Lots, a number one decentralized trade introduced that it has joined forces with

@tezosdomains to make sure a clean launch of the Tezos Domains (TED) token.

Tezos (XTZ) Present Market Standing

XTZ has a circulating provide of 941,432,655 XTZ cash, whereas its most provide isn’t out there, in accordance with CoinMarketCap. On the time of writing, XTZ is buying and selling at $0.7386 representing 24 hours improve of three.88%. The buying and selling quantity of XTZ prior to now 24 hours is $16,644,450 which represents a 31.26% improve.

Some prime cryptocurrency exchanges for buying and selling XTZ are Binance, BTCEX, OKX, Deepcoin, and Bitrue.

Now that you understand XTZ and its present market standing, we will focus on the value evaluation of XTZ for 2023.

Tezos (XTZ) Worth Evaluation 2023

Presently, Tezos (XTZ) ranks 55 on CoinMarketCap. Will XTZ’s most up-to-date enhancements, additions, and modifications assist its value go up? First, let’s deal with the charts on this article’s XTZ value forecast.

Tezos (XTZ) Worth Evaluation – Bollinger Bands

The Bollinger bands are a kind of value envelope developed by John Bollinger. It offers a variety with an higher and decrease restrict for the value to fluctuate. The Bollinger bands work on the precept of normal deviation and interval (time).

The higher band as proven within the chart is calculated by including two occasions the usual deviation to the Easy Shifting Common whereas the decrease band is calculated by subtracting two occasions the usual deviation from the Easy Shifting Common. When the bands widen, it reveals there’s going to be extra volatility and once they contract, there may be much less volatility.

When Bollinger bands are utilized in a cryptocurrency chart, we may count on the value of the cryptocurrency to reside throughout the higher and decrease bounds of the Bollinger bands 95% of the time. The above thesis is derived from an Empirical legislation.

The sections highlighted by purple rectangles within the chart above present how the bands develop and contract. When the bands widen, we may count on extra volatility, and when the bands contract, it denotes much less volatility. The inexperienced rectangles present how XTZ retraced after touching the higher band (overbought).

When contemplating the chart above, we may see that the Bollinger bands are presently swelling after a interval of compressing. Furthermore, XTZ has constantly been touching the decrease band, as such, we might even see XTZ retrace and transfer in the direction of the SMA. Nevertheless, primarily based on remark of XTZ conduct there’s a chance of XTZ feint shifting in the direction of the SMA after which altering instructions in the direction of the decrease band.

Though the bands are widening, it’s going through downwards, as such, we might even see the value of XTZ additional fall. Nevertheless, there could also be small corrections the place XTZ strikes horizontally throughout the Bollinger bands.

In the meantime, the Bollinger bandwidth (BBW) indicator is valued at 0.33 and it’s going through upwards. Curiously, the final time the BBW indicator touched this space the route of the road modified. Therefore, perhaps we may see the bands assemble once more, but it surely wants affirmation. Nevertheless, if the above assertion isn’t fulfilled we might even see the bands widen additional till the BBW indicator learn 0.36 and 0.51.

As such sellers could have to wish to take into account getting into the market earlier than their revenue shrinks. Consumers may have to attend for XTZ to hit all-time low and money in on it as the chance current itself.

Tezos (XTZ) Worth Evaluation – Relative Energy Index

The Relative Energy Index is an indicator that’s used to search out out whether or not the value of a safety is overvalued or undervalued. As per its title, RSI indicators assist decide how the safety is doing at current, relative to its earlier value.

Furthermore, it has a sign line which is a Easy Shifting Common (SMA) that acts as a yardstick or reference to the RSI line. Therefore, every time the RSI line is above the SMA, it’s thought-about bullish; if it’s beneath the SMA, it’s bearish.

Presently, the RSI is beneath the Sign line, therefore, XTZ is bearish. Moreover, the RSI has reached a price of 26.43, and its deemed as oversold. Nevertheless, as the road appears to be heading upward, we might even see the market appropriate the value sooner or later.

The Stochastic RSI measures the power or the weak point of the RSI indicator. As such, it compares the present RSI with the vary of previous RSI values for a particular interval. The StochRSI reads a price of 1.982 and it’s heading within the route of getting out of the oversold area.

In the meantime, as per the RSI Help and Resistance by the DGT indicator, XTZ has simply retraced after touching the crossunder oversold line. Presently, XTZ is heading towards the Crossover Oversold area (Orange line). If XTZ manages to interrupt the above-mentioned line, then we might even see it strategy cross bear zone.

For the reason that Stochastic RSI and RSI are each heading upwards, we may assume that XTZ has reached its backside. As such, XTZ could preserve rising in value. Therefore, consumers made want to contemplate getting into the market as XTZ appears to be presenting a superb entry level.

