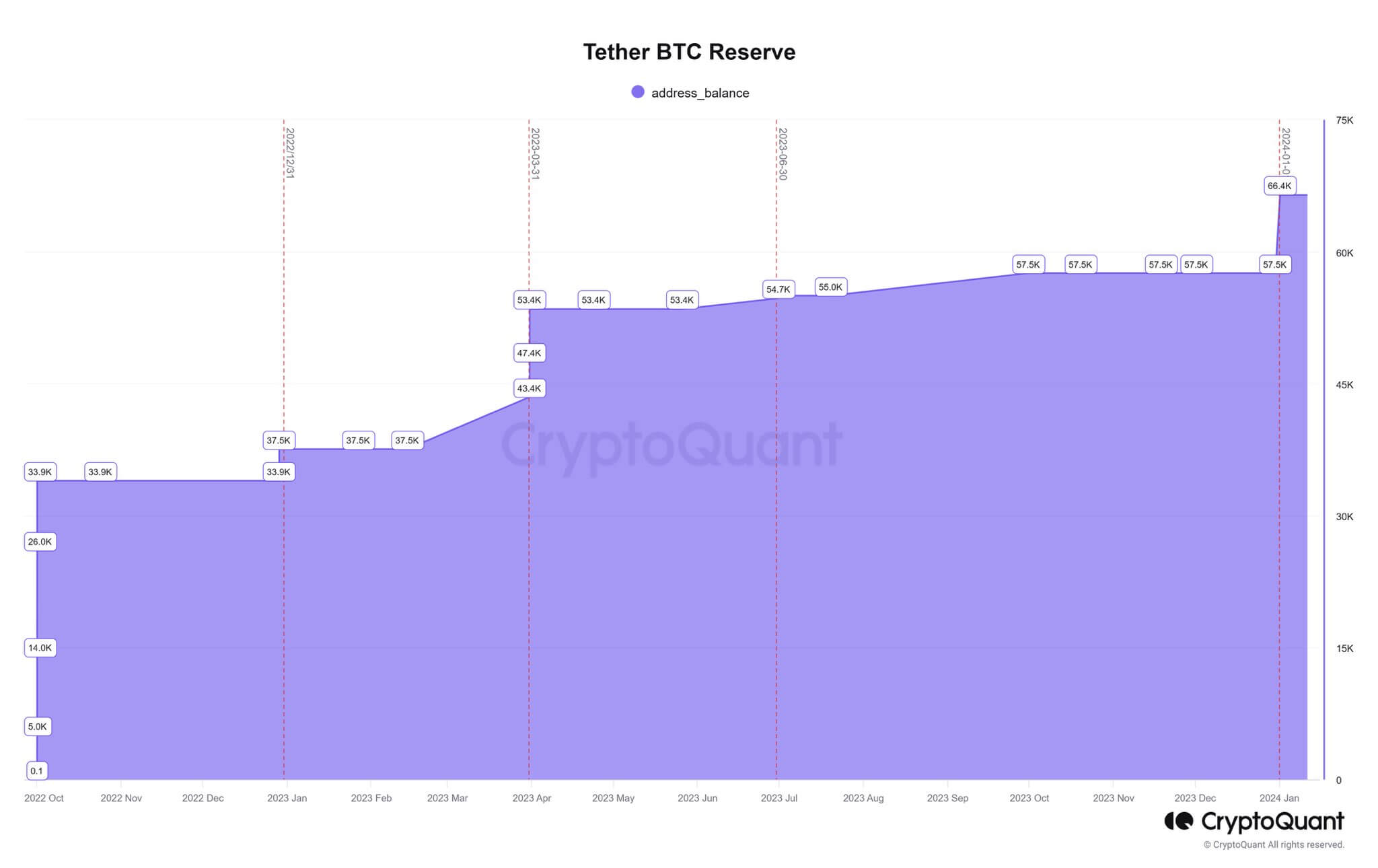

Tether has considerably elevated its Bitcoin holdings, now comprising greater than 66,000 BTC, with an estimated worth exceeding $2.8 billion.

In line with information shared by CryptoQuant founder Ki Younger Ju, Tether’s BTC holdings surged to 66,400 from the 57,500 recorded at the start of the yr—indicating an acquisition of roughly 8,900 BTC within the ultimate quarter of 2023.

This strategic transfer aligns with Tether’s plan to allocate as much as 15% of its realized funding income towards buying BTC for its stablecoin reserves.

An handle, “bc1qjasf9z3h7w3jspkhtgatgpyvvzgpa2wwd2lr0eh5tx44reyn2k7sfc27a4,” probably belonging to Tether, is the Eleventh-largest Bitcoin holder, in keeping with Bitinfocharts information. 21.co Analysis Analyst Tom Wan found the identical handle final yr. The pockets at the moment boasts an unrealized revenue of $1.1 billion.

Regardless of the notable enhance in its Bitcoin holdings, Tether has not formally disclosed its BTC handle and has but to answer inquiries from StarCrypto as of press time.

BTC mining investments

As well as, the stablecoin issuer is engaged in strategic investments in BTC mining.

Final November, the corporate dedicated to take a position roughly $500 million in BTC mining actions over six months. CEO Paolo Ardoino expressed the corporate’s ambition to raise its share of the general computing energy on the Bitcoin community to 1%.

The agency is actively pursuing the institution of mining services in Uruguay, Paraguay, and El Salvador, every boasting a considerable capability starting from 40 to 70 megawatts.

USDT’s rising provide

Over the previous yr, Tether’s USDT stablecoin has skilled a big surge, witnessing a strong 38% enhance in its market capitalization from $66 billion to a powerful $91 billion in 2023.

This constructive momentum has endured into the brand new yr, with the stablecoin’s market capitalization reaching $95.08 billion as of press time.

The substantial development has prompted issues throughout the group concerning Tether’s means to satisfy redemption calls for with satisfactory reserves.

Addressing these worries, Cantor Fitzgerald CEO Howard Lutnick emphatically reassured the group that Tether diligently upholds the mandatory reserve necessities for its stablecoins.