Tezos (XTZ) Worth Evaluation – Shifting Common

The Exponential Shifting averages are fairly just like the easy shifting averages (SMA). Nevertheless, the SMA equally distributes down all values whereas the Exponential Shifting Common offers extra weightage to the present costs. Since SMA undermines the weightage of the current value, the EMA is utilized in value actions.

The 200-day MA is taken into account to be the long-term shifting common whereas the 50-day MA is taken into account the short-term shifting common in buying and selling. Based mostly on how these two traces behave, the power of the cryptocurrency or the development may be decided on common.

Particularly, when the short-term shifting common (50-day MA) approaches the long-term shifting common (200-day MA) from beneath and crosses it, we name it a Golden Cross.

Contrastingly, when the short-term shifting common crosses the long-term shifting common from above then, a dying cross happens.

Often, when a Golden Cross happens, the costs of the cryptocurrency will shoot up drastically, however when there’s a Demise Cross, the costs will crash.

When contemplating the chart above we may see that XTZ has been actually attempting arduous to surge after it spiked in 2023. Though there was a Golden cross throughout the latter half of Mach 2023, XTZ was solely in a position to check the 200-day MA. For the reason that second half of April 2023, XTZ has been collapsing. Although there was assist for XTZ at $0.878, the bears had been too sturdy, as such, that assist stage couldn’t maintain XTZ from falling.

Presently, it looks like XTZ has reached all-time low and is discovering its approach up. If XTZ begins to rise, its trajectory could also be obstructed by the 50-day MA which may because the quick resistance. Therefore, these going lengthy may have to contemplate getting into the market they usually could take into account having their take revenue close to the 50-day MA.

Tezos (XTZ) Worth Evaluation – Elder Drive Index

Elder Drive Index is an indicator that was invented by Alexander Elder, who was an entrepreneur. The indicator primarily makes use of two parameters to adjudicate the shopping for and promoting power and thereby predicts the market development. Particularly, it depends on value change and quantity. As such the power of the shopping for power or promoting power relies on both the value change or the quantity.

At any time when the EFI is bigger than zero, or optimistic, let’s imagine that the development is bullish, as there may be extra shopping for strain. Nevertheless, when the EFI is within the adverse zone, let’s imagine that the cryptocurrency is within the adverse zone and the promoting strain is extra.

Furthermore, the Elder Drive may be used to determine development reversals and breakouts. As an example when the EFI is making decrease highs whereas the cryptocurrency is making greater highs, then let’s imagine that it is a bearish divergence. Nevertheless, within the occasion that the cryptocurrency is making decrease lows whereas the EFI is making greater lows, then it’s a bullish divergence.

Presently, the EFI indicator reads a price of -71.708K and the EFI line appears to be heading towards the zero line. The above sentence reveals that the bear’s energy is waning whereas the bulls are taking up the market.

The above chart approves of the thesis that the bear’s energy is waning away. When trying on the Bear Bull Energy (BBP) indicator we may see that the BBP line is heading in the direction of the zero line. We might even see cross the zero line and fluctuate within the optimistic area.

Nevertheless, as per the EFI indicator, there was obstruction for it to rise above -37,603K stage, therefore, we might even see some friction on the identical spot. The above assertion might be justified, because the rising EFI modified instructions at close to the 37,603K stage. As such, there’s a chance that the EFI line may change route. Therefore merchants ought to take this stage to account when buying and selling.

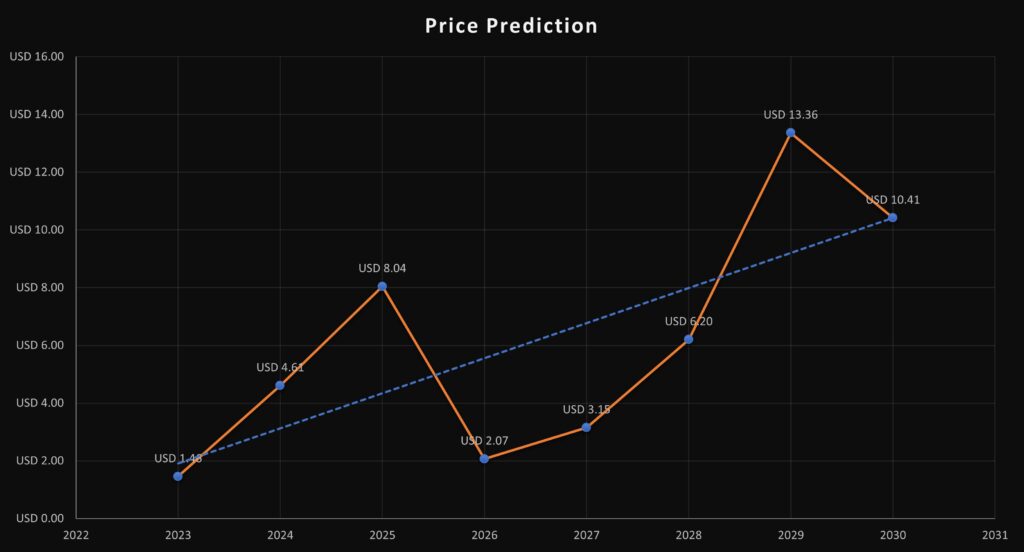

Tezos (XTZ) Worth Prediction 2023-2030 Overview

| 12 months | Minimal Worth | Common Worth | Most Worth |

| 2023 | $1.251 | $1.455 | $2.00 |

| 2024 | $3.650 | $4.607 | $5.214 |

| 2025 | $7.254 | $8.042 | $9.2158 |

| 2026 | $1.520 | $2.066 | $2.750 |

| 2027 | $3.025 | $3.148 | $4.005 |

| 2028 | $5.520 | $6.201 | $6.7891 |

| 2029 | $10.120 | $13.362 | $15.156 |

| 2030 | $9.248 | $10.413 | $12.365 |

| 2040 | $18.951 | $21.781 | $23.512 |

| 2050 | $30.215 | $33.98 | $36.981 |

Tezos (XTZ) Worth Prediction 2023

When contemplating the chart above, we may see that XTZ has been fluctuating in a falling wedge. If XTZ follows the traditional breakout from the falling wedge, we may count on the costs to rise. Therefore, as per the most effective practices of buying and selling the falling wedge, consumers could wish to have the entry level on the breakout level of XTZ from the wedge. Furthermore, they might wish to set the take revenue near Resistance 2 at 1.19. This “take revenue” level has been derived by trans-positioning the peak of the wedge throughout the early days of its formation and setting it on the breakout level.

There lies one other chance the place XTZ has the potential to rise to Resistance 3 at $1.45. The aforementioned thesis might be justified by the XTZ’s spike in early 2023. As such, we may count on XTZ to reciprocate its spike in early 2023.

We may see that after XTZ reaches Resistance 2 there appears to be a retracement the place the value fluctuated between Resistance 1 and a pair of. This rebounding of XTZ between Resistance 1 and Resistance 2 earlier than the subsequent surge to Resistance 3 or 4 might be a superb entry level for consumers who missed out on the spike throughout its preliminary phases.

Furthermore, XTZ could attain Resistance 4 at $1.76 if it reciprocates its fluctuation sample in late October 2019.

Since XTZ is at its lowest level there appears to be no assist apart from Help 1 which may be very near the place XTZ is presently. Nevertheless, this doesn’t negate the truth that XTZ can’t additional cut back.

Tezos (XTZ) Worth Prediction – Resistance and Help Ranges

The chart above highlights a darkish triangle space which reveals how XTZ was bullish because it was buying and selling above the 1:1 Gann line. Throughout its rise, XTZ was in a position to nearly attain the 1:3 Gann line. Nevertheless, after reaching the extent, XTZ couldn’t maintain on. As such we may see it slide between the two:1 and 1:1 Gann line. Though XTZ examined the two:1 Gann line on quite a few events, it wasn’t in a position to break it. Presently, XTZ is just under the 1:8 Gann line and we might even see it surge.

If XTZ takes the formation of its early 2023 rise and spikes sooner or later, then we might even see it rise alongside the 1:2 Gann line (white bars) earlier than it begins to slip alongside the two:1 Gann line. Nevertheless, within the occasion that XTZ takes the formation of its rise in 2019 then we may see it rise alongside the 1:1 Gann line, nonetheless, we might even see some consolidation and value correction earlier than XTZ truly spikes.

Tezos (XTZ) Worth Prediction 2024

There will likely be Bitcoin halving in 2024, and therefore we should always count on a optimistic development out there as a result of person sentiments and the hunt by traders to build up extra of the coin. Nevertheless, the yr of BTC halving didn’t yield the utmost XTZ primarily based on the earlier halving. Therefore, we may count on XTZ to commerce at a value, not beneath $4.6 by the top of 2024.

Tezos (XTZ) Worth Prediction 2025

XTZ could expertise the after-effects of the Bitcoin halving and is anticipated to commerce a lot greater than its 2024 value. Many commerce analysts speculate that BTC halving may create a big impact on the crypto market. Furthermore, just like many altcoins, XTZ will proceed to rise in 2025 forming new resistance ranges. It’s anticipated that XTZ would commerce past the $8 stage.

Tezos (XTZ) Worth Prediction 2026

It’s anticipated that after a protracted interval of bull run, the bears would come into energy and begin negatively impacting the cryptocurrencies. Throughout this bearish sentiment, XTZ may tumble into its assist areas. Throughout this era of value correction, XTZ may lose momentum and be approach beneath its 2025 value. As such it might be buying and selling at about $2 by 2026.

Tezos (XTZ) Worth Prediction 2027

Naturally, merchants count on a bullish market sentiment after the crypto trade was affected negatively by the bears’ claw. Furthermore, the build-up to the subsequent Bitcoin halving in 2028 may evoke pleasure in merchants. Nevertheless, that pleasure has not been amplified in XTZ to that extent. As such, we may count on XTZ to commerce simply above its 2026 worth at round $3.148 by the top of 2027.

Tezos (XTZ) Worth Prediction 2028

Because the crypto neighborhood’s hope will likely be re-ignited trying ahead to Bitcoin halving like many altcoins, XTZ could reciprocate its previous conduct throughout the BTC halving. Therefore, XTZ could be buying and selling at $6.2 after experiencing a substantial surge by the top of 2028.

Tezos (XTZ) Worth Prediction 2029

2029 is anticipated to be one other bull run as a result of aftermath of the BTC halving. Nevertheless, merchants speculate that the crypto market would step by step grow to be steady by this yr. In tandem with the steady market sentiment, XTZ might be buying and selling at $13.35 by the top of 2029.

Tezos (XTZ) Worth Prediction 2030

After witnessing a bullish run out there, XTZ and plenty of altcoins would present indicators of consolidation and may commerce sideways and transfer downwards for a while whereas experiencing minor spikes. Due to this fact, by the top of 2030, XTZ might be buying and selling at $10.5

Tezos (XTZ) Worth Prediction 2040

The long-term forecast for XTZ signifies that this altcoin may attain a brand new all-time excessive(ATH). This may be one of many key moments as HODLERS could count on to promote a few of their tokens on the ATH level.

If they begin promoting then XTZ may fall in worth. It’s anticipated that the typical value of XTZ may attain $21.8 by 2040.

Tezos (XTZ) Worth Prediction 2050

The neighborhood believes that there will likely be widespread adoption of cryptocurrencies, which may preserve gradual bullish beneficial properties. By the top of 2050, if the bullish momentum is maintained, XTZ may hit $34

Conclusion

If traders proceed displaying their curiosity in XTZ and add these tokens to their portfolio, it may proceed to rise. XTZ’s bullish value prediction reveals that it may attain the $1.45 stage.

FAQ

Tezos is a generic and self-amending crypto-ledger that may instantiate any blockchain-based ledger. The operations of an everyday blockchain are carried out as a purely useful module abstracted right into a shell accountable for community operations.

Like different cryptocurrencies, Tezos (XTZ) may be traded in cryptocurrency exchanges like Binance, Huobi International, Kucoin, Gate.io, Coinbase, and others.

XTZ has a chance of surpassing its current all-time excessive (ATH) value of $9.175 in 2021.

XTZ is among the few cryptocurrencies that has proven resilience. If XTZ breaks out of its rising wedge, it’d attain $1.75 quickly after it breaks the Resistance 1,2, and three ranges.

XTZ has been one of the appropriate investments within the crypto house. It’s extremely risky, as such, it has fairly a margin when its value fluctuates. Therefore, merchants could also be allured to spend money on XTZ. It’s a very good funding within the brief time period and in the long run as properly.

Arthur Breitman was the one that wrote the Tezos whitepaper.

The current all-time low value of XTZ is $0.3146

The utmost provide of XTZ isn’t out there.

XTZ may be saved in a chilly pockets, sizzling pockets, or trade pockets.

It was launched in June 2018.

Tezos (XTZ) value is anticipated to succeed in $1.455 by 2023.

Tezos (XTZ) value is anticipated to succeed in $4.607 by 2024.

Tezos (XTZ) value is anticipated to succeed in $8.042 by 2025.

Tezos (XTZ) value is anticipated to succeed in $2.066 by 2026.

Tezos (XTZ) value is anticipated to succeed in $3.148 by 2027.

Tezos (XTZ) value is anticipated to succeed in $6.201 by 2028.

Tezos (XTZ) value is anticipated to succeed in $13.362 by 2029.

Tezos (XTZ) value is anticipated to succeed in $10.413 by 2030.

Tezos (XTZ) value is anticipated to succeed in $21.78 by 2040.

Tezos (XTZ) value is anticipated to succeed in $33.98 by 2050.

Disclaimer: The views and opinions, in addition to all the knowledge shared on this value prediction, are printed in good religion. Readers should do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates won’t be held responsible for any direct or oblique harm or loss.